The“Uber-for-X” Model and the Complexity of On-Demand Delivery

/

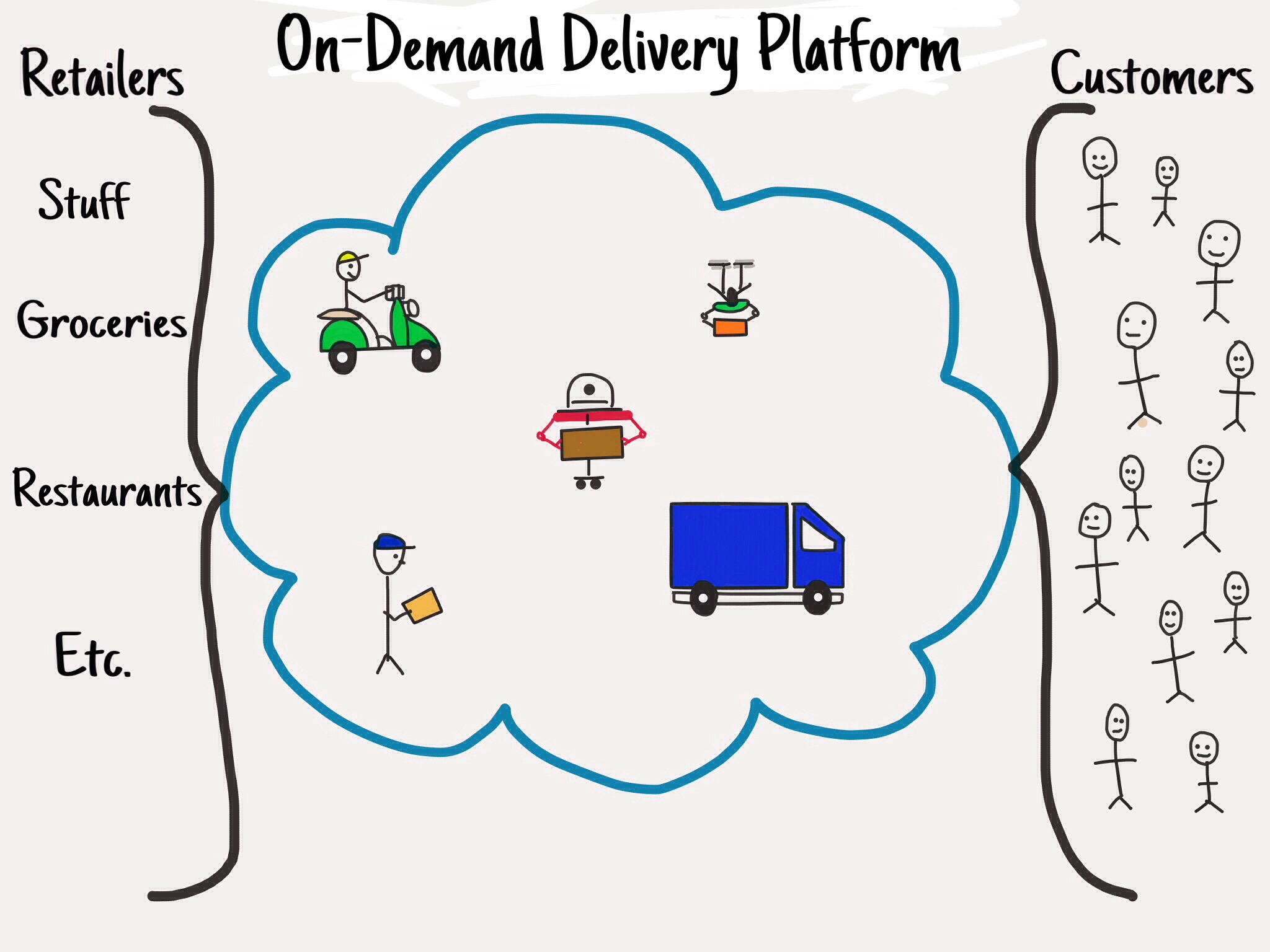

Uber’s success in disrupting transportation has led to enormous VC funding of “Uber-for-X” businesses where smartphones are used to connect customers with nearby workers on demand. A number of startups have entered the same-day / same-hour delivery market with the intent of fundamentally transforming how we shop and eat.

Rapid on-demand delivery combines the convenience of ordering from anywhere with the immediate product availability of traditional bricks and mortar retail stores. Increasingly retailers are piloting rapid same-day delivery, the most notable being Amazon’s Prime Now which offers free two-hour delivery across a SKU range of up to 40,000 in select markets. Convenient and low cost same-day delivery is emerging as the next logical paradigm in retail and will gradually become the expectation for many consumers. The rapid delivery trend coupled with the global shift to on-demand consumption has led to a massive funding of delivery startups; some notable start-ups include:

Instacart - Same-day grocery delivery and home essentials. $275 million USD total funding.

Deliveroo - Home / office Delivery of restaurant meals. $475 million USD total funding

Doordash - On-demand delivery from stores and restaurants. $186 million USD total funding.

Postmates - On-demand delivery from stores and restaurants. $278 million USD total funding.

While the funding of these startups may seems large, consider that Uber has received $8.7 billion USD in total funding.

Benefits to Merchants (retailers, restaurants)

A decentralised delivery system that focuses on an entire city or area allows individual stores and restaurants to tap into a pool of drivers / couriers who can be mobilised automatically based on the driver’s location, pick-up location, and delivery address. The value proposition to retailers is that the marketplace eliminates the need for individual retail stores and restaurants to build their own delivery networks while at the same time offering rapid delivery. This presents a unique opportunity for traditional brick-and-mortar retailers to leverage their existing retail infrastructure to offer same-day delivery and win back customers who have migrated to pure play eCommerce retailers.

In the restaurant industry, a delivery platform is a no-brainer as restaurants have high fixed costs and low variable costs, so each additional order goes directly to the bottom line.

Marketplace Challenges

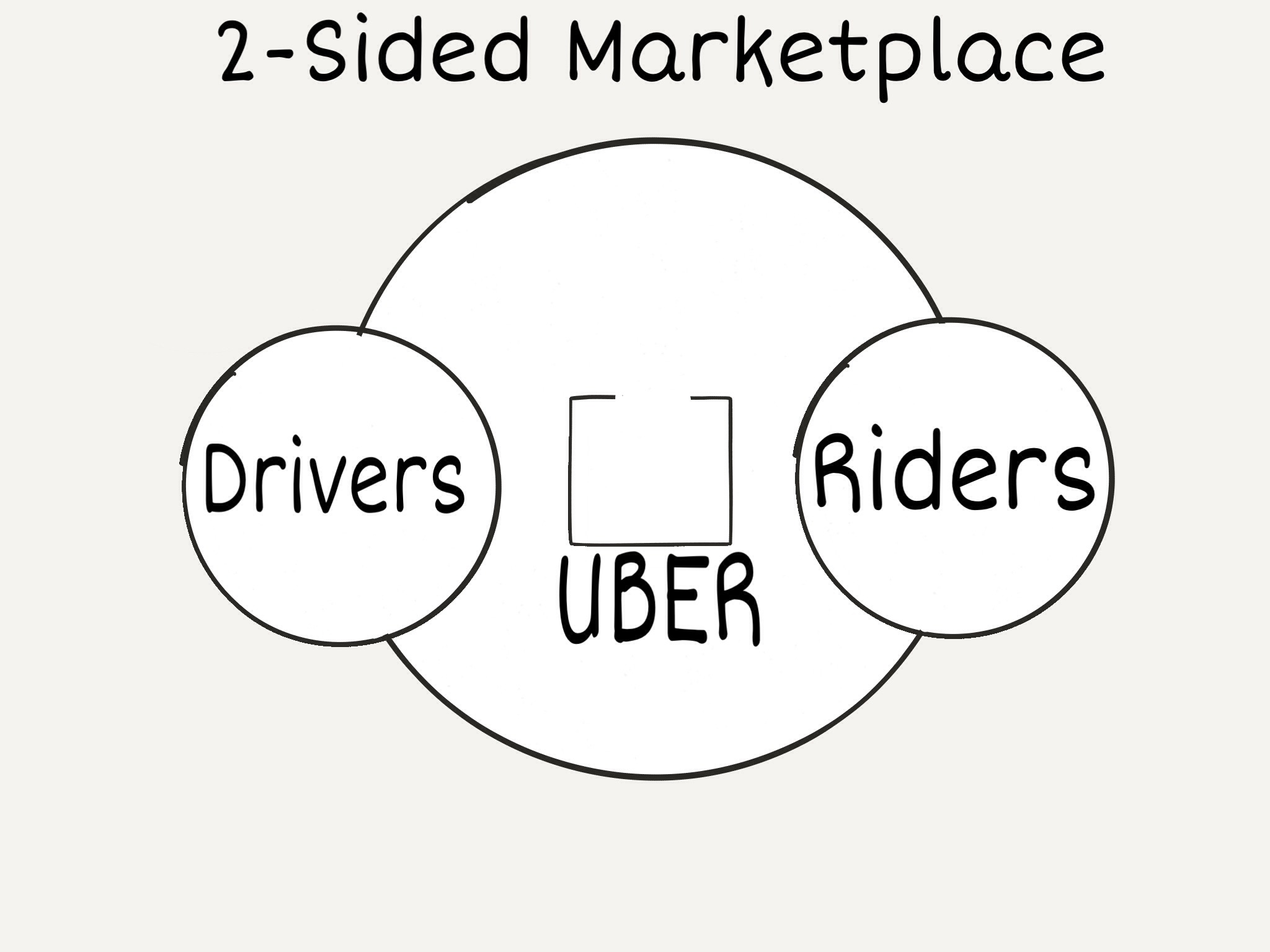

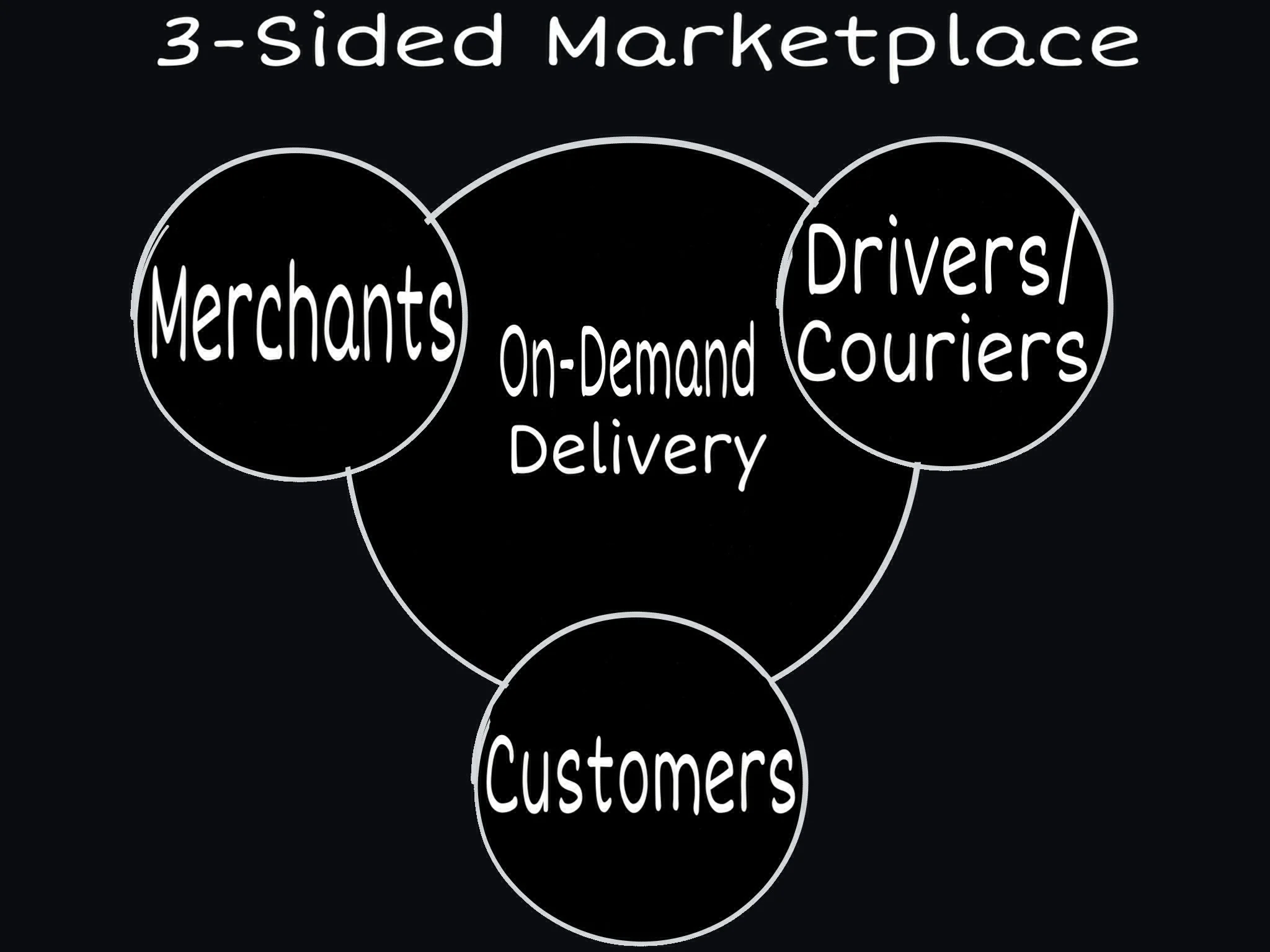

These on-demand delivery companies provide a marketplace for customers to order from local retailers or restaurants via smartphone or computer, charge a flat rate for delivery to the customer, manage the delivery, and charge a commission to the retailer or restaurant. Ideally, customers can order from multiple stores and receive just one delivery. The hope for these companies is to do to on-demand delivery what Uber’s two-sided marketplace of drivers and riders did for ride-sharing. The most important distinction here is that these on-demand companies are building a three-sided marketplace where a distinct group of users on each side need to be attracted to the same place. In order to succeed, the marketplace has to be able to add value to each side which consists of customers (demand), couriers / drivers (supply), and retailers / restaurants (merchants). An added complexity for these startups that was not a factor in the ride sharing marketplace, is that they need to establish partnerships with each and every restaurant or retail store in order to offer their products through the app.

And lastly, the marketplace needs to be built city by city; the fact that you have sufficient coverage across the three sides in San Francisco means little when rolling out to Miami or Tokyo. As a result, the roll-outs are slow but can become extremely valuable and very difficult for competitors to overcome. It's fair to assume that the primary means of differentiation is the platform's retail/restaurant coverage plus the ability to dispatch drivers / couriers as quickly as possible. The retail / restaurant coverage is likely a much easier problem to solve than the expedient dispatch of orders. Finally, as with most marketplace businesses, over time it is reasonable to assume that the majority player in a given market will prevail just as Uber has prevailed over Lyft in the U.S. ride-sharing market.

These are just Logistics Companies

While the“Uber-for-X” business model appears to be relatively simple, the scale and operational execution required to be profitable is exceedingly difficult. What stands out to me is that the core competencies for these companies - forecasting and routing algorithms, labor scheduling, and building the scale to have the delivery density to reduce transportation costs are the same core competencies required to be a successful logistics company.

My gut tells me to be highly sceptical of these companies. “Uber-for-X” sounds great, but Uber solved a major inefficiency in the transportation market by giving customers an excellent on-demand transportation experience and reducing the driver’s idle time. Given how poor public and taxi services are in many major cities, there was a huge appetite for Uber on both sides of the marketplace. Is there enough consumer demand and similar inefficiencies in the on-demand delivery market or will this be a niche option? Even though I am sceptical, companies like Amazon, Uber, Airbnb, and Netflix owe their phenomenal success to their ability to redefine existing markets. Retail is in flux and it’s not clear how it plays out, but if fast and convenient same-day delivery becomes the standard that the majority of people will want, these companies have the potential to redefine how we get our stuff.

Some doubts and questions that I will explore in subsequent posts:

- Are Uber and Amazon best positioned to own the on-demand delivery market?

- Are these companies just treading water until autonomous delivery comes about?

- These are logistics businesses, why aren't traditional logistics companies getting into the mix?

- What happens to parcel delivery companies if same day delivery is expected by consumers?

I cover forward-looking topics that are relevant for everyone that will be part of the future logistics industry. You can read more articles here or sign-up for a free monthly newsletter here.