Top 25 Risk Factors for Manufacturing Supply Chains

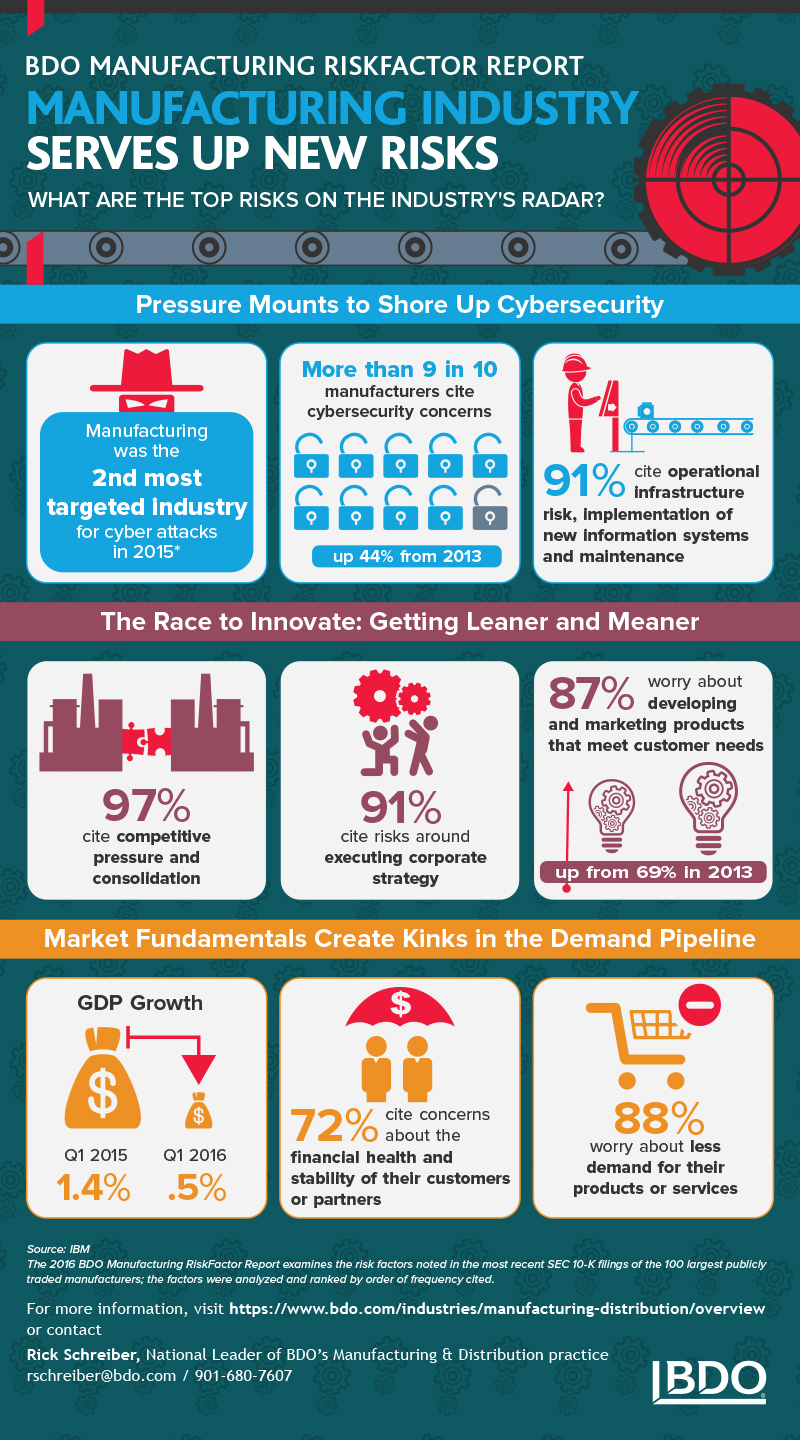

According to a recent report from BDO USA, an accounting and consulting organization, manufacturers' intellectual property, supply chain data and products have become prime targets for cyber criminals.

The 2016 BDO Manufacturing RiskFactor Report examines the risk factors in the most recent 10-K filings of the largest 100 publicly traded U.S. manufacturers across five sectors including fabricated metal, food processing, machinery, plastics and rubber, and transportation equipment.

The factors were analyzed and ranked by order of frequency cited.

Manufacturing Industry Serves Up New Risks

The manufacturing industry is getting mixed reviews.

The Institute for Supply Management (ISM) Index reported that activity was up in April after five straight months of declines.

Then, in late May, the Purchasing Manager’s Index reported the first reduction in output since September 2009.

In the trenches, manufacturers say domestic demand has been solid, while global business has been more challenging. And the end customer matters: in a recent earnings call, Caterpillar’s CEO noted, “Just about any market that’s away from oil is doing pretty good.”

“Pretty good” is a modest but realistic goal for manufacturers this year, and their top concerns echo this cautious optimism. The annual analysis of the most frequently cited risk factors found the supply chain remains at the top of the list - cited by 100 percent of manufacturers we analyzed - while emerging and growing risks in cybersecurity, competition, labor, pricing, regulations and international operations are also keeping manufacturers up at night.

“All it takes is one weak link in the security chain for hackers to access and corrupt a product feature, an entire supply chain or a critical piece of infrastructure. The stakes are too high in the manufacturing industry for complacency or inattention. Security can no longer be considered an add-on to products and processes. It must be built in from design to distribution, and monitored with a high level of priority.” Shahryar Shaghaghi, National Leader, Technology Advisory Services and Head of International BDO Cybersecurity.

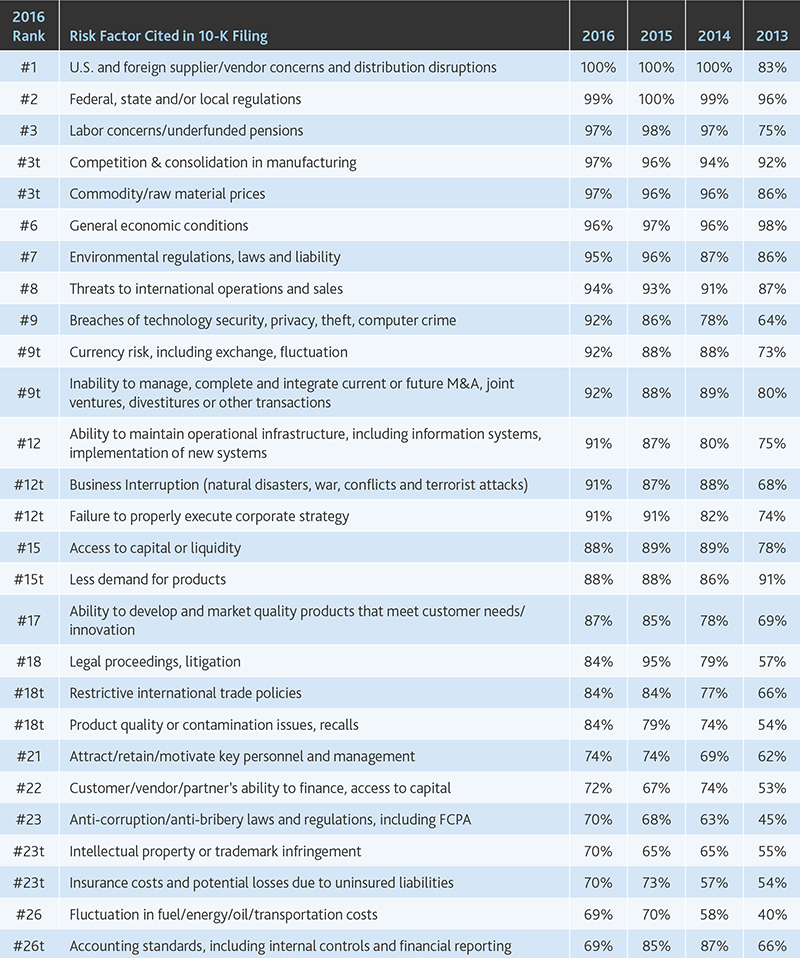

Top 25 Risk Factors for Manufacturers

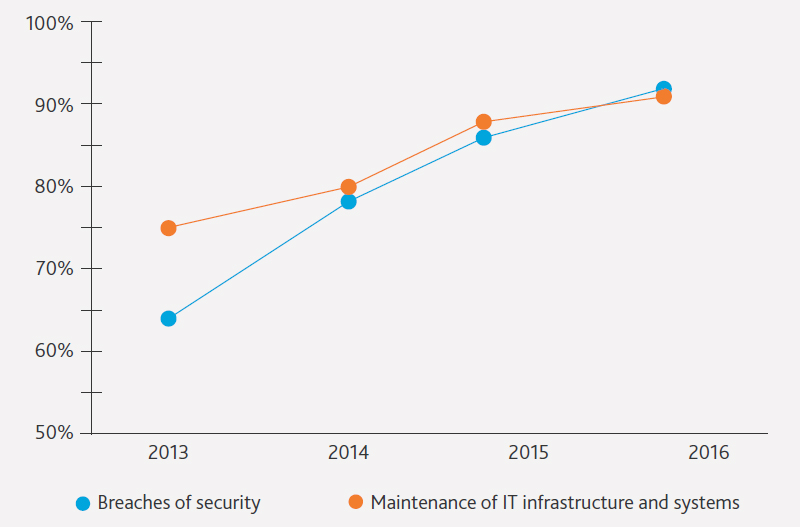

Manufacturers Scamper to Shore Up Security

Manufacturing was the second-most targeted industry for cyber attacks in 2015, according to IBM.

While the industry may have flown under the radar as high-profile attacks against the retail, financial services and healthcare industries made headlines, manufacturers’ information, intellectual property and products have become prime targets for cyber criminals.

As a result, cyber risk is moving up on manufacturers’ list of priorities, ranking in the top 10 risk factors for the first time in our analysis.

More than nine in ten manufacturers (92 percent) cite cybersecurity concerns this year, up 44 percent from 2013. Nearly all (91 percent) also cite operational infrastructure risk, including information systems and implementation of new systems and maintenance.

While manufacturers recognize the cyber issue, only eight percent in the MPI Internet of Things Study, sponsored by BDO, said they are very confident in their ability to prevent an IT breach. As manufacturers develop smart products and processes, more data and network entry points are created every day.

To maintain a competitive advantage, manufacturers must contend with both information technology risks and operating technology risks. Companies are increasingly wary of product performance problems and liability that can result from system breaches, in addition to vendor issues and equipment failures. Eighty-four percent of manufacturers report product quality, contamination and recalls this year, up from 79 percent in 2015.

Cybersecurity Concerns Take Center Stage

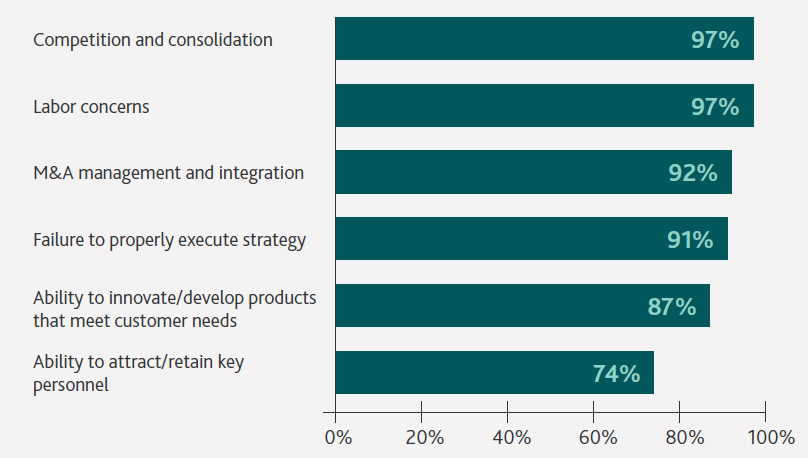

Competition and Consolidation Spur Innovation Risks

Nearly all manufacturers (97 percent) cite competitive pressure this year, and those concerns may also be contributing to a number of related business challenges.

Our Q1 2016 Manufacturing & Distribution M&A Review and Outlook found industry M&A activity last year surpassed 2014 levels, but slowed sharply in December 2015 and January 2016. Strategic and financial buyers alike are exhibiting a continued interest in deals, but lower valuations and still-challenging economic fundamentals are tempering optimism. Ninety-two percent of manufacturers cite the inability to manage, complete and integrate current or future M&A or joint ventures this year, up from 88 percent in 2015.

Facing heightened competition, manufacturers are clamoring to be leaner and meaner. More than nine in ten manufacturers (91 percent) note inability to properly execute corporate strategy - including cost reduction, capacity expansion or improving efficiencies - as a concern this year.

Furthermore, 87 percent report risks around their ability to develop and market quality products that meet customer needs, up from 85 percent in 2015 and 69 percent in 2013. Keeping up with emerging technologies like the Internet of Things (IoT), machine learning and virtual reality is likely fueling this uptick.

Manufacturers also continue to face challenges bridging the talent gap. Today’s factory jobs require greater technical competencies, and companies are competing for a new generation of workers in a shallower talent pool. Labor concerns are cited by nearly all (97 percent) manufacturers this year, and risks related to labor strikes are cited by 66 percent, up from 62 percent in 2015.

Moreover, with major strategic and technological changes impacting the industry, the right leadership team is more important than ever. For the second year running, nearly three quarters (74 percent) of manufacturers note concerns attracting and retaining key personnel.

“The skills gap is impacting manufacturers of all sizes, in all sectors. Despite boasting higher wages and greater benefits than average, the manufacturing industry is on track for two million unfilled jobs in the next decade. Manufacturers are fighting to win over the same pool of applicants as Silicon Valley and other tech-enabled industries. It’s critical to educate the next generation about the opportunities manufacturing jobs offer.” - Larry Barger, Senior Director in BDO’s Manufacturing & Distribution practice.

Competition Drives Key Business Risks

Market Fundamentals Cause Uncertainty at Home

Slow economic growth has led to cautious manufacturers and consumers. GDP growth for Q1 2016 was just 0.5 percent, as opposed to 1.4 percent during the same period last year, and consumer spending has also been soft. Amid this uncertainty, 96 percent of manufacturers cite general economic conditions as a risk, and 88 percent cite concerns over less demand for their products or services.

Manufacturers also worry about the fiscal health and diversity of their customer base. Just under two-thirds (64 percent) cite the loss or slowing rate of purchases from a major customer in their filings, and 72 percent disclose concerns about the financial stability of their customers and partners, including their access to capital and financing.

According to the Federal Reserve Bank of New York’s latest Survey of Consumer Expectations on credit demand and access, the rejection rate per applicant increased by one percentage point from October 2015 to March 2016. Meanwhile, businesses are increasingly skittish about taking on debt, with demand for commercial and industrial loans plunging in the first few months of the year.

Turbulent International Winds Blow Manufacturers Back Ashore

While the U.S. market is still contending with some economic weakness, the global picture is grimmer. The Wall Street Journal recently reported that manufacturing activity in China, France and Brazil is declining and global industry leaders like Honeywell and Cummins are citing difficulties abroad.

The strength of the dollar, which reached 12-year highs in November, also contributed to lower-than-expected profits and greater challenges for manufacturers looking to increase their global business. Demand from international customers for U.S. goods and services has historically increased when America is “on sale.”

Amid these concerns, 94 percent of manufacturers note threats to international operations and sales, up from 93 percent last year and 87 percent in 2013. Ninety-two percent cite currency risk, including exchange rates and fluctuation, up from 88 percent last year.

Manufacturers with global operations also cite growing concerns over the international regulatory environment. Seventy percent of manufacturers worry about their ability to comply with the Foreign Corrupt Practices Act (FCPA) and other anti-corruption and bribery laws.

Following heightened enforcement, FCPA risks have escalated since 2013, when just 45 percent of manufacturers noted it as a concern. A 2014 FCPA enforcement action against a mid-sized firearms manufacturer illustrated that global giants aren’t the only industry players subject to scrutiny.

National and international debates around trade are also top of mind for manufacturers. This year, 84 percent cite restrictive international trade policies as a risk. The National Association of Manufacturers (NAM) applauded the Trans‑Pacific Partnership, which was signed in February after seven years of negotiation, and its efforts to promote open markets. Still, the Office of Foreign Assets Control’s economic sanctions settlements have totaled $3.5 million year to date.

Challenging global markets, trade issues and the strong dollar are encouraging reshoring initiatives. According to the NAM, unit labor costs in the U.S. manufacturing sector have declined by 12.3 percent since the end of the recession, which further encourages companies to hire and expand in the United States.

A March 2016 study from the International Economic Development Council also found that “the cost savings that American firms had enjoyed [from outsourcing] began to erode around the year 2010.”

“U.S. manufacturers appear just one cup short of a complete recipe for significant success in the coming years. A comparatively attractive market, technological advancement and presidential platforms focused on manufacturing growth all bode well. Unfortunately, the critical ingredient of skilled talent isn’t readily available on the shelf, and manufacturers and the country must invest in education to change the conversation.” - Rick Schreiber, Partner and National Leader of BDO’s Manufacturing & Distribution practice and NAM Board Member.

While emerging technology, competitive and regulatory risks are impacting every sector, gauging the mood of the manufacturing industry might depend on who you ask.

Economic uncertainty may have executives planning cautiously for growth, but in the context of the global economy, U.S. end customers have more money to spend than their international counterparts.

At the same time, many manufacturers are incentivized to move jobs back home - only to compete for skilled labor in short supply.

In 2016, we expect manufacturers to continue to adapt to new technology opportunities like IoT and automation. By aligning with innovation, they will be better positioned to attract new engineers and skilled workers.

Transportation Equipment

Nine risks top the list of concerns among the transportation equipment companies analyzed: supplier chain concerns; federal, state and local regulations; general economic conditions; labor concerns; industry competition; breaches of security; inadequate access to capital or liquidity; environmental liability; and business interruption.

As the auto industry innovates autonomous vehicles, companies are becoming more fearful of security and data breaches that could not only put consumers’ personally identifiable information at risk, but also their physical safety.

In addition, 70 percent cite seasonality or cyclicality of business results as a risk, which is notably greater than the industry average (45 percent). The increasing frequency of extreme weather events and business interruption due to natural disaster could be contributing to this uptick.

Transportation equipment manufacturers are also frequent clients of government agencies, and as a result, 60 percent mention restrictions on government spending and contracts in their annual filings.

According to IBISWorld, growth in this sector has been offset by declines in military spending. While ongoing budget sequestration and pressure on the government to trim its spending could be contributing to these challenges across the industry, the outlook for commercial airlines and automobiles looks brighter.

Article Topics

BDO News & Resources

Manufacturers Must Invest in Supply Chain to Stay Ahead of Disruptions Adapting Approaches to Address Escalating Freight Expenses BDO: Manufacturers’ shift from optimization to reinvention through Industry 4.0 BDO Survey: Majority of middle market manufacturers recognize Industry 4.0 opportunity Dyn Urges Companies to Use Multiple Vendors in Wake of Cyber Attacks Top 25 Risk Factors for Manufacturing Supply Chains 2016 BDO Manufacturing Risk Factor Report More BDOLatest in Supply Chain

Spotlight Startup: Cart.com Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Apple Overtaken as World’s Largest Phone Seller More Supply Chain