Onfleet and a Last Mile Delivery Platform

/Source: Onfleet

The local last mile delivery market is a fragmented one with about 7,500 courier and parcel delivery companies in the U.S. alone. Within this crowded delivery market are logistics providers that range from giants like Fedex, UPS, and DHL, to retailers like Amazon, technology companies like Uber and Postmates, and many small-and medium-size operations in between. Technology is rapidly changing how consumers interact with businesses and this has led to on-demand delivery business models that enable local businesses to reach more local customers.

On-demand delivery, however, poses some remarkable logistical challenges - ultra-efficient route planning, the flexibility to adapt to unforeseen events in real-time, and the ability to provide highly accurate customer ETA’s to name a few. Uber transformed the taxi industry by meeting some of these same operational challenges and satiating consumers demand for simplicity, efficiency, and convenience. Uber simply made the customer experience so much better and now many tech companies, including Uber, are trying to do the same for delivery.

Hundreds of companies have emerged to allow you to get pretty much whatever you want, when, and where you want it. Many of these companies have struggled with logistics and have increasingly turned to tech companies that provide a delivery platform. I recently spoke with Khaled Naim, CEO of Onfleet, whose company provides cloud-based delivery management and route optimization software that manages companies last mile deliveries. Onfleet’s platform enables retailers, restaurants, and any local business to provide same-day delivery services with an Uber-like end user experience for their customers. Onfleet has raised about $5 million in funding, powers tens of thousands of daily deliveries, and has clients in 50 countries.

Businesses that use Onfleet receive optimized route planning, driver dispatching, location tracking, real-time traffic and road speeds, data collection, and analytics. Consumers receive an Uber-like experience which allows them to track driver locations, receive real-time notifications, and provide feedback upon completion of delivery.

Onfleet does not make any actual deliveries direct to the consumer but instead provides the software platform to businesses that provide delivery services.

The Cloud

I view Onfleet’s platform somewhat analogous to Amazon Web Services (AWS). AWS allowed companies of all sizes to gain access to enterprise-level computing resources with zero upfront investments. By moving to the cloud, companies can focus on their core business instead of buying and building their own back-end infrastructure. Similarly when it comes to logistics software, if you’re not a giant like Amazon, Fedex, or Uber (etc.) it probably does not make a whole lot of sense to build your own platform or use a hodgepodge of custom or packaged software that may limit future opportunities due to the closed nature of these products. If you’re a food delivery startup, why build your own last mile delivery platform when you can just plug in a few API’s to a platform like Onfleet and get up and running in a few days with minimal upfront investments or training. Or, if you’re an existing local courier, restaurant, or retailer with a private fleet, why not tap into a powerful last mile delivery toolset that gives your customers a modern Uber-like end user experience.

It's a Platform World

According to Khaled, companies typically realize efficiency gains of 30-40%, which makes for a nice business but this could be just the beginning of a far more lucrative business for Onfleet. Khaled says that Onfleet’s longer term plans involve a last mile digital freight brokerage platform where deliveries could be dynamically assigned to drivers on the platform. Khaled envisions a future where deliveries are assigned to the cloud and Onfleet’s software matches the delivery to the most optimal driver on the platform based on the pickup / drop-off location, location of the driver, vehicle capacity, time windows, existing driver routes, and the skill set of the driver.

I’ve written about a last mile delivery platform before here and I feel strongly that a platform approach will ultimately gain a successful foothold in the battle for the last mile for these reasons:

Customers increasingly expect more from retailers in terms of speed, flexibility, reliability and predictability of deliveries.

Most retailers and local businesses will never have the volume or route density to justify their own fleet AND meet their customer’s rising expectations.

The vast majority of local delivery providers are too small to be dedicated partners for retailers that want to offer same-day delivery.

Couriers and retailers with their own fleets have periods where they need extra capacity and periods when they have excess capacity.

Let's face it, if you’re not Amazon you don't have the scale, easy access to capital, nor the expertise to justify your own logistics systems and infrastructure.

A last mile delivery platform such as Onfleet’s could encourage a shift to an environment where multiple businesses share delivery fleets. The platform could aggregate local last mile delivery capacity from many couriers, local delivery providers, and retailers with private fleets and make this capacity available to local businesses. And, retailers and restaurants with or without their own drivers could assign deliveries on the platform and provide their customers with fast and convenient delivery wrapped up in a modern Uber-like delivery experience.

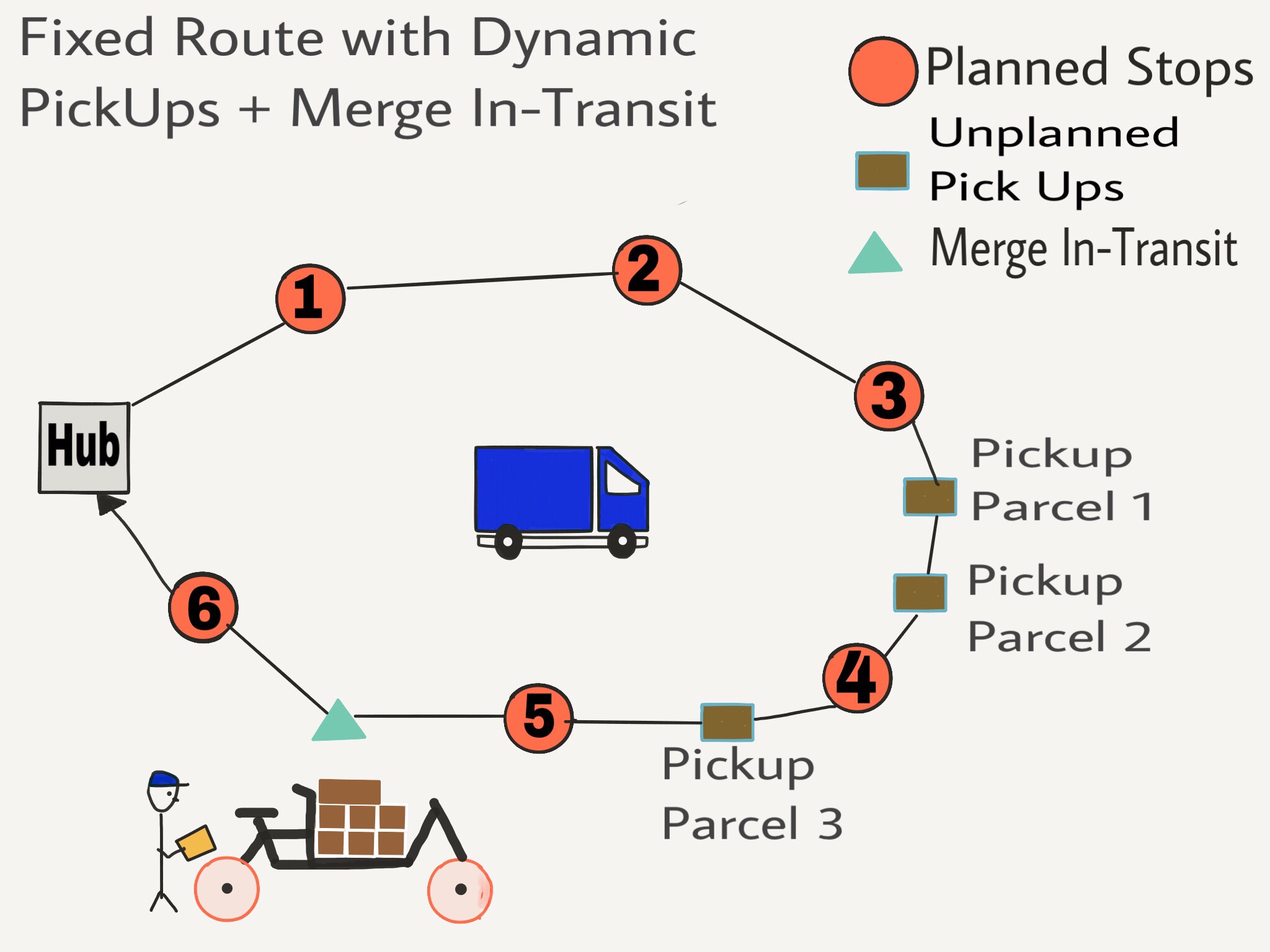

The concept is simple and is basically just carpooling for packages, but instead of people, the driver would pick up and drop off packages heading in the same direction:

Source: Executive VP of Art @ Techgistics

Another use case would be a retailer that has a fixed route planned on a software like Onfleet. As the driver progresses through the route, capacity in the vehicle becomes available. And, between deliveries there is enough time to make a few additional pick-ups and deliveries. This would be “known” by the platform and as route adjacent pick-ups and deliveries become available, the platform could auto-assign additional stops to the driver without disrupting the driver’s originally planned deliveries. It could look something like this:

If you want to take this a step further, the truck could meet up with a courier to aggregate and merge parcels in-transit. The truck could be matched with a courier who would be better suited to navigate busy urban streets and make the final mile deliveries to consumers:

And while the algorithms required to power this would be exceedingly challenging, all of the other pieces of the puzzle to make this a reality already exist - real-time communications, always connected devices, driver and delivery tracking, secure payment, and critical document capture all conveniently conducted within a smartphone. In exchange for providing market access with sophisticated routing and matching algorithms, the platform would take a percentage of each transaction.

This type of platform would be a win-win-win for retailers, drivers, and consumers. As the platform scales, pickup times become shorter, and both delivery costs and times decrease. Consumers get cheap and fast delivery. Retailers can offer same-day or same-hour delivery that allows them to compete with companies like Amazon. Drivers earn better wages by being better utilized and making more deliveries.

And, according to Mckinsey & Company, in ten years 80% of parcel deliveries will be done by drones, robots, and autonomous ground vehicles - each of these delivery methods could be plugged into the last mile platform as available resources. The next five to ten years will certainly bring about significant disruption in last mile delivery and while it’s unclear which technology, companies, or business models will emerge as the winners of the last mile, one thing is clear - a platform that enables retailers and delivery providers to share their resources in order to build the critical mass required to meet consumers rising delivery expectations provides a far superior path forward than going at it alone. Onfleet has set their sights on becoming a multi-billion dollar business - a last mile delivery platform may just get them there.

I cover forward-looking topics that are relevant for everyone that will be part of the future logistics industry. You can read more articles here or sign-up for a free monthly newsletter here.