Supply Chains that Push and Pull Different Products

Push-driven supply chains have been around forever whereas pull-driven supply chains have become increasingly popular and in most cases arguably better. But what about employing push and pull for different products in a single supply chain or distribution network? The mobile phone retail supply chain presents such a case of simultaneously maintaining both strategies.

Many supply chains employ a push strategy to a certain “decoupling point” and then serve the market with a pull strategy from that point forward to the end customer. For instance, PC computer sub-assemblies might be built to a push strategy. Then final configurations are built to a pull strategy, so push and pull live together in the same supply chain in serial (one after the other). But in the case of retailing mobile phones, push-pull strategies are also applied separately to different products in parallel (side-by-side). Here is why.

Mobile telecom operators sell smartphones and plans. Because most of the recurring profit comes from the service contract, not the phone, the overall goal is (or should be) to maximize the total revenue derived from the customer, known as the Average Revenue per Unit (ARPU). And the key to maximizing ARPU is product availability, especially in today’s more competitive and mature markets. But product availability impacts mobile telecom operators in two different ways, due to serving two different consumer attitudes:

- Consumers with a strong brand loyalty (e.g. towards Apple’s latest model) who may wait for major launches and availability. Here product availability is also crucial for the in-store positive experience and for reputation building.

- Consumers with little brand loyalty who focus on price and availability. Here the more commoditized the market, the bigger the impact of product availability on the ARPU, because there is less margin in the phones, so the margin contribution comes from the contract.

This bifurcated market generates the need for two different customer-driven supply chain strategies depending on the product and its lifecycle. A push strategy is needed for new products with strong consumer loyalty to manage scarcity and fair allocation. Product may be allocated based on different priorities due to business decisions (such as retail priorities, key accounts, or wholesale requirements). There may also be quotas due to credit or insurance conditions. And a pull demand-driven strategy for other products with less brand loyalty.

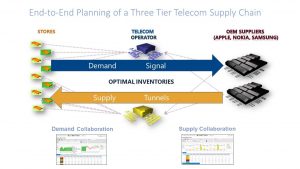

This must be accomplished over a three tier supply chain with:

- OEM suppliers (such as Apple, Nokia, Samsung, or Huawei)

- Mobile carriers (such as Vodafone, Teléfonica, or Verizon)

- Retailers, which can include carrier owned stores, but also include distributors, franchised stores and e-commerce

Further challenges include high demand volatility, the need to operate in omnichannel networks, short product lifecycles, seasonality peaks (e.g., Christmas), strong promotional activities, and high churn rates (as much as 2% monthly). It requires sensing demand signals in complex, multi-echelon distribution networks and taking advantage of risk-pooling strategies for postponement, equivalent items, and source availability.

The way to optimally address both consumer demands is through a dynamic and profitable assortment at the Point of Sale (POS), thus taking full advantage of product availability to maximize ARPU. This is achieved by evolving the traditional process into an end-to-end model among extended business partners, also known as a response network: a single responsive system able to continually synchronizing the network, meeting increasing customer expectations.

Demand is sensed at the stores and a single system spanning the three separate enterprises is leveraged across the network via optimal inventory targets, tailoring product availability across key sales channels (owned stores, 3rd party, online, etc.). This single unified model approach guarantees customer service levels while minimizing inventory need.

By leveraging store data (stocks and sell-out), mobile operators are able to produce daily automatic replenishment proposals that employ demand/inventory modeling logic. Instead of manual store-initiated provisioning orders, a centrally planned model automatically generates replenishment orders. Stores can focus on servicing demand, rather than worrying about stock levels.

Thirteen telecom providers on three continents have made this transformation. If your company is facing multiple demand streams requiring both push and pull strategies, a similar approach could be the best way to achieve sustainable high shelf fill rates (top line) and reduced inventory investment/deployment (EBITDA).

Click here for a supply chain analyst report on “response networks” as described above.