Updated: October 29, 2019

Most tariff change announcements since this article was first published have been at short notice. Take President Trump’s August 1 announcement of a 10% tariff starting September 1, at that time covering the majority of Chinese imports still untaxed.

One month is short notice. It was already too late for ocean freight going to East Coast ports. Almost no time either for West Coast bound shipments, except for near ready orders, and possibly rush jobs (although it’s not common practice for suppliers to have reserve stock on hand).

Before making orders, importers needed to first work out how much extra they will pay for a shipment arriving after the tariff change and weigh that against a surge in demand hiking freight prices. Switching to more expensive air cargo, especially at the last minute generally isn’t financially feasible, either. Price hikes aren’t relevant for shipments that would have gone by air anyway, because of lower capacity utilization on this mode.

Products imported by smaller retailers are the most risky politically because they hit the importers, consumers and inflation hardest. Consequently they were the last to be taxed, and it wasn’t surprising when, on August 13, the tax on the majority of these was deferred until after retailers had stocked up for holiday sales.

The table in the article proper has also been updated.

This past year has been a taxing one for companies that import from China to the United States.

On May 10th, tariffs on $200 billion worth of Chinese imports increased to 25%. These may be soon joined by additional tariffs on the remaining $300 billion of goods. When combined with the tariffs applied over the past year, importers are paying a hefty price. However, it’s not just the increased duties they’re paying. The past year has also seen transpacific freight prices, air and ocean, hit hard, with some interesting, expensive dynamics emerging.

What’s Behind The Tariffs

A key aspect of Trump’s presidency, from his perspective, is to protect the domestic economy.

His efforts range from renegotiating the NAFTA agreement (“the worst trade deal in the history of the world”) to an expansive series of tariffs – and not just on Chinese imports. Here’s a quick overview of the China tariffs that have gone into effect since first announced just over a year ago:

CHINA TRADE TARIFF LISTS: IMPORT VALUE AND IMPLEMENTATION

4a$125 billion21%15%Aug 23, 2019

Sep 1, 20194b$125 billion38%15%Aug 13, 2019

Dec 15, 2019

| LIST | 2018 IMPORT VALUE (USD) | % IMPORT VALUE | TAX | FIRST ANNOUNCED | FINALIZED | EFFECTIVE |

| 1st | $34 billion | 6% | 25% | Apr 3, 2018 | Jun 15, 2018 | Jul 6, 2018 |

| 1st Increase | 30% | Aug 23, 2019 | Deferred | |||

| 2nd | $16 billion | 3% | 25% | Apr 3, 2018 | Jun 15, 2018 | Aug 23, 2018 |

| 2nd Increase | 30% | Aug 23, 2019 | Deferred | |||

| 3rd | $200 billion | 35% | 10% | Jul 5, 2018 | Sep 17, 2018 | Sep 29, 2018 |

| 3rd Increase | 25% | Aug 2, 2018 | May 5, 2018 | May 10, 2019 | ||

| 3rd Further Increase | 30% | Aug 23, 2019 | Deferred | |||

| 4th | $325 billion | 57% | 10% | Sep 7, 2018 | Aug 1, 2019 | Was due Sept 1, 2019, but refer following rows |

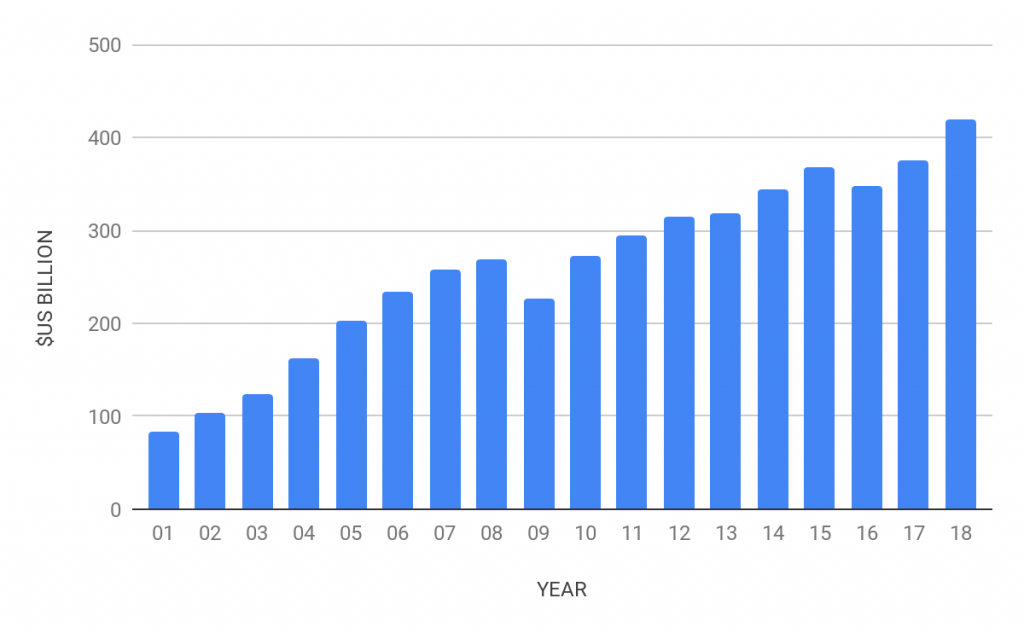

There are still serious doubts if the tariffs will achieve their intention of reducing the trade deficit between the two countries.

To date, the deficit has only widened. That will likely not change. A recent HBR article was confident that using tariffs to fix trade deficits defies two centuries of economic theory – namely, tariffs may not reduce deficits, and reducing trade deficits may not help the economy.

THE WIDENING US-CHINA TRADE DEFICIT

Despite multiple rounds of negotiations, it’s unclear where the trade war will end. Geopolitically, this goes beyond “only” China-US relations. Trump’s standing in political opinion polls, America’s standing in the international community, and the global economy are at stake as well.

This is exacerbated by unpredictable executive decisions, leaving importers to make tough decisions in a chaotic environment with big sudden shifts. And every round of tariffs brings retaliation creating equal uncertainty for US exporters. The recent turn of events seems to be a watershed. Anyone involved in international trade must wonder what is now at stake.

Until now, one of the biggest unmentioned impacts on importers has been freight costs.

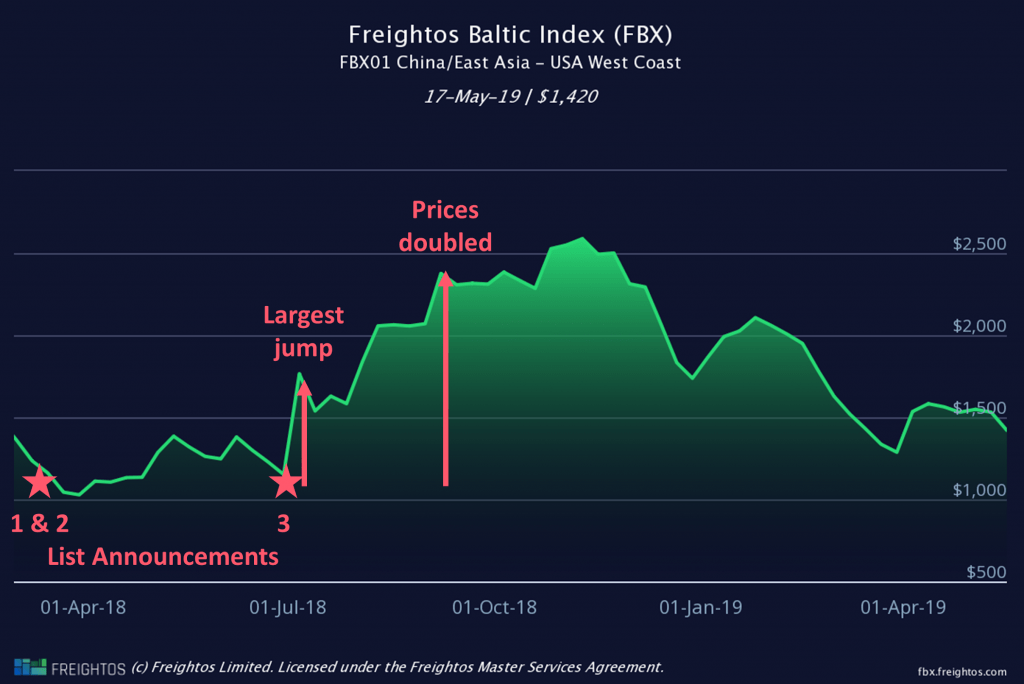

Based on Freightos research, much depends on how much warning is given about a tariff increase. Short notice tariff changes wreaked havoc, while longer notice periods tariffs saw transpacific freight prices first rise spectacularly and later come crashing down.

The Impact Of Short Notice Tariff Changes

May’s tariff increase, which Trump’s tweet suddenly brought back from an indefinite deferment, is a good example.

With just five days between tweet and implementation, mayhem ensued. Customs summarily rejected shipments with an arrival date of May 10 or later while they scrambled to update their website and systems.

Some ocean shippers looked to ship by air to beat the tariff increase, and some air shippers investigated bringing their shipments forward. That pushed air cargo searches on WebCargo by Freightos up 35% for the week.

Not that air could help…

In most instances, trying to arrange last-minute air freight would not have been financially feasible. As an example, the general air cargo rate for a PVG-LAX $5,000 value shipment weighing 500 kg would have been around $1,650. The 10% tariff added $500 and the additional tariff another $750 in duties. The additional cost for shipping at inflated express prices, however, would have been about $2,475. On the other hand for shipments of high value and low weight, air cargo can work.

This wasn’t the first tariff increase to be slapped on by the White House with little warning.

The list for the July 2018 tariff hike was finalized just three weeks before coming into effect. Risk-averse importers whose products have not yet come under any of the punitive tariffs might wonder if they will get short notice too. And with many of the remaining potential affected products being high-value, products like laptops and cell phones, it won’t just be the risk-averse considering advance shipping. All importers are now living with uncertainty and many are preparing by increasing inventory State-side.

Tariffs Changing With Longer Notice

The dynamic of freight pricing for long-notice tariff changes is more interesting.

Take the notice that the 10% tariff would increase to 25% on January 1, 2019, providing time, according to the Administration, for importers to shift supply chains. This gave importers time to front-load shipments, placing as many advance orders as their warehouses and working capital could handle.

Importers covered by the first two tariffs had already started advance shipping. Alone, this shift would have been sufficient to increase ocean prices. Unfortunately for importers, ocean carriers had learned their lesson from 2017 and were better managing the supply of ocean liner capacity. Prices rose fast, bringing peak season in early and making it stronger and more durable than previous years.

China to US West Coast prices (FBX01) nearly doubled between June 29 ($1,255/FEU) and September 7 ($2,376/FEU), with a massive 53% week on week increase occurring at one point during that period (July 6).

CHINA-US PRICES DOUBLED WHEN THE FIRST TWO TARIFFS WERE IMPLEMENTED

However, when, in February, the increase to the 10% tariff was deferred, advance shipping dried up. China-West Coast prices dropped more than 5% each week for five straight weeks, a feat not even matched by the year-long collapse of prices in 2017.

Beyond The Knee-Jerk Reactions

So, how should importers be dealing with tariffs?

Clearly, one step would be sourcing elsewhere.

Many larger importers were already moving some of their production away from China due to costs associated with rising wage levels and new environmental regulations. Fewer smaller operators followed suit, being more dependent upon China’s reliability and relative ease of business. However, the recent tariff includes many products imported by smaller ecommerce businesses. At Freightos, we’re hearing from more and more users that the extra tariff cost is making it uneconomical to source from China.

Nathan Resnick, whose company Sourcify helps importers streamline product sourcing, saw re-sourcing pick up a year ago:

“The transition of production outside China to South East Asia based countries like Vietnam has spiked significantly since these new trade tariffs were implemented. We’ve seen a substantial rise in manufacturing demand outside of China, with many Chinese factory owners also opening new facilities in other countries.”

Importers wishing to evade the tariffs have several other options beyond paying the higher tariffs or re-sourcing, but, as the JOC reports, each has its shortcomings. They can simply hope that the tariff war will go away sometime soon and hold back on purchase orders for now. Tariff engineering options like reclassifying products, shifting aspects of production to another country or making re-export drawback requests, and applying for a Section 301 exclusion are all potential, but fairly inaccessible, options.

And of course, they can temporarily reduce the impact of potential tariff increases by shipping earlier, even if that means paying extra for storage and tying up capital.

Broader-Reaching Impacts

The longer the tariffs stay on, the broader the potential damage. For instance, IHS Markit estimates US and China’s tariffs will cut global growth by 0.2 to 0.3 percentage points, but that cut would be doubled if untaxed US imports get a 25% tax. Clearly, there is a lot at stake.

One profoundly damaging aspect is long term supply chain planning. Changing suppliers takes months, building new factories takes years. Yes, supply chains are becoming more dynamic by necessity, and Freightos is playing a role by providing dynamic access to shipping options. But so far the tariff changes have outpaced the ability of importers and exporters to change their supply chains. As for what happens next, for anyone involved in international trade, the omens aren’t looking good.