The automotive spare parts industry is a highly competitive domain. Spare parts manufacturers, vendors, and suppliers are continually battling unclear demand signal, demand-supply fluctuations, and friction in the automotive supply chain. More importantly, if you misread demand signals, your operation might be prone to losing sales to your competitors or incur additional costs.

In all of this, a next-generation inventory management system — backed by real-time visibility — has a lot to offer in terms of supply chain optimization duties, especially in obtaining accurate demand signals. Roambee regularly engages with automotive supply chain players to help realize this, and in this article, we look at one such success story.

We will learn how a leading aftermarket automotive battery distributor is transforming its automotive supply chain with real-time inventory visibility and clear demand signals across its operational footprint!

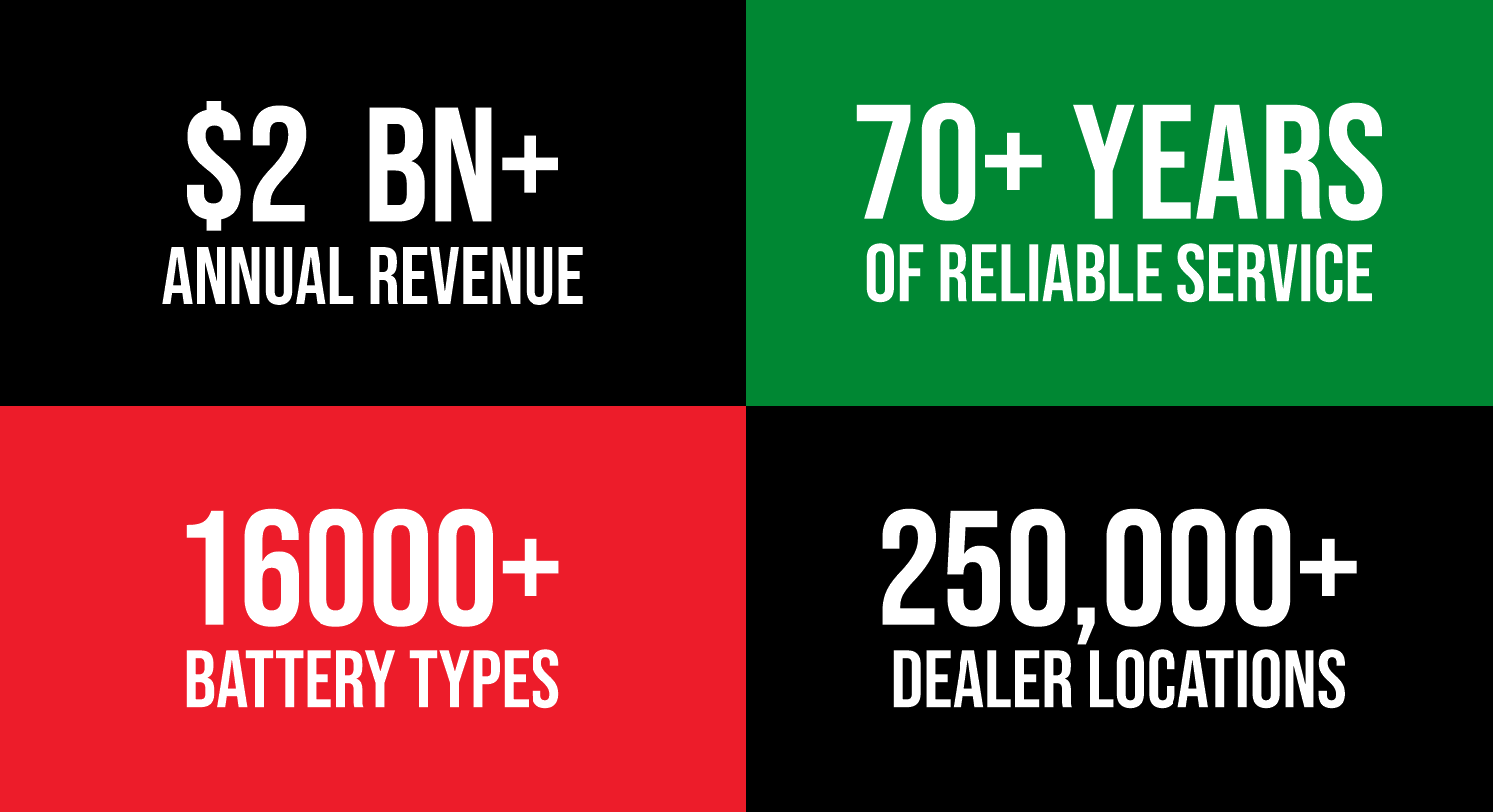

The battery distributor has one of the most extensive aftermarket automotive battery retail, marketing, and distribution firms in North America. It has a market share of more than 20 percent and an annual revenue of upwards of $2.0 billion.

The company offers more than 16,000 types of batteries in its product portfolio, available across 250,000+ dealers. It has more than 250 distributors dotted around the North American region, acting as nodes in its automotive supply chain.

Being a significant player in the aftermarket battery space, the company has to deal with varying automotive supply chain events. It includes getting the batteries to various stores, reacting to demand signals, managing an optimum supply, and much more. With 70+ years of experience under its belt, it has realized that there's enormous value locked in operational efficiency through clear demand signal, and traditional systems are just not cutting it.

The quest to achieve excellence brought the battery distributor and Roambee together. Roambee assisted the company with its one-of-a-kind Immersive Location-Aware Inventory Management Platform to realize operational efficiency. It brings a generational upgrade to any legacy systems and manual inventory management processes.

More on that later. First, let us take a quick look at if you should care about this success story.

But Who Should Care?

If your company deals with high-value spare parts and is part of an automotive supply chain, you must read this through. Suppliers of automotive aftermarket parts such as tires, engine parts, OEM-specific components, and automotive lights will find value in this success story.

Let's focus on the challenges faced by the battery distributor and how Roambee's all-around, end-to-end visibility and inventory management system helped them get the right product to the right customer at the right time.

Let us get started!

The Battery Distributor Saw Friction in Its Automotive Supply Chain

As a company at the forefront of its business, the battery distributor realized that its operations need to move from a distributor-to-dealer supply chain model to a multi-tier supply chain model, enabled by IoT (Internet of Things). In its bid to achieve operational efficiency, the battery distributor was facing the below-mentioned challenges.

Inaccurate Demand Signal

One of the most important aspects of any supply chain is the ability to read demand signals effectively. Unfortunately, in a legacy inventory management system, it is done predominantly by instinct, manual processes, or by applying basic data analytics principles to the already fragmented and untrusted state of the raw master and transactional data — yes, not even near real-time. Making it hard to achieve an accurate demand signal.

The battery distributor, so far, took care of its operations based on previous data and its vast experience. It worked under normal circumstances; however, it was not enough to maintain a business advantage over its competitors.

The company was dealing with the loss of sales and operational inefficiencies from inaccurately interpreting the demand signal. Delayed information on the lack of the required batteries at a dealer location was causing a significant amount of lost business and revenue opportunities. When the battery distributors’ products were not available on store shelves, there was a risk that potential customers would move to a competitor to fulfill their requirements.

High Operational Costs

Due to the lack of an accurate demand signal and to ensure ample stock at every outlet, the battery distributor had to replenish the batteries via an outdated blind milk run delivery model. It means that the company’s route drivers had to carry more than the estimated number of batteries, based on previous experience.

The outcome? Since the number of batteries sold at the dealer location was different each time; the route drivers would have more batteries than required. However, even if they could match the required number, they could not precisely predict which type of battery needed replenishment.

In such a case, the replenishment of the required batteries at the dealer location had to be postponed until the next scheduled milk run, which could take days, weeks, or even months. The apparent problem here was the lack of real-time visibility that enables a clear demand signal.

The battery distributor realized that store-level real-time visibility could help optimize its transportation lines — allowing it to send the right product at the right time to the right customer.

The predominant milk run delivery and product replenishment process brought the company unnecessary expenses that could be avoided with accurate demand signal, which comes from real-time stock data at a dealer location.

However, standardizing the POS (Point of Sale) machines or ERP (Enterprise Resource Planning) across a network of more than 250,000 dealers — many of which are small automotive service shops — was not practical. Especially when the battery company also had more than 250 distributors that provide service to these shops.

Lack of Control

The battery distributor operates on the high-touch business model, which means the distributors in its network operate more as independent entities than as part of a larger ecosystem. The company experienced a lack of control in delivering the batteries. Once the product was shipped, the company lost touch with the product and relied on multiple parties and fragmented transactional systems to confirm its delivery status.

Because of the lack of control, the company also came across multiple unaccounted problems that affected optimum operational efficiency. But the most significant burden came directly from the high cost of service per battery, which significantly impacted the company's and its independent distributor's bottom line.

On top of everything, the company had no store-level visibility, and a sale was only confirmed when their truck drivers went to replenish the stores.

The Company Looked into Visibility Solutions for Its Automotive Supply Chain

It is easy to think that RFID (Radio Frequency Identification) technology can solve this problem by offering item-level visibility. The battery distributor did consider it once when it invested in the technology four to five years back. But it soon recognized RFID's limitations.

It would have taken the company years to deploy the infrastructure-heavy RFID technology across its network of 250,000+ retail locations. Moreover, RFID did not solve the lack of control issue since the battery company still needed to depend on distributors and store owners to maintain and service the RFID infrastructure.

Furthermore, when the company ran a pilot at a few of their distributor locations, they found that RFID signals had a tough time working with lead-acid batteries. It led to inaccurate product-level visibility, voiding its use.

Active RFID was out of the question as well because of its high cost of deployment and operations, in addition to replacing all its battery racks.

The company even tried developing their in-house visibility solution based on Bluetooth Low Energy (BLE)-technology, but the research time and cost were significantly high. In exploring these technologies, it was able to identify the value a robust inventory management partner brings to the table; this is where Roambee came in.

Roambee Brought a Self-Provisioning Inventory Management System to The Battery Distributor

Roambee, with tremendous experience in supply chain monitoring and an eye for innovation, offers an on-demand, pay-as-you-go, infrastructure-light inventory management system.

It starts at the company’s location, where each battery gets tagged with an item-level sensor. It then ventures on to the company's routes around the country. Let us look at the transformation that this technology solution brought about.

Self-Provisioning Inventory Management System

Roambee's easy-to-deploy self-provisioning inventory management system is one of the reasons why the battery distributor considered this solution. The company wanted a system to control inventory without needing their distributors or store owners to participate extensively or have additional long training sessions, unlike with traditional RFID or BLE (Bluetooth Low Energy) solutions.

Roambee's innovative solution brought an elevated level of autonomy to the battery distributor with its user-friendly inventory dashboard that brings item-level visibility under one roof. You have information around your products' state, the exact location indoors, and whether the products have been sold after they reach the shelves.

Item-Level Visibility across Retail Outlets

Roambee's advanced technologies bring visibility to both the battery distributor's automotive supply chain and its dealer network. Our indoor location monitoring sensor solution coupled with advanced AI (Artificial Intelligence) algorithms deduce whether the batteries are on the shelves or being checked out.

Based on the data captured, the system helps the battery distributor understand the product's sales velocity, if it is expired, or if it needs replenishment. It highlights the need for a clear and steady demand signal.

Next-Generation Demand Signal with Next-Level Granularity

With the above system working in symbiosis with the battery distributor’s automotive supply chain, Roambee enables the next generation of demand signals with unprecedented item-level granularity.

It is essential to understand that it is not just a clear demand signal, but it is fundamentally different from a supply chain's current practices. The user has complete control over deployment, visibility, and actionability. Thanks to the package-level details offered by Roambee, the battery distributor could deal with demand-fluctuation effectively and service its stores efficiently.

Roambee-enabled dynamic route planning — based on demand signal — helps the company optimize its transportation and move away from a traditional milk run approach. It improves operational efficiency and cost of sale through fewer truck runs and carrying minimal, but accurate, stock.

The Bottomline

The Roambee solution brings a massive opportunity and competitive advantage to the battery distributor. It can now ensure sufficient stock at each of its 250,000+ dealers with an accurate demand signal and service these locations at a reduced operational cost, with immediate results visible in optimizing the deliveries.