The Changing Nature of Automotive Mobility

The results of an extensive study paint a complex mosaic of opportunities and challenges for automakers, with a large and powerful consumer segment more willing than prior generations to forego vehicle ownership altogether.

Nearly 2 billion strong worldwide, Gen Y (born 1977–1994) represents the largest and most influential consumer segment since the Baby Boomers.

When it comes to getting from one place to another, they crave connectivity and convenience, and frequently base their transportation decisions on overall cost and the quality of their customer experience.

Moreover, the decision criteria Gen Y consumers are using to base their transportation choices, and the impact of megatrends shaping the automotive industry, are resulting in numerous complexities, and significantly challenging and changing automakers’ products and how they engage Gen Y consumers—a segment that has ever-increasing options for alternative modes of transportation outside of vehicle ownership to meet their mobility needs.

Deloitte conducted a study of more than 23,000 consumers across 19 countries. The Deloitte Global Automotive Consumer Study included Gen Y consumers, Baby Boomers (1946–1964), and Gen X (1965–1976) consumers.

Why Gen Y and Why Now for Automakers?

Of the generations that make up automakers’ customer base, Gen Y is emerging as the largest segment influencing the industry. These young consumers represent one of the most interesting and complex segments in the last 100 years.

Referred to as the “technology generation,” Gen Y has grown up in a connected world that has changed how they interact with friends, family, and the world around them.

Their ability to immediately connect with anyone they desire—at their convenience—has to some degree also offset the need to own a vehicle to engage with people in their lives. That need has been replaced by email, texting, video chats, and other connected technologies.

Moreover, the need to complete tasks that require access to a vehicle are being met by emerging transportation models such as car- and ride-sharing, improved public transportation, and multimodal systems that are shifting preferences to vehicle access versus vehicle ownership—and, as a result, redefining mobility.

In addition, a specific set of megatrends (table 1) are influencing not only the need to own or lease a vehicle, but are also influencing vehicles themselves in markets around the world.

Table 1. Automotive Megatrends Impacting the Industry and Consumers

Given these dynamic forces and emerging transportation options that are challenging traditional vehicle ownership models, what can automakers do to connect with Gen Y consumers? How can they engage Gen Y consumers—both those who may not be currently interested in vehicle ownership and those who are ready to buy—in a way that creates customer experiences that differentiate their brands and products? Are there new business models automotive companies need to consider in response to market forces largely outside of their control? Finally, given the long product development cycles within the automotive industry, what should automakers be considering today in order to meet consumers’ needs and expectations three to five years from now?

To explore these questions, Deloitte* conducted a study of more than 23,000 consumers across 19 countries. The Deloitte Global Automotive Consumer Study included Gen Y consumers, Baby Boomers (1946–1964), and Gen X (1965–1976) consumers.

An initial analysis of the study focused on understanding the factors influencing the transportation decisions of Gen Y consumers: Are they are interested in vehicle ownership, what trade-offs they are willing to pay for to own a vehicle, how do preferences for technology (inside and outside of the vehicle) and lifestyle needs impact their choice in the purchase or lease decision, and does the entire customer experience influence the final vehicle purchase decision?

The study also explored whether those factors differ for Gen Y consumers worldwide. Three developed economies (the United States, Germany, and Japan) and three emerging economies (China, India, and Brazil) were used as a proxy to analyze the global landscape. In 2013, these six nations represented 63 percent of global automotive sales and 58 percent of the global economy.5 By focusing on these countries, we were able to examine similarities and differences between Gen Y consumers across geographies, societies, and markets.

Making the Case for Gen Y: A High-Growth Segment

Will Gen Y buy vehicles?

At nearly 80 million strong, Gen Y accounts for more than a quarter of the population in the United States, and nearly equal proportions globally.6 The growing number of Gen Y consumers in the workforce and their increasing purchasing power is also expected to cast significant influence on a myriad of products, including personal vehicles. According to our study, nearly 64 million Gen Y consumers in the United States—an impressive 80 percent of the Gen Y population—are planning to purchase a vehicle in the next five years. Surprisingly, these numbers are still higher for China and India, where approximately 90 percent of Gen Y consumers expect to purchase a vehicle in the next five years.

But not all markets are poised for strong growth within the Gen Y segment. In Japan, which is witnessing the convergence of forces like an aging population, traffic congestion, and infrastructure challenges, and has convenient access to alternative modes of transportation, fewer than half of Gen Y consumers plan to purchase a vehicle in the next five years.

These regional nuances create a number of challenges for automakers that are focused on the development of “global vehicles” that appeal to consumers in multiple markets and reduce cost and complexity of the product development and manufacturing processes. Moreover, the changing landscape of transportation choices and the impact of the industry megatrends outlined in table 1 result in a complex environment where public and private sectors are equally vested in delivering mobility models that meet the transportation needs of their societies and consumers.

Gen Y Will Buy, But Complex Factors Impact Decisions to Own

Affordability, cost, and the availability of public transportation

For a generation first hit by the dot-com bubble, and then one of the deepest and prolonged recessions in recent economic history,7 it is no surprise that affordability and operational costs are the biggest criteria influencing Gen Y consumers’ vehicle purchase decisions. More than three-fourths of Gen Y respondents in the United States who don’t currently own or lease a vehicle said they can neither afford to buy nor maintain a vehicle. The availability of public transportation and the choice of walking instead of using a personal vehicle rounded out the top three reasons US Gen Y consumers cited for not owning a vehicle. In fact, in nearly every market, affordability, operational costs, and the fact that lifestyle needs are currently met by walking or public transit were cited as the top reasons why Gen Y doesn’t own a vehicle (figure 1a). It’s also important to note that Gen Y consumers’ priorities were similar to the other generations in the study (for example, affordability, operational costs, use of public transportation); however, our study reveals that this young generation tends to relate to these concerns more strongly than Gen X consumers and Baby Boomers.

Figure 1. Gen Y Purchasing Influencers (who currently do not own or lease a vehicle)

But would Gen Y consumers be willing to buy cars even if automakers were able to address the issues of affordability and operational costs? The answer—it depends.

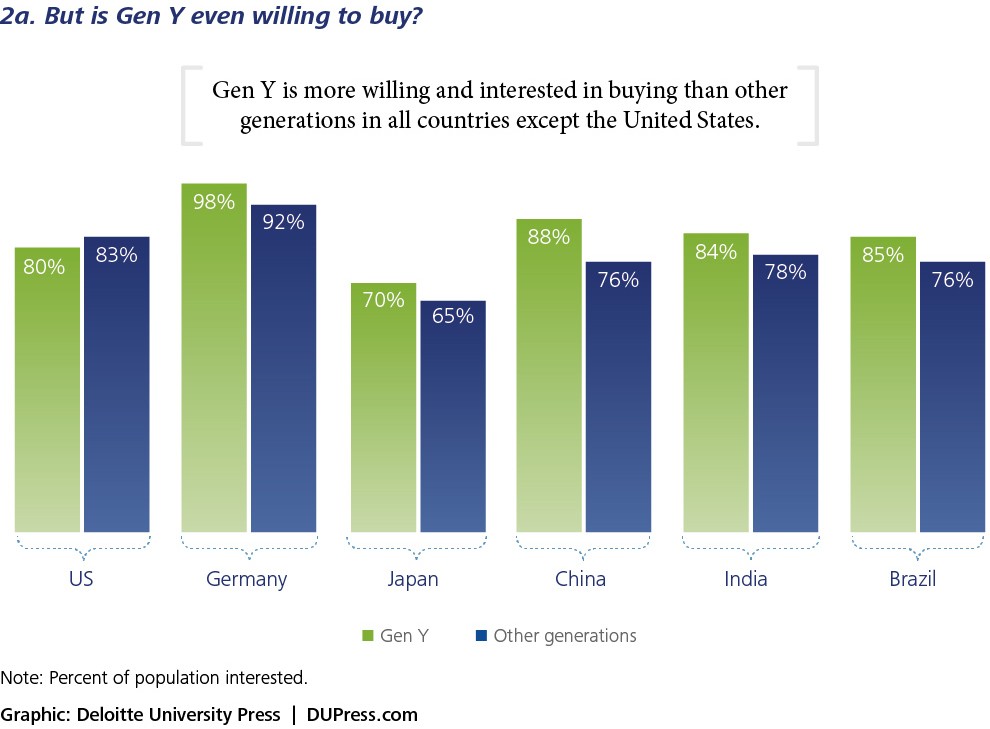

Gen Y consumers in the countries studied, excluding the United States, would be more willing and interested than older generations in vehicle ownership if affordability improved (figure 2a). However, nearly a third of the Gen Y consumers in Japan are not interested in any of the current models in the market, whereas only 2 percent of the Gen Y consumers in Germany appear to be uninterested in the vehicles on the road today. Moreover, some of the factors impacting consumers’ vehicle ownership decisions are outside of the control of automakers. In Japan and China, for example, inconvenient and/or expensive parking is a primary reason many Gen Y consumers are not interested in buying a vehicle. Despite these challenges—both within and outside the control of automakers—it is encouraging to note that Gen Y consumers for the most part are more willing and interested in buying or leasing a vehicle than other generations in five of the six focus markets (figure 2a).

Figure 2. Loyalty and Preferences

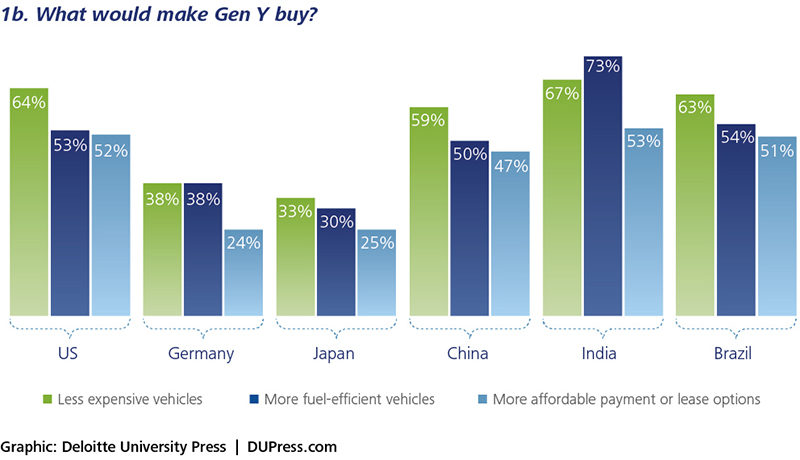

Value for Money

Gen Y consumers across all of our six focus countries want less expensive and more fuel-efficient vehicles. They want to spend less on vehicle ownership, both with respect to the initial capital to purchase a vehicle, as well as ongoing maintenance and operational costs such as fuel, parking, and repairs. In fact, fuel efficiency was identified by nearly three-fourths of Gen Y consumers in India as the most important motivating factor in purchasing a new vehicle (figure 1b). Gen Y consumers in the United States, in comparison, would be more inclined to purchase a vehicle if better payment options were available (figure 1b).

Again, when exploring the factors that would cause Gen Y consumers to purchase a vehicle, forces outside the control of automakers could influence the purchase decision of these young consumers. Gen Y consumers in the study—particularly those in emerging nations—cited improved infrastructure and increased access to convenient and affordable parking as primary reasons that would cause them to consider purchasing a vehicle. Also, for all of the six focus countries value for money (including fuel efficiency) ranks as a primary consideration for Gen Y consumers. While automakers are independently working on fuel efficiency, government regulations are also influencing the speed at which more fuel-efficient models are introduced to the market. These factors illustrate the impact of the trends outlined in table 1 and underscore the need for automakers to work closely with the public sector.

Convenience and Lifestyle Choices Influence Demand

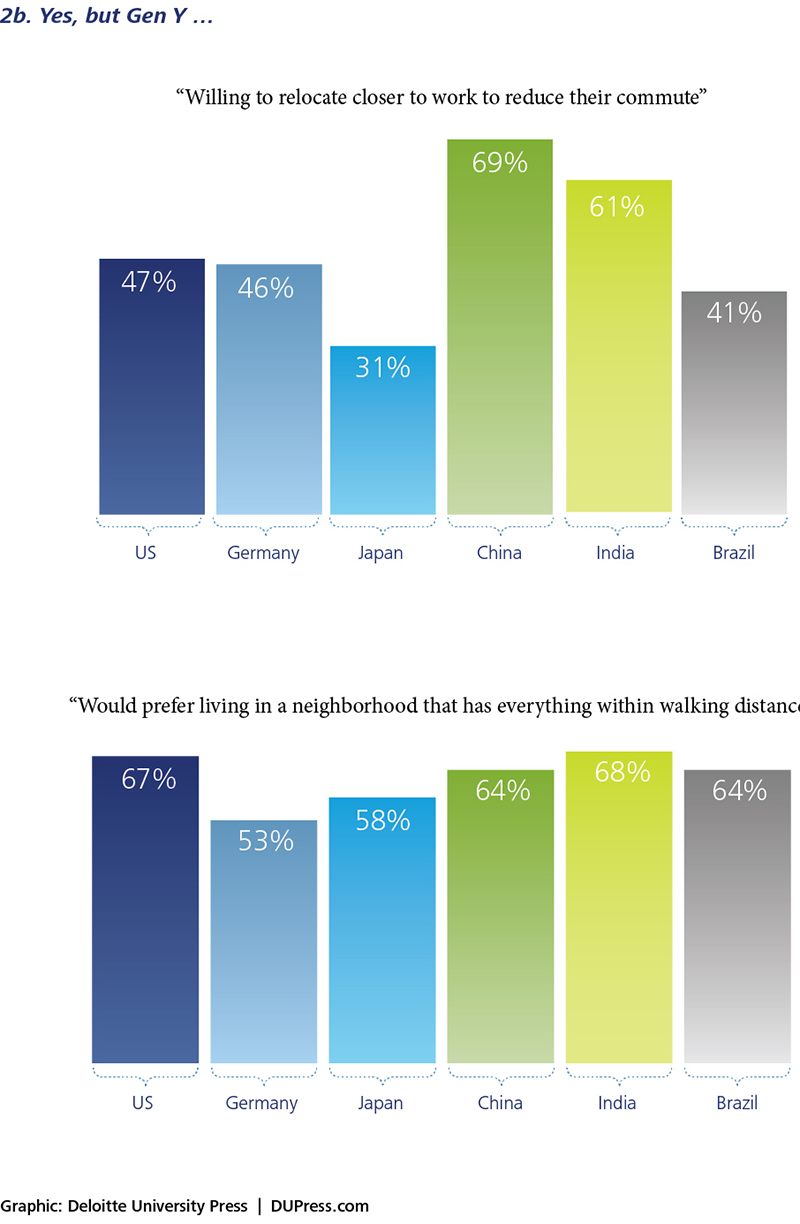

While consumers across all generations in the United States describe themselves as cost conscious, Gen Y more so than other generations places a greater value on convenience—particularly as it relates to these young consumers’ lifestyle choices. In the United States, 47 percent of Gen Y consumers are willing to relocate closer to work to reduce their commute compared to just 22 percent of the consumers across other generations. Furthermore, over half of Gen Y consumers in each of the six focus countries indicated they would prefer living in neighborhoods that have everything they need within walking distance (figure 2b).

Figure 2. Loyalty and Preferences

Growing Preference for Alternative Modes of Transportation

The rising popularity of car-sharing services is also an important consideration for automakers as research has found that as many as 32 personal vehicle purchases are avoided for every car-sharing vehicle in the 10 key car-sharing markets in the United States.8 Forty-two percent of US Gen Y consumers (versus 28 percent for other generations) are willing to use car-sharing, car-pooling, or similar services if they were readily available and convenient. The preference for car-sharing and similar services is stronger in China and India where nearly three out of five consumers—across all generations in our study—are willing to use car-sharing, car-pooling, or similar services.

These alternatives to vehicle ownership are further driven by the emergence of other high-quality transportation systems, as well as mobility/technology options which today offer convenience that allow Gen Y consumers to remain connected and productive while on the go.

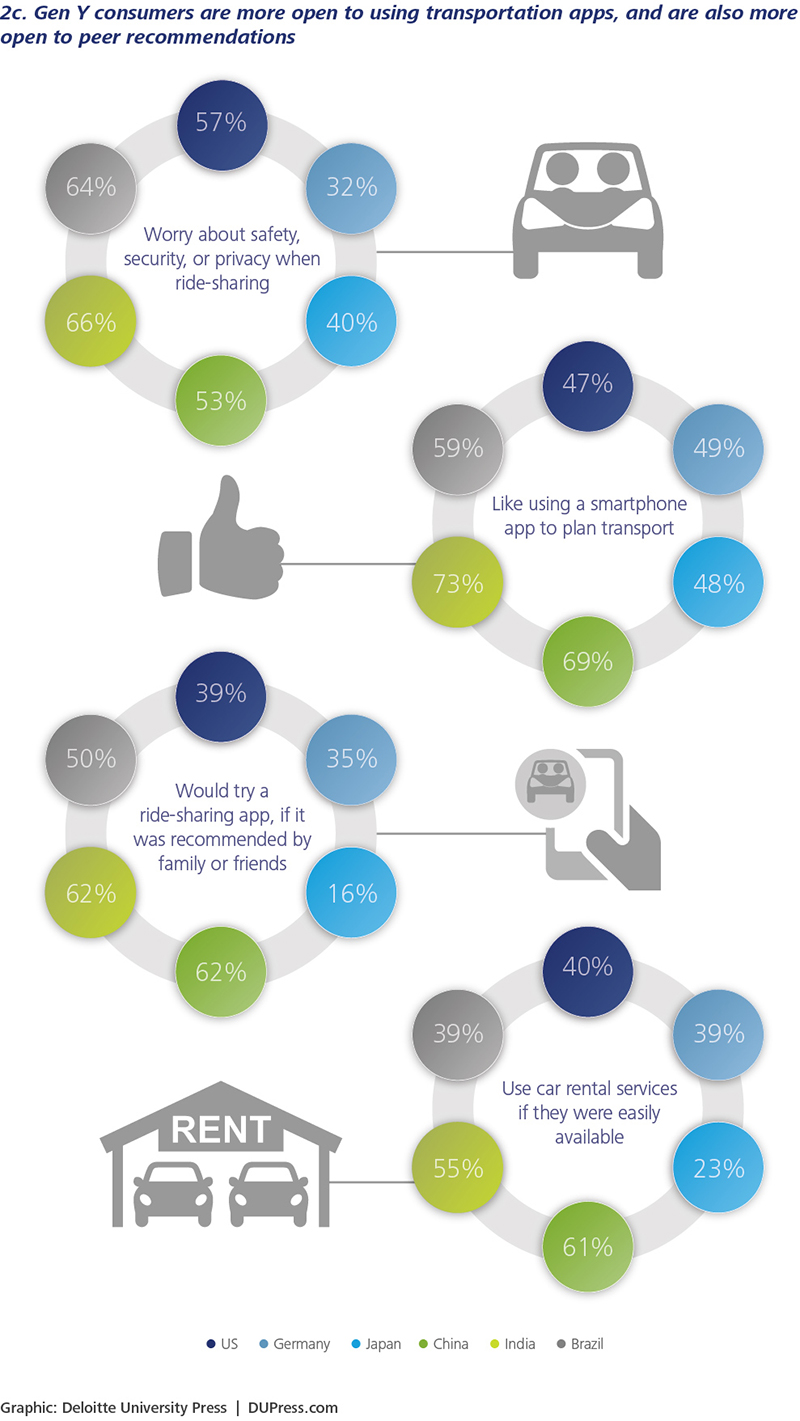

Gen Y consumers are interested in using these alternative transport options, particularly if they are safe and are enabled by technology. In the United States, 40 percent of Gen Y consumers said they would use car rental services if they were easily available and allowed for different pick-up and drop-off locations (figure 2c). Yet, safety concerns linger, with more than half of Gen Y consumers in India, Brazil, China, and the United States worrying about safety, security, or privacy when ride-sharing/carpooling or using public transportation (figure 2c).

Figure 2. Loyalty and Preferences

In all six focus countries, Gen Y consumers are also more open compared to other generations to using transportation apps on their smartphones—particularly those apps recommended by family and friends, which is aiding the adoption of alternative modes of transport. An overwhelming majority (73 percent) of Gen Y consumers in India like using a smartphone app to plan their transportation (figure 2c). And nearly 62 percent of Gen Y consumers in China and India said they would try a ridesharing app if it was recommended by a friend or family member versus only 39 percent of Gen Y consumers in the United States and a mere 16 percent in Japan (figure 2c).

With consumers’ desire for convenience and value ever increasing, new models and forms of transportation will continue to challenge traditional car ownership and push the evolution of mobility. For automakers, the convenience that car-sharing models and improved public transportation systems offer represents a critical challenge to overcome and, at the same time, offers opportunities to consider additional business models. BMW’s DriveNow car-sharing service and Daimler’s Car2Go are two examples of OEMs experimenting with these new types of business models.9

Walking Away From Their Vehicles

Even if the concerns Gen Y consumers associate with owning or leasing a vehicle are addressed, in most markets these young consumers are more likely than older generations to abandon vehicle ownership. This is particularly true in India, where 42 percent of Gen Y consumers would be willing to abandon vehicle ownership even if it meant an increase in travel costs. The noted exceptions are China and Japan, where other generations are more willing to abandon their personal vehicles (17 percent for Gen Y consumers versus 19 percent for other generations in China and 16 percent versus 20 percent in Japan).

Americans’ love for driving may also be fading. Our study reveals an apparent slippage in the loyalty that consumers attach to their personal vehicles. In fact, the average number of miles driven by Americans has fallen by 7.6 percent compared to a decade ago.10 Our study found that only 64 percent of Gen Y consumers in the United States said their preferred mode of transport was a car they own, in comparison to 81 percent of consumers representing other generations. Like their counterparts in India, Germany, and Brazil, Gen Y consumers in the United States are also more likely as consumers of other generations to abandon their personal vehicles—in fact, three times as likely. Nearly a third of Gen Y consumers said that they would be willing to give up driving a car even if they had to pay more to travel. So while their cost consciousness and initial desire for a vehicle may be strong, Gen Y consumers appear more fickle—many will abandon vehicle ownership altogether, even at a higher cost, for a more convenient option. This convenience factor is also transforming into new lifestyle choices. For example, a strong willingness to locate closer to work and living in neighborhoods where everything is within walking distance. It is also driven at least in part by the general economic conditions, and new and improved alternative transportation models.

Summing It Up

What do Gen Y consumers want in the cars they buy?

Across the six focus countries, our study reveals several key themes that emerge as primary considerations for Gen Y consumers—not only with respect to whether or not they will buy a vehicle, but also factors that influence which brands they consider and ultimately choose. Those themes include technology (safety, autonomy, and connectivity), alternative powertrains, convenience, customer experience, and cost.

Gen Y Wants Technology (most of it, anyway)

Gen Y has a penchant for technology. This is equally true with regard to vehicle technology as Gen Y consumers in all six focus countries identified advanced vehicle technology as an important feature they desire in their personal cars. Interestingly, with a generation that seems constantly connected through personal, mobile, digital technology, when asked to identify the area of greatest benefit expected from advanced vehicle technologies, Gen Y and other generation consumers in all six focus countries selected safety technologies over cockpit technologies (figure 3a). They report a very strong desire to buy vehicles that don’t crash. Specifically, they want technology that recognizes the presence of other vehicles on the road, and technology that would automatically block them from engaging in dangerous driving situations (figure 3d). Given the high per vehicle fatalities due to vehicle accidents in emerging markets,11 it’s not surprising that interest in crash avoidance technologies is even higher in these markets. However, the gap between emerging nations and the developed nations is not wide. While 84 percent of Gen Y consumers in India and 83 percent in China felt they would derive significant benefit from these technologies, a comparable 75 percent of US consumers cited significant benefit from crash avoidance technologies (figure 3d).

Figure 3. Technology and Automation (for all consumers)

While there was agreement from Gen Y around the world about the desirability of advanced safety and crash avoidance technology, the same was not true for cockpit and connectivity technology. In the developed economy markets, Gen Y consumers showed a significantly lower level of interest in the benefits of connectivity and cockpit technologies than their counterparts in Brazil, India, and China (figures 3a and 3e). We can only speculate that Gen Y consumers in these developed markets have become more accustomed to their always-present personal smartphones, with their 24/7 connectivity being everything they need, and more than what automakers can provide. But whatever is the rationale for this divergence, it creates a new wrinkle for global automakers trying to satisfy Gen Y consumers.

Figure 3. Technology and Automation (for all consumers)

These results underscore one of the most complex challenges automakers face with respect to cockpit and connectivity technology—introducing new connectivity innovations at the same pace as the technology industry. Moreover, Gen Y consumers around the world quickly and easily abandon older smartphone and tablet technology as soon as new innovations are available. These expectations are being transferred to their automotive experience and present challenges for automakers that need to provide these customizable cockpit technologies, much more rapidly and at lower costs than they have been able to do thus far. Given the pace at which technology companies launch new and enhanced products, it has become nearly impossible for automakers and their suppliers to keep pace with them. Automakers will need to consider new business models and new business partners to meet consumer demand, particularly when it comes to these technologies. The likelihood of disruptions in the future in the automotive value chain—where value is created and who benefits from these advanced cockpit connectivity technologies—seems to be high.

And what about autonomous, self-driving vehicles? Most consumers, including Gen Y, are currently much more comfortable with basic levels of automation (for example, technologies that allow vehicles to prevent skidding or lose grip with the road). As the level of vehicle automation increases, we see desirability to have it in their vehicle decreases across the six focus countries (unless, the technologies address their safety concerns). In fact, consumers are least interested in fully self-driving vehicles in all nations surveyed. Again, however, there is a notable difference between consumers in developed economies and those in emerging economies, with a much higher level of interest (nearly double) in fully self-driving vehicles in Brazil, India, and China (figure 3b). While consumers in all six focus countries show an inclination toward basic automation, the divergence between developed and emerging economy nations on this topic again poses additional complexities for global automakers. Given low interest levels in these technologies, it is not surprising to see IHS Automotive predicting only 11.8 million self-driving cars to be sold annually across the globe by 2035 (well under 10 percent of the global market).

Regardless of Gen Y consumers’ stated desire for certain vehicle technologies, our study suggests that consumers are unwilling to pay significantly more for access to those features. Though three-fourths of US consumers indicated they would pay a premium for the technology they desire, only 25 percent are willing to pay $2,500 or more. In Japan, consumers are even less willing to pay extra for vehicle technologies, with only 9 percent ready to pay a premium of $2,500 or more compared to 33 percent in Germany, 26 percent in China, 39 percent in India, and 41 percent in Brazil.

Gen Y Wants Alternative Powertrains (and fuel efficiency)

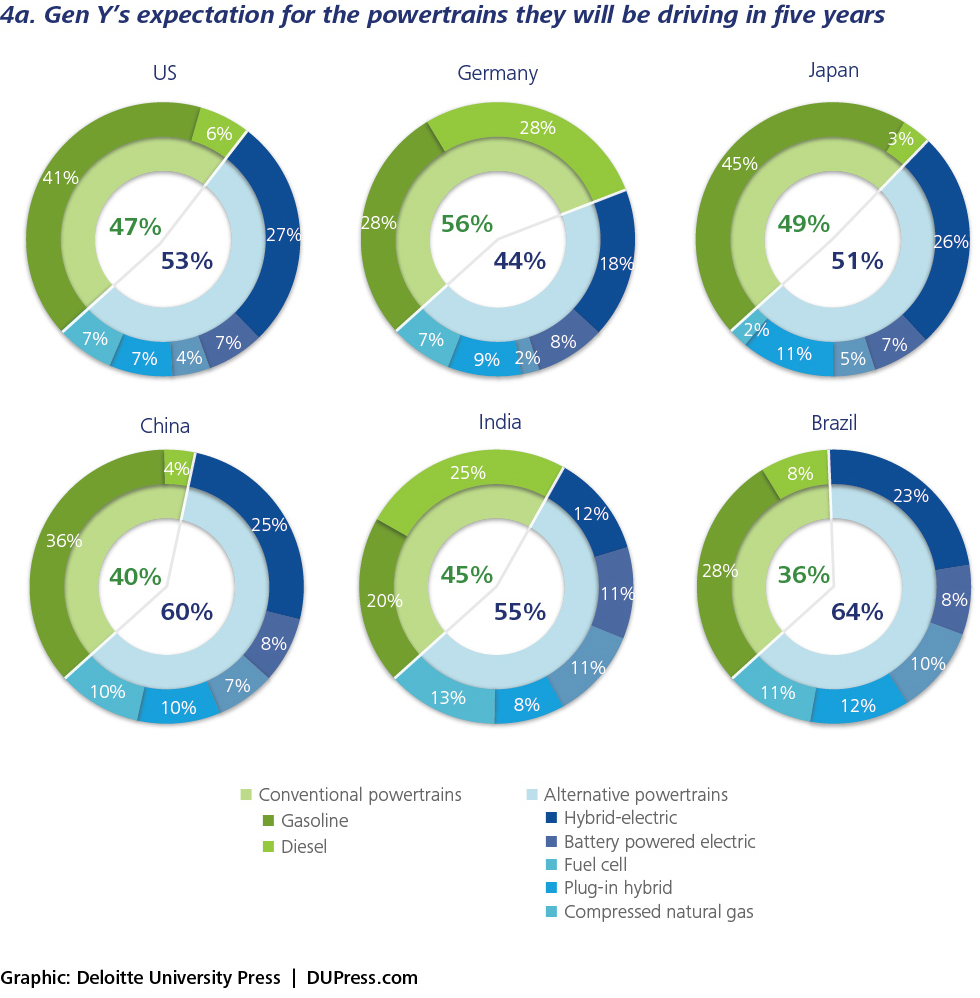

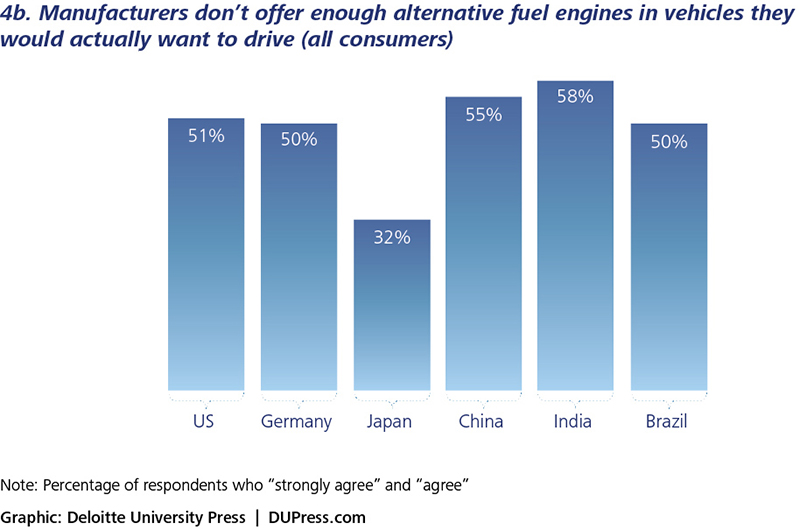

Closely linked to technology is the continued advancement of alternative powertrains. Gen Y consumers in all six focus countries listed vehicles that only use alternative fuels (instead of fossil fuels) as the second greatest benefit—behind vehicles that don’t crash—resulting from vehicle technology (figure 3c). These results are not surprising since the majority of Gen Y consumers representing the six focus countries expect to be driving a vehicle with an alternative powertrain within the next five years (figure 4a). At the same time, it is also clear that consumers’ needs aren’t currently being met when it comes to alternative powertrains. More than half of the consumers in the United States, Germany, India, China, and Brazil agree with the statement that “Manufacturers don’t offer enough alternative fuel engines in vehicles I would actually want to drive” (figure 4b).

Figure 4. Rise of the Alternative Powertrains

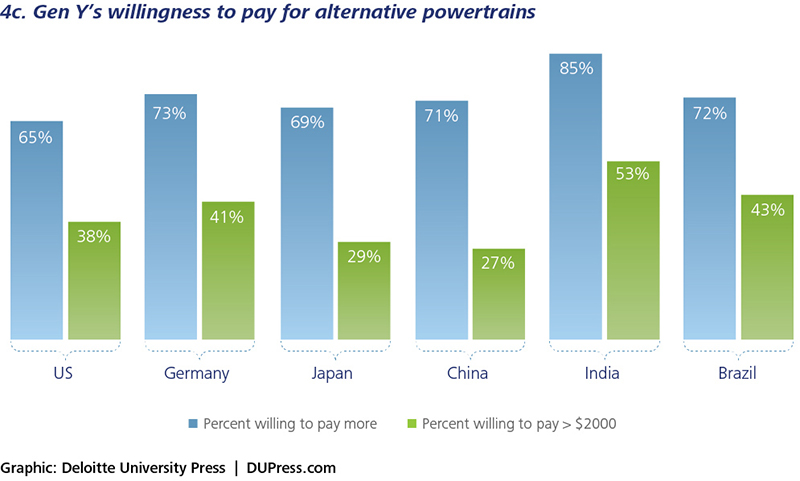

Moreover, a majority of consumers in developed markets expect vehicles with alternative powertrains to be priced more closely in line with vehicles powered with traditional gasoline-powered internal combustion engines. Only 38 percent of US Gen Y consumers (and even lower, only 27 percent, for other US generations) indicate they would be willing to pay a premium of at least $2,000 for alternative powertrains (figure 4c). In contrast, consumers across all generations in markets like India are willing to pay more for alternative powertrains.

What’s interesting is that once again, cost (versus the environment) appears to be the motivator driving interest in alternative powertrains. More than half of the Gen Y consumers in the United States said they are motivated to buy an alternative powertrain by their desire to save money on fuel rather than to save the environment. In fact, nearly the same number said they would prefer to drive a traditional vehicle if it could provide comparable fuel efficiency.

As consumers become increasingly knowledgeable about alternative powertrains and the various trade-offs/benefits and as traditional engines continue to become more efficient, significant price premiums for alternative powertrains will be a tough sell for the majority of consumers, especially in developed markets where only a third of consumers are ready to pay a premium of $2,000 for alternative engines.

Given there is a clear appetite for fuel efficiency in the near future, most automakers are placing bets on which type of alternative powertrain will win out. In almost all markets, Gen Y consumers expect the powertrain of choice to be hybrid electric (not plug-in). This preference for a non-plug-in hybrid appears largely based on the greater convenience offered by the non-plug-in hybrid, and our study repeatedly found both cost and convenience as the primary considerations in most automotive-related decision making by consumers worldwide. However, despite this, the majority of consumers representing our six focus countries want automakers to offer a range of engine options for each model that they produce. This preference for choice is not restricted to Gen Y, but is common across all generations. Consumers state that they prefer to have range of powertrain options for any given car model over a specialized line of vehicles that have only alternative powertrains, and by a considerable margin.

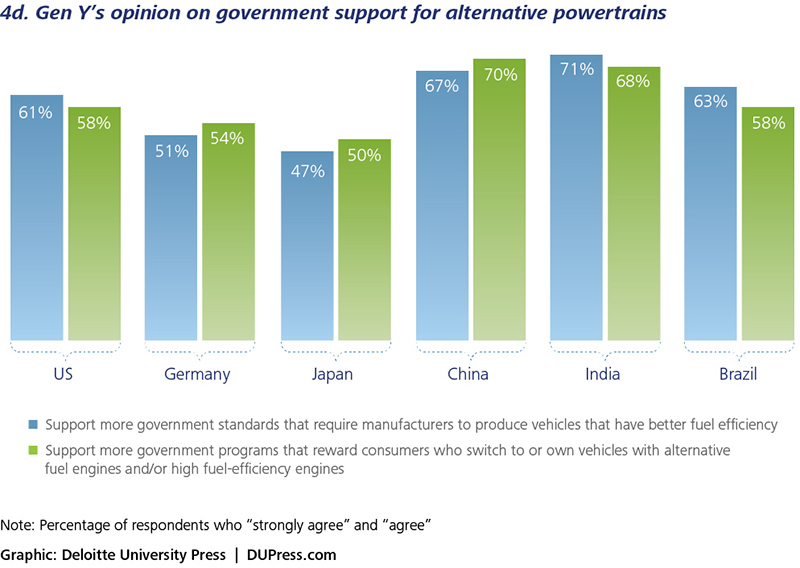

These consumers are even supportive of governments helping the cause. Our study found that the majority of Gen Y consumers across all six focus countries are very receptive to both government incentives and standards in an effort to increase fuel efficiency (figure 4d).

But, are consumers knowledgeable about various alternative powertrains and their benefits? Consumer knowledge may also impact interest in and willingness to pay for different types of alternative powertrains. Knowledge about alternative powertrains is low across the six nations with less than a third saying they are very knowledgeable about alternative powertrains. These findings suggest consumers have not made up their minds with regard to preferences for specific alternative powertrains, thereby presenting an opportunity to automakers to educate their consumers on the pros and cons of the various alternative powertrain types.

Overall, consumers report that they want more alternative powertrains and options from automakers, all aimed at improving fuel efficiency and lowering their operating costs, and are very comfortable with government policy-makers creating incentives for consumers and mandates for higher fuel efficiency for automakers. As automakers try to satisfy consumers’ current and forecasted demand for alternative powertrains, they are taking different paths—both in types of alternative powertrains offered as well as model and powertrain combinations. While some manufacturers have nameplates exclusively offered with alternative powertrains, others are offering models that allow consumers to select the powertrain they desire—just as they would offer other vehicle options (color, interior fabric, sound system, etc.). But the power of choice is most desired by consumers from all generations.

Gen Y Wants Convenience (and a better customer experience)

Convenience revolving around the entire customer experience (both during the purchasing process and post-sale service and maintenance) emerged as a primary factor that would influence Gen Y consumers’ interest in vehicle ownership and, perhaps more importantly, the brand they ultimately chose. Three-fourths of respondents across all generations in the study indicated the cost and quality of the service bundle would influence their final purchase decision. Consumers also appear to want more from their dealership experience—particularly in emerging markets. When asked about the importance of free routine maintenance, including a dealer’s ability to conduct repairs, pick up a vehicle for service, or drop off a loaner, consumer interest in emerging markets consistently outranked interest in developed markets.

For automakers, these findings underscore the importance of convenience around the entire customer experience and the need to deliver an exceptional experience at every touch point.

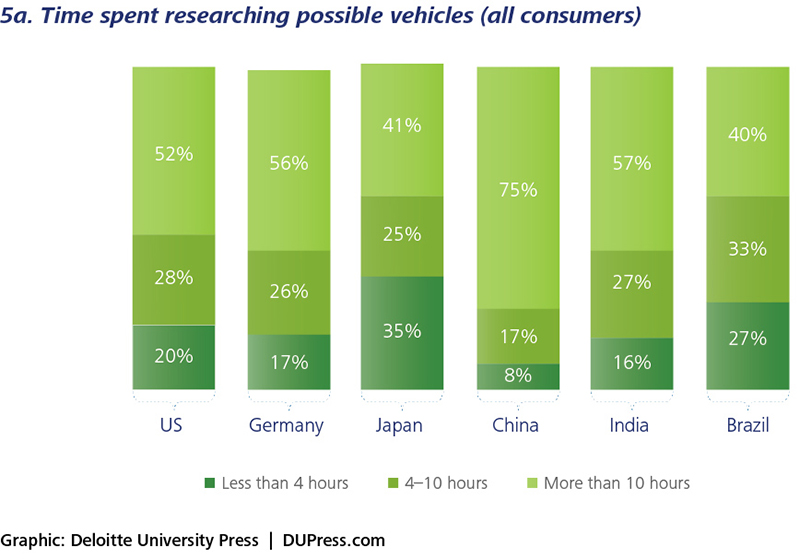

Time spent at the dealership was also an important customer experience factor. Across the focus countries, a majority of consumers across all generations indicated they invest more than 10 hours researching possible vehicles to purchase. And there was little difference between Gen Y consumers and other generations. Consumers from China spent the most time researching vehicles, with roughly 75 percent spending 10 hours or more. In contrast, only 41 percent of consumers in Japan invest 10 or more hours in conducting research (figure 5a).

Figure 5. Convenience and Customer Experience

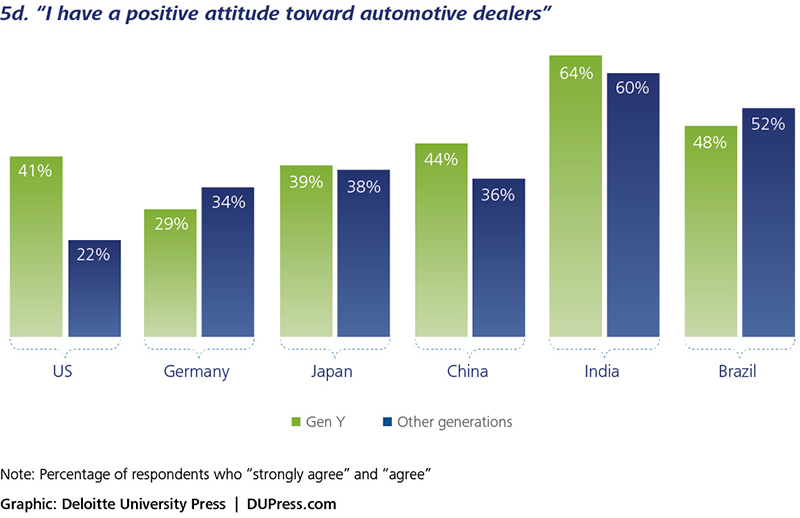

In addition to convenience, however, dealers are also faced with a perception of being less trustworthy than other sources for vehicle information, which is unfortunate given the amount of time spent at the dealer and the significant number of consumers in most of the six focus countries who feel dealers treat them with respect and have a positive attitude toward dealers (figures 5c and 5d). When it comes to their trusted source for research, dealership visits consistently rank low on Gen Y consumers’ list of trusted sources for vehicle information. Gen Y consumers in the United States indicate reviews on independent websites as their most trusted source, whereas in all of the remaining focus countries, Gen Y consumers indicate family and friends as their most trusted source. Only in Japan did dealership visits rank within the top three most trusted sources (figure 5b).

Gen Y Wants Lower Costs

Finally, and as discussed previously, cost associated with vehicle ownership is perhaps the most influential theme that emerges in our study in attracting Gen Y consumers to vehicle ownership. Certainly the cost of the vehicle is an important consideration, but Gen Y consumers consistently appear to be very focused on the long-term operational costs and their willingness and ability to pay those. To offset these concerns, more and more of these young consumers are turning to transportation models that provide convenient mobility without the long-term cost obligations which many view as a burden associated with vehicle ownership.

Automakers have a tremendous opportunity to address Gen Y cost concerns with more creative and flexible total purchase and operating cost (purchase, maintenance, fuel, parking, insurance, residual protection) financing options. In fact, many of the products offered today are already starting to address Gen Y consumers’ operational cost concerns. Cars are going further, lasting longer, using less fuel, and requiring less maintenance around the world and automakers are indeed becoming more creative with lease and financing options. However, the gap between what is offered today to address Gen Y cost concerns and what is needed to make Gen Y more comfortable with a purchase decision is still wide and new business models are offering alternative options that alleviate the need to own. Automakers will need to increasingly look beyond the product and focus equally on the customer experience, and perhaps even alternative business models, to satisfy current and future Gen Y consumers.

Clear Preferences

The results of our study paint a complex mosaic of opportunities and challenges for automakers. A lot is at stake, particularly with a large and powerful consumer segment like Gen Y more willing than prior generations to forego vehicle ownership altogether.

Fortunately, this young tech-savvy generation has made its preferences very clear. Of the many likings they have toward the vehicles they own, “cost” and “convenience” come out as the defining themes which automakers need to address to win over this generation. This means automakers should use more creative and all-inclusive bundled cost approaches with the ability to not only lower overall costs but also create greater certainty in maintaining stable costs. In addition, they also need to provide more creative services that will result in greater convenience for Gen Y across their entire gamut of customer experiences. These two themes really stand out as the “key factors” influencing whether Gen Y buys, and—if they buy—who they buy from. But these same factors present considerable challenges for OEMs, suppliers, and dealers to meet Gen Y’s expectations while still making a reasonable profit.

In addition to cost and convenience, for Gen Y consumers interested in vehicle ownership, a new set of brand differentiators emerge. New features like vehicle technology (inside and outside of the vehicle), alternative powertrains, and even the customer experience will influence the decision-making process and consumers’ ultimate purchasing decision.

The rise in popularity of car-sharing and similar models among Gen Y, as well as improved public transportation systems also create a new set of competitors (and opportunities) for automakers.

Automakers not only compete against each other, but also increasingly against other factors influencing the need to own or lease a vehicle. Those automakers that look at opportunities beyond the traditional business models and sales processes will more than likely have the opportunity to win lifelong customers—particularly young Gen Y consumers.

Source: Deloitte University Press

Article Topics

Deloitte News & Resources

MHI Report: Investment increases as supply chains become more tech-forward and human-centric Global Trade Tensions, Material Shortages Not Expected to Ease in 2024 Blockchain in Supply Chain Continues to Mature Supply Chains Struggle to Access Reliable Emissions Data from Suppliers State of the industry: MHI releases annual report at ProMat 2023 MHI and Deloitte launch 2023 Annual Industry Report survey How Amazon Is Preparing For Fully-Electric Drone Delivery More DeloitteLatest in Technology

Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Apple Overtaken as World’s Largest Phone Seller Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs Talking Supply Chain: Procurement and the AI revolution 80% of Companies Still Unsure How to Best Leverage AI, Study Finds Supply Chain Stability Index: “Tremendous Improvement” in 2023 AI Not a Priority for Retailers and CPG Companies More Technology