The Maersk Shift: Where it started

For Maersk, June of 2016 was the breaking point. After a rough 2015, the first half of 2016 was no different.

Demand for ocean freight was lower than anticipated, and Hanjin Shipping, another top ten ocean liner, was already teetering on the verge of bankruptcy. Meanwhile, Maersk’s energy business was being hammered. Oil prices tanked, cancellations increased and Maersk drilling and supply chain services would run up nearly $2 billion dollars in annual losses.

So three months after an executive meeting on June 23rd, an updated strategy was released, tracking a radical shift into a slimmer Maersk, focused on providing end-to-end logistics services.

In this essay, we’ll explore Maersk’s shift, the unique asset-heavy carrier advantages that encouraged this decision, and individual products developed over the past four years to realize the vision, across their core ocean services, freight forwarding, and value added services. Finally, we’ll explore the potential impact (and coping tactics) for existing forwarders.

The Post-2016 Strategy: End-to-end Shipping

The September 2016 decision mapped out a clear new direction. Maersk would split into two divisions – a Transport & Logistics division, and an energy division. The latter would be spun off or sold. Meanwhile, the golden child – Transport & Logistics – charted three pillars for growth:

- Product offering and customer experience

- Efficiency by unifying entities

- Better capital discipline, with an emphasis on acquisitions.

Nearing the end of 2020, Maersk has remained true to that goal. The end result is a tectonic shift. Global logistics has always hosted a rotating cast of ocean liners, forwarders, customs brokers and others. Maersk is now going to lengths to change that, walking the delicate line of competing with some of their largest customers.

The Freight Game of Thrones

And that line is already being crossed.

In the weeks following the Damco brand subsumption, DB Schenker released a press release that referenced the Damco changes:

“The last thing shippers need at present is further uncertainty.”

Thorsten Meincke, Member of the Management Board for Air and Ocean Freight at DB Schenker.

Promptly followed by a shot across the bow:

“For companies in longer-term Damco agreements, we can provide prioritized quotes quickly at very competitive rates”

DB Schenker Chief Commercial Officer in the Americas, Daniel Bergman.

While not outrightly linked to this release, Maersk, now a shipping line and forwarder, terminated its key account status. DB Schenker, meanwhile, said that it had moved volumes away from Maersk earlier in the year. Other sources reported that DB Schenker was not the only forwarder making this shift.

Driving the Maersk Shift

The shift to full end-to-end integration, of course, leaves no one else in the middle.

It’s powered by a number of core Maersk advantages. The first is size, of course, with Maersk running over 17% of global ocean capacity, but also selling land-services to just under 20% of those same customers.

This isn’t just about pricing power that derives from those volumes. Yes, Maersk maintains valuable real-time information and market strength to shape pricing. But shipping remains an open market and regardless of technology or how far in the supply chain Maersk stretches, it still has 4.1 million TEUs of capacity it must fill.

The two other advantages that a full asset owner in the container space can leverage is the ability to combine data and containers for new and smarter services, as well as improved exception management for actually changing the trajectory of shipments when containers are underway.

As Adam Banks, Maersk’s former CTO/CIO recently said:

The asset owners actually have an advantage here….What we’ll be able to do is on the same sailing offer five different products. There may well be a premium product that uses express routes through the ports, is last-loaded, first-off, saving four days. You could sell that either as express or you could set it as a higher guarantee. Today, 75 to 80% of cargo arrives on time. As long as you know which 75 to 80% is, you can provide a guarantee on that.

Adam Banks, Maersk’s former CTO/CIO

Beyond guaranteeing loading and shipment of containers for Maersk’s direct enterprise customers – at a price – Maersk and other carriers are uniquely positioned to intervene during the course of the shipment. And while it’s not there right now, with the right digitization in place, this exception management could extend to SKU level exception management for even smaller importers and exporters.

Presumably, this type of interaction would take place via technology that could, in theory, be further exposed to forwarders. In essence, this would allow forwarders to provide similar levels of service. However, given the rearing of direct competition for both larger and smaller businesses, it’s clear that there is a Maersk incentive to at least maintain a few services exclusive to direct sales.

Advantages Beyond Shipment Booking and Execution

Beyond the pricing and underlying ocean freight control, on display in this interchange, Maersk wields three less obvious advantages:

- Data. A Maersk ocean liner generates some 2 GB of data per day. But the Maersk website, which the company cites as one of the top ten global B2B websites by revenue, likely generates far more in terms of searches, booking, and tracking data. Multiplied across the forwarder-formally-know-as-Damco, Twill, and a bevy of smaller companies, Maersk has a real-time tap into global supply chains like few companies in the world.

- Customers. Digital transformation is not always about new technology. Frequently, cultural shifts can be far more imposing. When Maersk decides to change behavior, like pushing all bookings and amendments to digital, their massive scale makes it far easier than smaller providers would find it. For example, in effort to combat the scourge of some 6,000 weekly emails and phone calls about shipment changes, Maersk simply added on a $50 fee for manual changes in order to encourage digital bookings. Few companies have a confident enough edge to push changes like that which could alienate some customers. Of course, Maersk might end up institutionalizing new behavior, only to soften the ground for other carriers to mimic without needing to invest as much.

- Capital. Remember the note that one of the three pillars of Maersk’s growth would be supporting capital? There’s cash behind that check. Analysts believe that Maersk can easily invest up to $1 billion dollars over the next two years in major acquisitions without even impacting their credit rating. Their 2019 annual investor report explained the strategy as “based on creating additional value to our existing customers,” which, in 2020, has driven multiple acquisitions. These acquisitions are wrapped within a company-level objective to ensure that overall returns on invested capital remain above 7.5%.

The Primary Maersk Plays

The foundation of Maersk’s strategy is a superior delivery network end-to-end, which delivers on fundamental needs for getting goods to the right place, at the right time, at the right price, with minimum environmental impact.

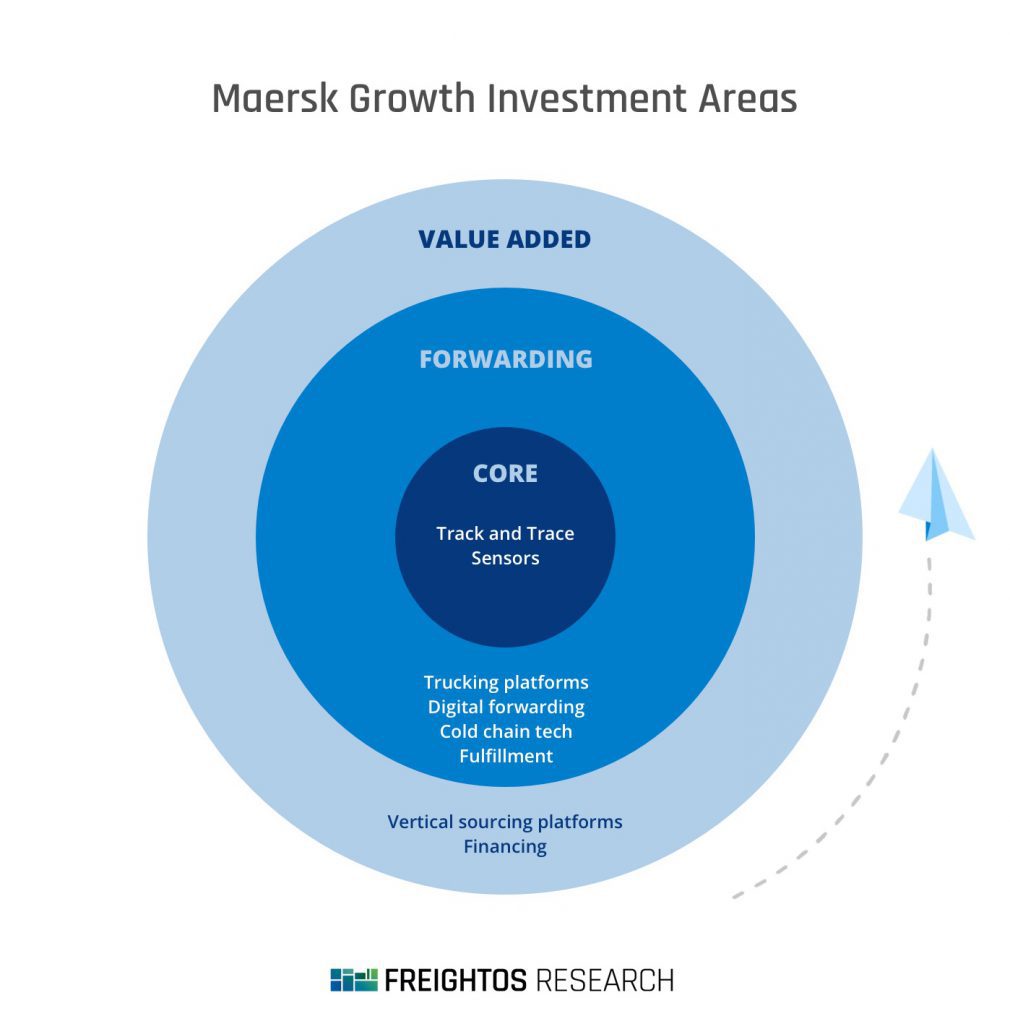

This report displays Maersk’s progress to this effect broken down into three areas of activity:

- Core Services: changes made to Maersk’s underlying ocean offering

- Forwarding: Maersk progress made on international and domestic freight offerings

- Value Added Services: Side bets or new offerings revealed by Maersk to either support other offerings or use as experiments for future directions

These three areas are categorized by four different categories:

- Internal product or offering developments

- Acquisitions

- Investments, primarily those of Maersk Growth

- Integration capabilities being developed in collaboration with others

Here’s what the full picture looks like:

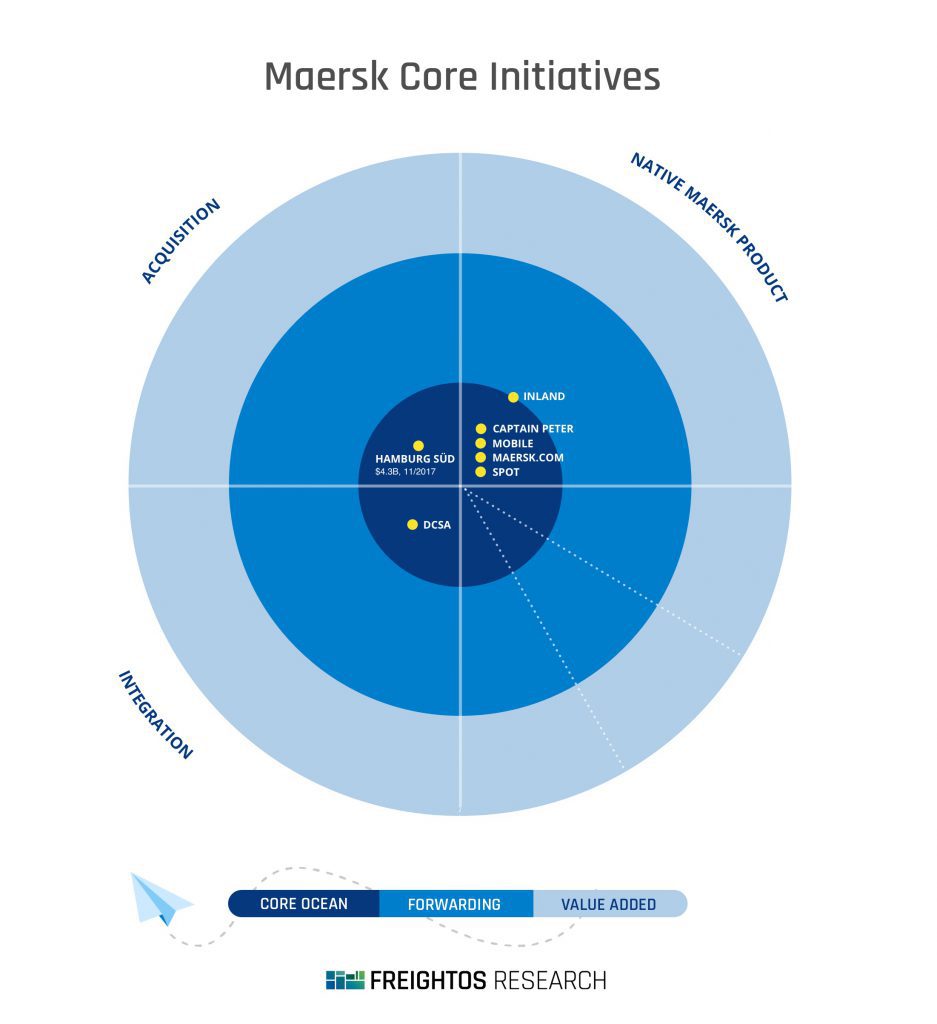

Maersk’s Core efforts

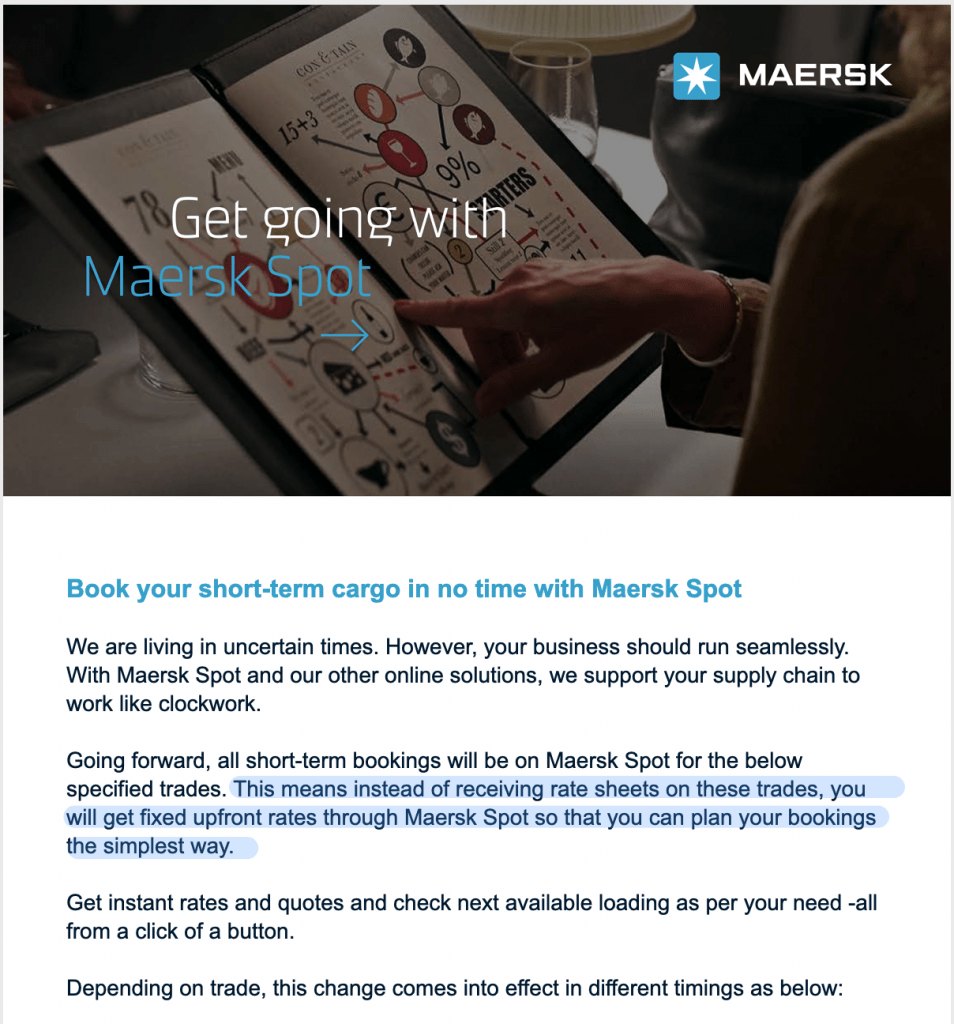

Starting with Dynamic, Differentiated Service with Maersk Spot

Maersk Spot, direct pricing and booking connectivity for shippers, has emerged as Maersk’s pièce de résistance. If Maersk’s starting point in the 2016 shift was that the company shipped 20% of containerized trade, the natural conclusion is that they could provide pricing like no other company in the world.

The offering, which launched on June 25, 2019, was quite simple, although in the conservative world of container shipping it stood out.

Shippers would get an all-in, instant price that would include guaranteed equipment and ocean loading within three days of the estimated time of departure or receive compensation. This goes both ways. Amendments more than seven days before shipment would trigger a cancellation fee, while a no-show fee would be levied within the week of shipping.

Maersk Spot isn’t just unique because it provides on-demand pricing.

It fixed a glaring business problem in the industry – a tacit understanding that container liners would charge extra, on top of existing fees, if they had a container they could ship for more (rolled cargo). Not to stay helpless, shippers could simply not show up with cargo to fill space they had booked if a cheaper alternative arrangement was available (“no shows”).

Despite increased frustration with this arrangement, rolled cargo and no-shows remains prevalent. A logistics manager playing a critical role in annual containerized freight spend in the high nine-digit levels recently confirmed that during the 2020 peak season, this continued to impact their cargo as well.

While a paradise for game theorists, this bizarre arrangement works for precisely no one. Maersk Spot is a unique in that Maersk can apply a homecourt advantage – their ships, their pricing, their unique ability to guarantee space and equipment.

It’s worked. Well. By the end of 2019, 24% of spot shipments were booked using Spot. By the end of 2020’s H1, that number had increased to 41%. This effectively creates a low-cost, scalable sales channel that makes it easier to service the higher-margin small businesses typically owned by freight forwarders.

Shifting Industry Habits

While many forwarders and carriers are experimenting with digital sales, Maersk is all-in. For example, in a recent email, Maersk clarified that fixed upfront rates could only be consumed through the Spot API.

The optionality this introduces it passed on directly to customers; Twill customers can select “Rollable” cargo and receive a $50 discount in exchange for allowing containers to roll to subsequent sailings on either the initial leg or transshipments.

In essence, this is a showcase of the Maersk (or any carrier) ability to create unique services.

As the same former Maersk CIO/CTO said:

“It isn’t a war between the carriers and the forwarders. But there will be products that the carriers can offer because they have insight into an actionability on the data from the physical world.”

Maersk’s real power isn’t just on the pricing side. It’s on the unique ability to prioritize container placement and guarantee movements across their 4.1 million TEUs of ship capacity. Containers can be loaded, unloaded, rolled, and reloaded based on the specific requirements… and this creates an experience customers may value enough to switch over to unlock.

A central element of Maersk’s strategic shift is the bet that direct control, reduced information entropy, and fewer middlemen marking up rates, will spell out success.

But the shift to direct pricing and booking isn’t the only change.

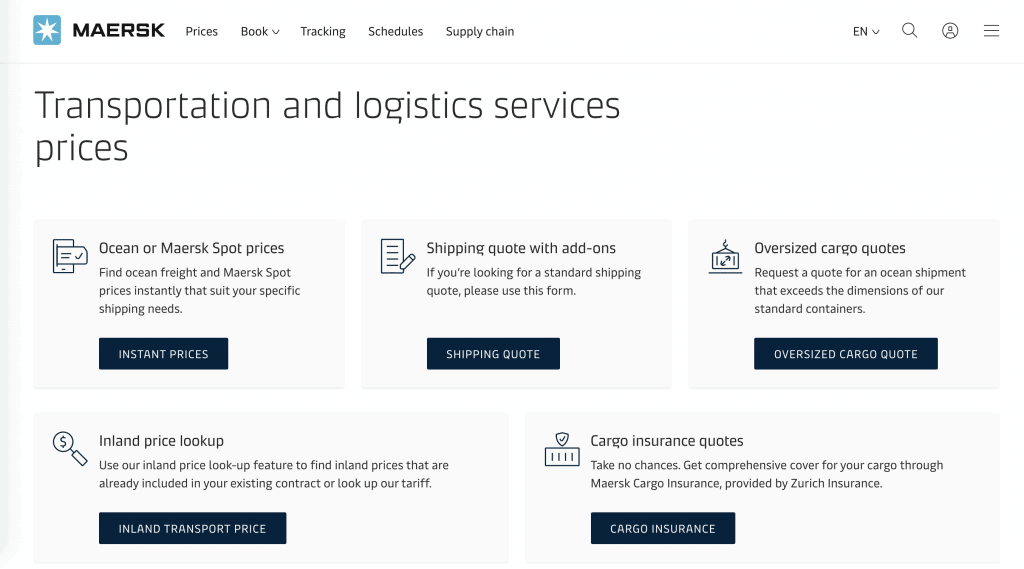

Website Sales: a new digital experience

In order to leverage this advantage, the right “delivery” tool for the digital maritime services needs to exit.

Maersk has invested in user and customer experience projects to rebuild their website properties. They continue to do so with some vigor and it seems to be working.

Nearly 60% of all Maersk bookings are done online, via their the website. One in every 12 containers shipped in the world are booked on the Maersk website, making it one of the world’s largest B2B websites, and about 98% of their bookings are done electronically. This translates into over $20 billion dollars of sales/year, augmented with additional services, like customs brokerage, which went live in 2019 across 22 new countries.

According to website analytic platform ahrefs, Maersk’s website has reaped major benefits, with high volumes of website traffic reaching their website.

Organic traffic to Maersk.com, ahrefs.com data

Maersk is also going to great lengths to try to replicate engaging consumer experiences for their business customers. One noteworthy example is Captain Peter, a mobile virtual assistant for remote container management of reefers:

Speaking of User Experience

There’s no more convenient bridge to talking about customer experience – and Maersk’s shifting crosshairs – than Maersk’s Twill Logistics.

Despite investing in a digital forwarder (Forto née FreightHub) and owning a top global forwarder (Maersk née Damco), Maersk still established Twill as a digital forwarder in its own right.

According to the site, it has serviced over 2,300 customers across 5,473 shipments since being founded in 2017. With a focus on ocean freight leveraging internal ocean freight services, Twill bridges Maersk’s core maritime competencies with a customer-facing solution.

Twill demonstrates two things:

- With Twill, Maersk very much sees itself going after the very small importer segment (especially the growing e-commerce segment) with entrepreneurial-focused messaging that were slated to be advertised to a very broad audience across both TV and radio.

- Twill is designed as a playground for experimentation. While Twill’s interface only offers full container load and inland shipments to entrepreneurs, limiting the full potential for now, it differentiates in other ways. Specifically, it offers a number of unique features that only a carrier can do with full control, like the ability to lock in rates and equipment, receive bonuses for making cargo rollable, and more. By tapping into Maersk’s core Spot service, Maersk’s gains the efficiencies of adjacent business units, much like Twill’s use of Modifi, a Maersk Growth investment, which is tapped to provide Twill customers with trade finance services.

Forwarding parity with value-added services

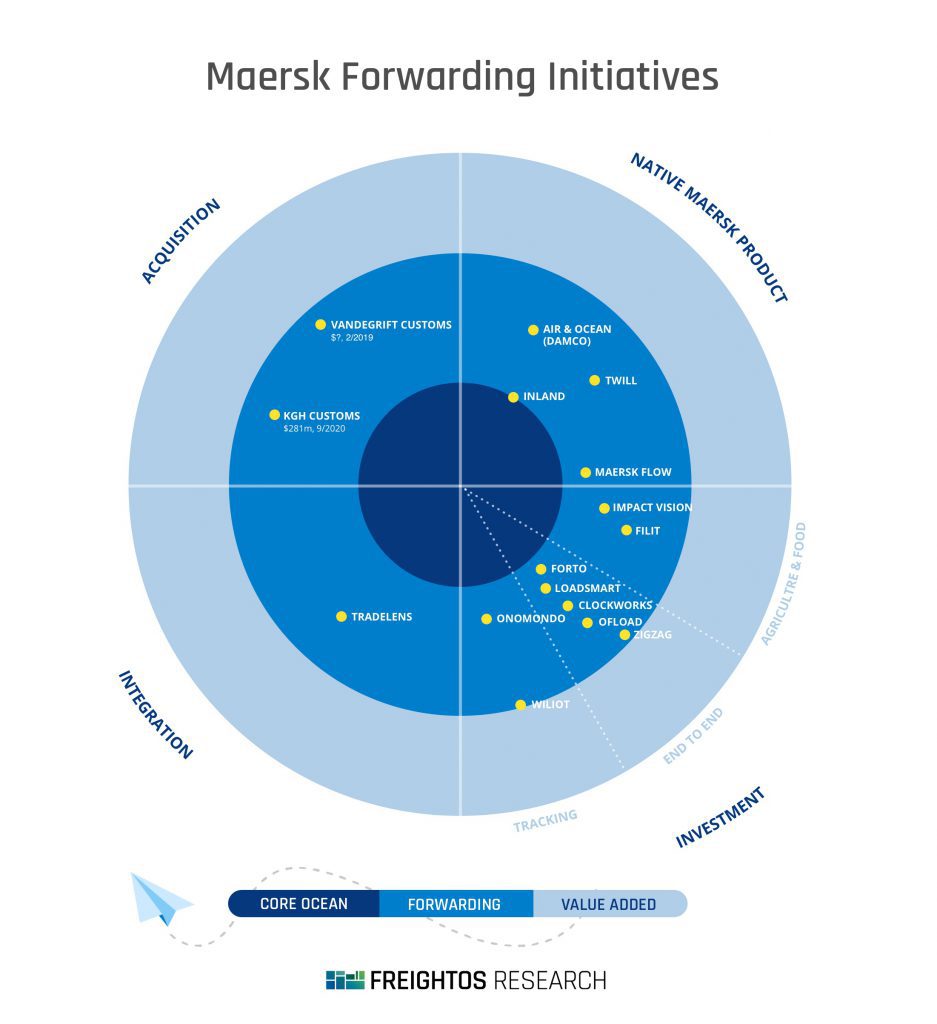

It’s Maersk’s steady advancement to take on even the most broad-serviced freight forwarder that represents a more radical shift. Through a range of acquisitions, rebrands, and integrations, Maersk is now positioned to handle everything from FCL shipments to air, reverse logistics, e-Commerce fulfillment and more. Here’s what it looks like:

The main forwarding business: Damco

According to Transport Intelligence’s Global Freight Forwarding 2018 report, Maersk’s forwarding brand was the world’s 20th largest air forwarder and the 17th largest sea freight forwarder.

This diversification has helped Maersk’ remain more resilient. In the first half of 2020, as ocean freight volumes remained lackluster, Maersk Group EBITDA increased by $51m due to strong air cargo rate increases. With a planned axing of the Damco brand at the end of 2020 and a merger of air and ocean less-than-container into a single loose cargo division, Maersk is ready to come up against forwarders, even though those competitors also represent one of its largest customer segments.

Beyond creating integrated offerings, the full 3PL integration into Maersk created more efficiencies. As the Maersk 2019 report notes:

A step change was made in early 2019 when we combined the sales forces of our land-based Logistics & Services products and our Ocean segment under the A.P. Moller – Maersk brand. Going to market as one sales force enables fully integrated value propositions and much simpler interactions to the benefit of our customers.

What does this mean in practice? Well, when a Maersk customer in southeast Asia recently needed urgent shipments, Maersk quickly put charter air flights in place. Eleven of them.

However, other forwarders have also managed air charters. And exciting as it is that Gartner has finally put Maersk, not Damco, on their 3PL magic quadrant (although not in the most envious box), air and ocean loose cargo are far from the only aspect of global forwarding, and the type of “end to end” integration that the 2016 strategy calls for. And this is where Maersk’s acquisition strategy really starts to rear its head.

Expanding into customs brokerage

A 40’ container may be standardized but the duties importers pay are anything but.

Maersk’s acquisition strategy focuses on plugging holes in their current offering – two of their four recent major acquisitions have been customs brokerage firms, each with a geographic specialty. In early 2019, Maersk’s first major acquisition check since the Hamburg Süd acquisition, was to buy Vandegrift, a large US customs brokerage based in New Jersey. Over the next year, Maersk would increase the team from 80 to 250. Vandegrift’s tech-centric approach to customs was cited as a major driver of the deal, leading to an eventual rebranding of the company’s reporting tool to “Maersk Customs Navigator” in March of 2020.

On the European side, in July of 2020, Maersk announced the acquisition of KGH Customs, a large European customs brokerage firm, for some $280 million. The deal, which would be finalized in September 2020, 5X’d Maersk’s European customs clearances.

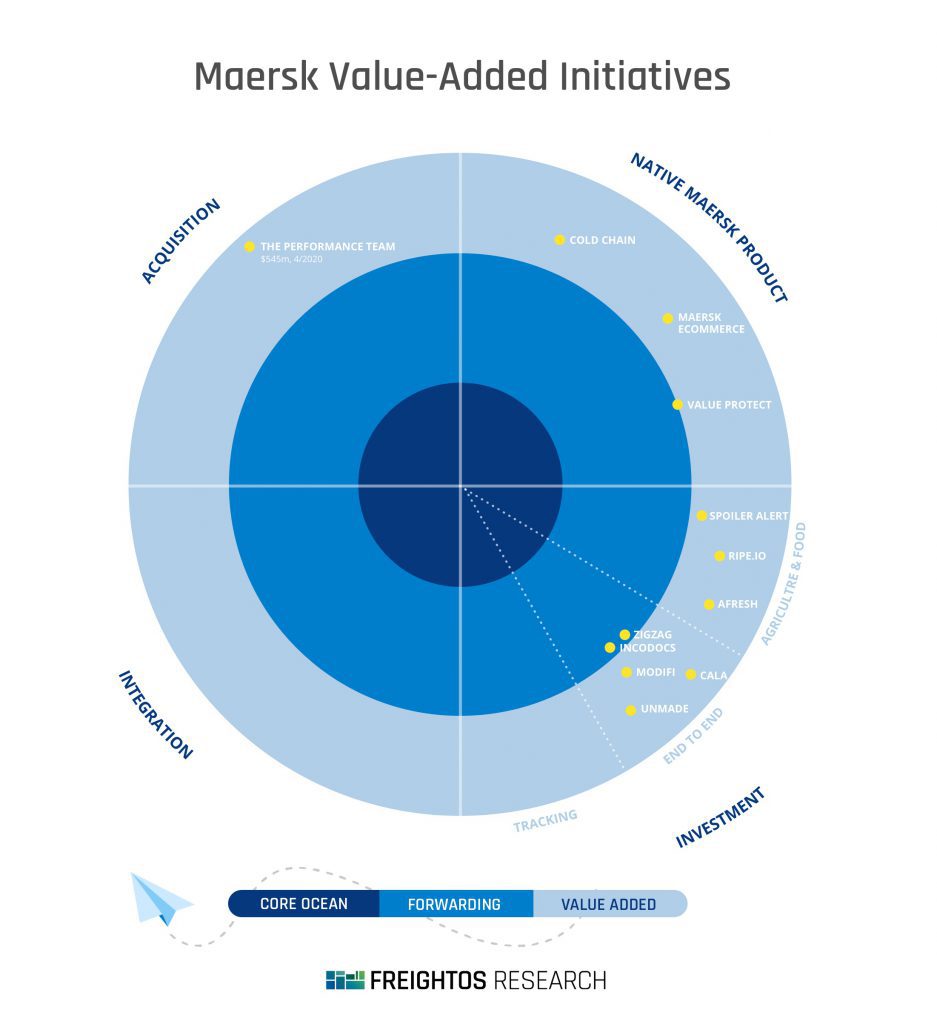

Growing into a Warehousing and Fulfillment Powerhouse

A natural evolution after shipping and customs is, of course, warehousing and distribution.

On April 1st, 2020, Maersk announced a $545 million dollar acquisition of The Performance Team. In one fell swoop, this placed Maersk “among North America’s leading Warehouse and Distribution providers,” adding another 24 warehouses to its existing 22 for a total of nearly a billion dollars in annual warehousing and fulfillment turnover. While Maersk already markets e-Commerce and reverse logistics services, this move reflects the rising importance of eCommerce in a post-COVID global logistics reality. This understanding is also manifested in investments that Maersk has made, as will be apparent shortly.

Trade Financing

Trade financing is emerging as a popular value-added service logistics providers offer to customers. Beacon, a UK-based digital forwarder backed by Jeff Bezos, has made this its calling card, and Flexport, one of the most well-known digital forwarders, has been offering financing since July of 2019.

Maersk began to pilot Trade Finance back in 2015 and had extended services to six countries by 2018. The service uses goods in Maersk containers as collateral and can rely on data from the previous three years of shipping history as additional insights for providing financing. True to the integrated approach, Maersk maintains the goal of increasing revenue from the existing customer base by:

creating financial solutions for small and medium-sized enterprises (SMEs) and by incorporating Trade Finance across Maersk’s Ocean and non-Ocean product offerings. (Maersk 2018/19 Magazine)

Insurance

Maersk’s insurance service, which is provided by Zurich Insurance, offers end-to-end insurance for shipments, including cold chain goods. Beyond optional integration of insurance payment while booking freight services, Maersk also offers insurance on the underlying Maersk container in case it is damaged while in the customer’s custody. At the time of publishing, this service was still fairly limited in geographic scope, being offered to customers in Spain, Austria, Belgium, Germany, Netherland, Denmark, Norway, and Sweden.

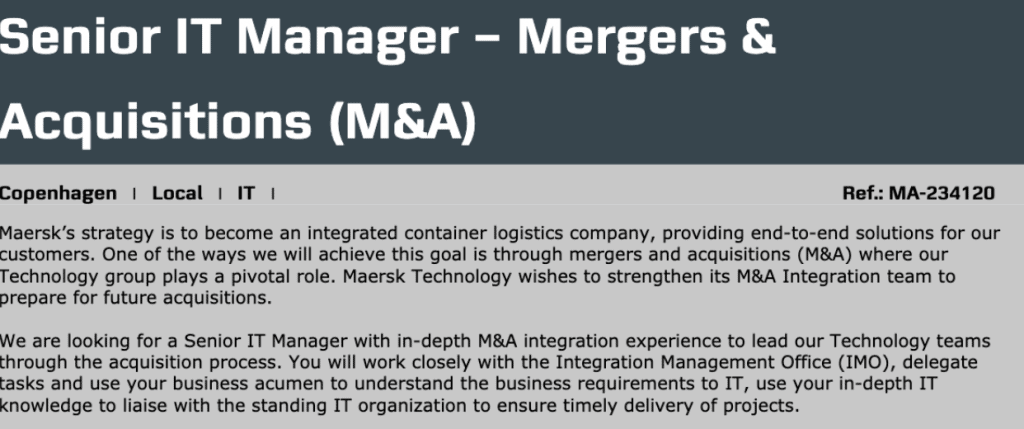

The Next Steps

It is fairly safe to assume that major acquisitions by Maersk in the near-term will be limited to integrated logistics solutions, likely in order to fill gaps in both service scope and geography. Here, creating an integrated technology stack will remain paramount, as evidenced in an early 2020 job post for a senior IT professional specializing in M&A integrations.

And If You Can’t Control Everything…Integrate.

Maersk Flow

Many companies around the world maintain relationships with multiple logistics service providers. Lacking a monopoly on global ocean freight, and certainly on land or air cargo, creates a potential chink in Maersk’s armor. This explains the release of Maersk Flow, on July 28th, 2020.

Maersk Flow is essentially a supply chain collaboration platform that enables shippers to work together with logistics providers and suppliers, with integrated e-form transmission to other major ocean liners.

By creating tooling for collaboration, Maersk can play defense against logistics forwarders, by selling a competitive edge of management across multiple providers, while increasing exposure and likely upselling to additional Maersk services.

However, for now, Maersk does not even require rate information to be uploaded for non-Maersk shipments, which is important for privacy purposes and avoiding antitrust issues.

It’s worth noting that there are a number of logistics tech startups in this space as well. Few have seen major traction, and while none have the Maersk star, it’s unclear if the logo is a brand recognition advantage or a liability, given Maersk’s role as a biased carrier. Given that it’s still in early stages, it remains to be seen how successful this experiment will be.

Third party Integrations

As Maersk expands its services, facing hurdles for internal integrations, it’s also taken some important steps to facilitate integrations externally, especially its core container shipping services that serve as a major differentiator.

Maersk Spot has robust API documentation, although the carrier does note that not all Spot functionality is available to third parties. Based on media reports, Maersk Spots is already integrated into a number of portals.

Maersk has also made major headway in encouraging smoother, reliable and accountable information flow between parties, backing Tradelens, a blockchain digital shipping platform created as part of a collaboration with IBM. This is clearly a need felt by other ocean liners as well, with Maersk’s 2019 report citing that 66% of global container capacity, 98 terminals, and 22 customs authorities around the world were involved in the effort. In addition, MSC and and CMA CGM also recently joined the platform, and Youredi was tapped as a partner to help with integrations.

While the Tradelens website lists a number of forwarders as planning to join TradeLens, seamless integration between customs authorities, ocean liners, and inland carriers could marginalize part of the role being carried out by global freight forwarders. This perhaps explains the more enthusiastic adoption across ocean liners. In addition, even technology experts are skeptical about the actual advantages of using Blockchain for many logistics applications.

Maersk is also an early supporter of the Digital Container Shipping Association (DCSA), an industry group creating standards for global containerized transport, and Maersk supplied DCSA’s CEO.

These efforts show ocean liner’s mutual interest in “playing nice” with each other. Part of the rationale of DCSA, according to a group of authors that includes Maersk’s Head of Technology Mergers and Acquisitions, is to facilitate collaboration across all ocean liners in order to optimize activities like port calls;

The use of a standard for sharing data on the timing of port call events allowing for estimations on the cargo flow and a foundation for the exchange of time slot allocations between shipping lines.

This alignment could also be an attempt to stave off the emergence of a Global Distribution Systems for international freight. As Adam Banks says:

By standardizing the data interfaces, we create the opportunity for GDS to step in and sweep us all into a large system. I would like to think that there’s enough smarts in the industry to stop that from happening and that carriers or large forwarders actually take advantage of those standards themselves rather than let themselves be taken advantage of because the standards exist.

Beyond Forwarder: Investing in further value adds

In sum, Maersk’s shift since 2016 has leveraged and extended core advantages in shipping, expanded across supply chain services with strategic acquisitions and improved connectivity capabilities, whether using internal products, like Flow, or external initiatives, such as TradeLens.

If these represent the high-risk, high-payoff bets, while other partnerships, such as the Zurich Insurance partnership, represent the high-confidence, low-payoff bets, then Maersk Growth is perhaps the home of mid-confidence, high-payoff bets. These moves are aimed at identifying new technology or business models that have some potential for serious synergies with the core businesses.

And, of course, the Maersk name instantly gives a boost in credibility for any portfolio member:

“Frey has been well received in the market, and that is certainly also a testament to Maersk, as an owner in the venture, being a trusted brand, that carries a lot of weight.”

Maersk Growth is quite a prolific investor, investing in 25 companies in under three years. The corporate venture capital’s website identifies three core areas of focus:

- Smart logistics

- Enabled trade

- Sustainable supply chains

Taking the model proposed so far, Maersk Growth appears to be working in concentric circles outwards, bolstering core container shipping capabilities, extending to the full international freight chain, and then introducing value-added services on top of that.

The investments made closest to Maersk’s core strengths are on IoT tracking, with an emphasis on cold-chain. Some prime examples include Danish Onomondo, a company creating a global cellular network for IoT, Wiliot, and ImpactVision, a US-based company that has raised $2.8 million to provide insights into food freshness. It is worth noting that alongside CMA CGM and MSC, Maersk has also invested and committed to large orders for container trackers from Traxens, a tech company specializing in tracking maritime and rail logistics shipments.

Where Maersk Growth’s strategy diverges from other carriers is the shift from core businesses towards logistics and broader supply chain operations. Here it’s clearer that these side-bets are geared towards plugging holes currently filled by freight forwarders. For example:

- An investment in Forto (previously FreightHub), a digital forwarder that now provides SKU-level shipment management

- Regional trucking platforms Loadsmart (US), Clockworks (US) and Ofload (AUS)

- Zigzag, a reverse logistics tech company

- Incodocs, a documentation management platform.

Some of these compete with internal Maersk solutions (Twill vs. Forto, for example), but also represent the vanguard of new business experiments that Maersk is running.

Zooming out one step more to the value added services and more experimental business models, things get even more interesting, more reminiscent of the full end to end supply chain envisioned in Maersk’s strategy, both on the sourcing and the fulfillment end.

This spans platform companies connecting fashion manufacturers or commodity traders directly to the buyers. Examples include Unmade and Cala, both of which focus on easier fashion design, HUUB, a full-service logistics management platform for fashion, and Spoiler Alert, a marketplace connecting retailers with discount channels.

Maersk in the Future

Four years have passed since the decision to go all-in on end-to-end, and Maersk is certainly making good on its word. Few multinational companies have pulled off such a transformation.

The decision to internalize Damco, acquire a large fulfillment company, and purchase two large customs brokers are quite startling wakeup calls that the line between carriers and forwarders has blurred. This shows some impressive agility, together with a firm backbone to make a bold choice with the potential to alienate a significant proportion of the core business’ customer base.

But, of course, it’s not a shoe-in victory for Maersk, for a number of reasons:

Unbundling/bundling: Before Netscape’s IPO, its CEO famously quipped that:

“there are only two ways to make money in business: one is to bundle; the other is to unbundle.”

Going through the cable TV → Netflix → cable app cycle is a good reminder that this is true. More importantly, it means that a one-stop shop does not guarantee victory. Google’s Suite has recently been assaulted by spreadsheet (Coda, Airtable) and presentations (Pitch) competitors and more. Providing outstanding service, whether in a niche or across the board, is a hard bar to maintain. And it’s unclear that one-stop shops are more likely to be able to provide that.

Diversification: Maersk may control close to 20% of global container capacity. That means there’s another 80% it doesn’t control. Maersk currently has a huge sunk cost in its carrier and terminal network (although their order book for new ships is one of the lowest of the top-ten carrier lists). In addition, forwarders may have an advantage when it comes to non-carrier services. While Maersk will always need to fill its ships to be profitable, forwarders have carrier flexibility, which can both be powerful tools in an arsenal. For now, DB Schenker serves as a particularly prominent proof point that forwarders (NVOCCs) will start to shift cargo from Maersk Line to ocean liners that don’t compete with them. This strategy may get more complicated as other carriers follow the Maersk play book. One way for Maersk to stave this off may be exposing the same functionality enjoyed internally by its forwarding functions to external forwarders.

One-stop shops are hard to build; they are even harder to expand globally. The large acquisition of global custom brokerages or selective investment in geo-specific trucking platforms are likely attempts to resolve this, but true global capabilities with competitive pricing across local carriers, knowledge of local regulations, and specialization, is elusive.

Finally, DNA. Maersk was an energy and shipping company. It is now well on its way to reinventing itself as a full-stack global logistics service provider. But turning around a container ship takes a long time. The question is whether alongside the external makeover, the Maersk teams have successfully transformed their DNA.

The stakes are enormous; Maersk is at a unique crossroad where it can bring existing technical networks, user bases of well over 100,000 customers, and a forward-thinking digital mindset to all focus on a fully integrated approach. As an executive at DHL recently commented “customer relationships and trouble-shooting” are key aspects of global freight that are unlikely to be fully digitized. Ever. Which means that customer service, outstanding digital experiences, and improved industry collaboration are going to be where the battle for the shipper will play out.