Over the last 5 years I have seen many companies launching inventory reduction programs. A common reason is to generate cash. Cash that can be used for new investments, to pay back loans or to pay cash dividends to shareholders.

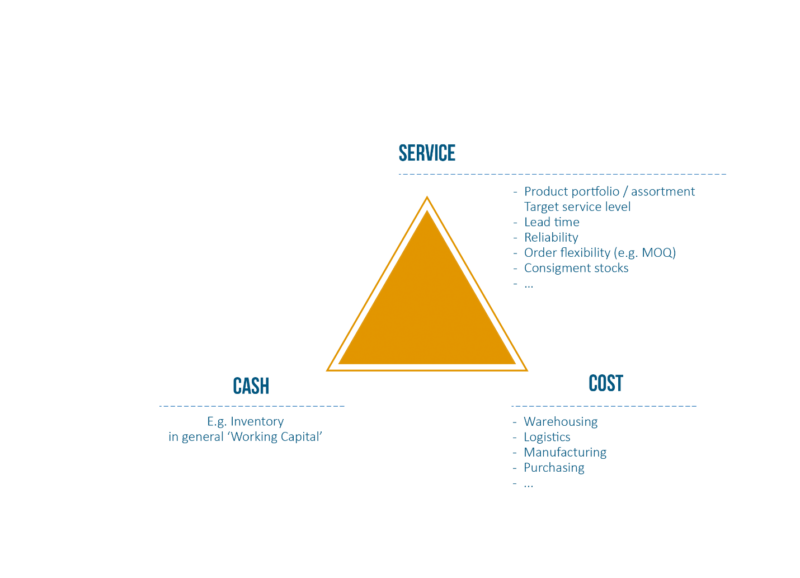

When launching an inventory reduction program, companies should be aware that inventory, as a part of Cash, should always be balanced with Cost and Service. The balancing of these three might be the essence of supply chain management. That’s why I’ve called the corresponding triangle the Supply Chain Triangle.

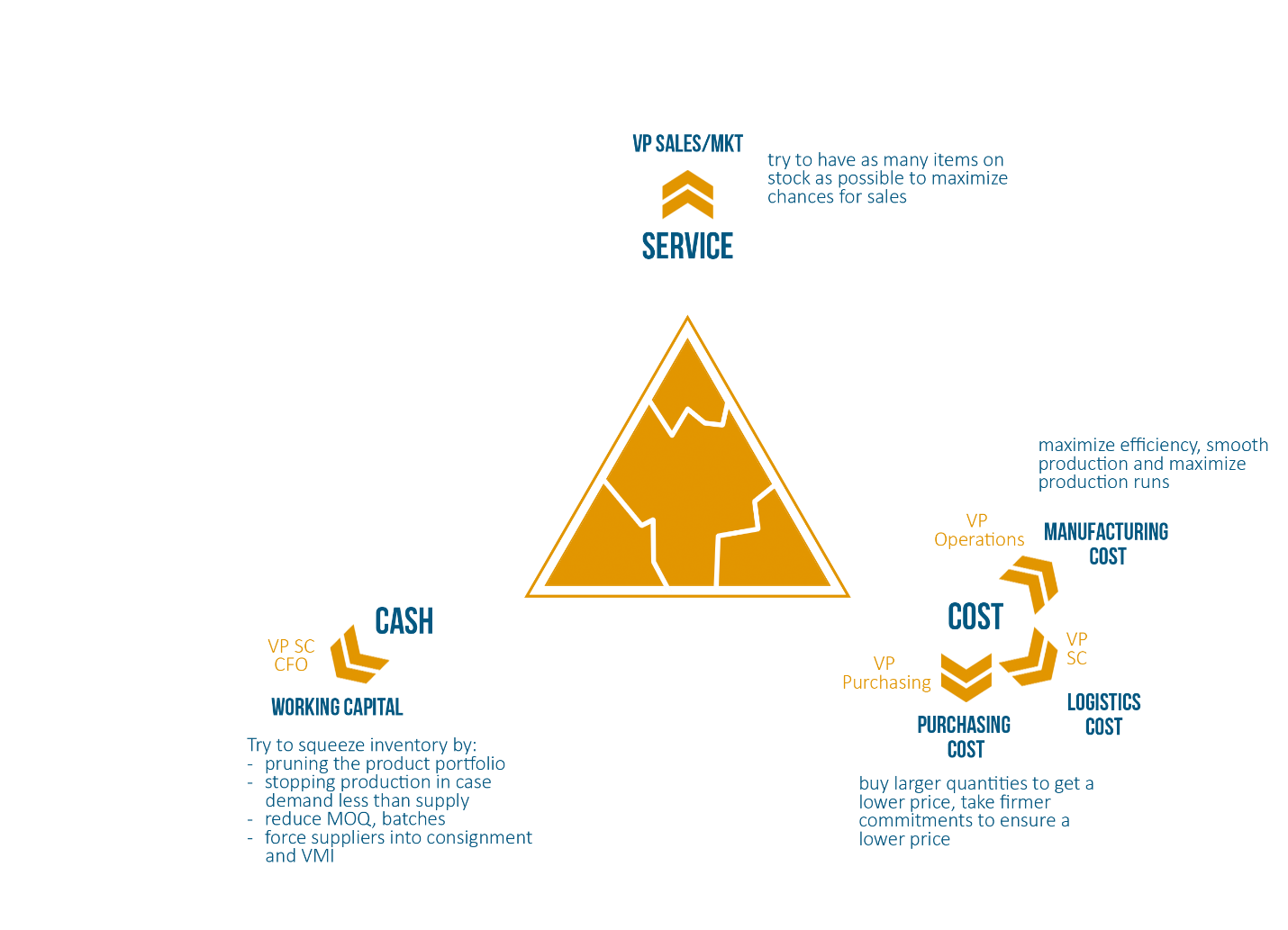

Figure 1 illustrates that Supply Chain Triangle. We will review each of the corners in more detail.

Service

Typical supply chain aspects of service are the customer lead time, the service level, the product portfolio, the order flexibility, the payment terms, etc.

Shorter lead times, a broader product portfolio and the use of consignment stocks can be extras from a service perspective. They can increase the inventory and as such require more cash.

We can also reducing lead times by providing excess capacity or by using faster transportation modes. This is increasing service by increasing cost.

Cost

On the Cost side, we primarily think of operational costs like purchasing cost, manufacturing cost, logistics cost, etc. Sourcing in Asia, the leveling of production and rounding to full trucks are measures that lower the cost but they increase inventory.

When making decisions, e.g. low cost sourcing from Asia, we need to look at operational costs, but also at the inventory costs. The cost of inventory is based on 3 components: the rent, the room and the risk. The yearly carrying cost can range between 25-55% of the inventory value so it’s significant. If by sourcing from Asia we double our safety stock, we also double the yearly carrying cost. We should account for these costs when making the business case.

Cash

Inventory is an important element of working capital. A reduction in working capital is freeing up cash. We see working capital reduction programs coming back every 3-5 years in companies. Many companies have launched such a program during the financial crisis. As customers were paying late and banks were reluctant to extend loans, companies aggressively lowered working capital to generate cash. Often to the expense of Cost, e.g. by stopping production or cancelling orders from suppliers. Often also with an impact on Service, by not having the right product at the right time. ‘Cash is King’ was the motto of that period.

A Traditional Organization Creates Tension in the Supply Chain Triangle

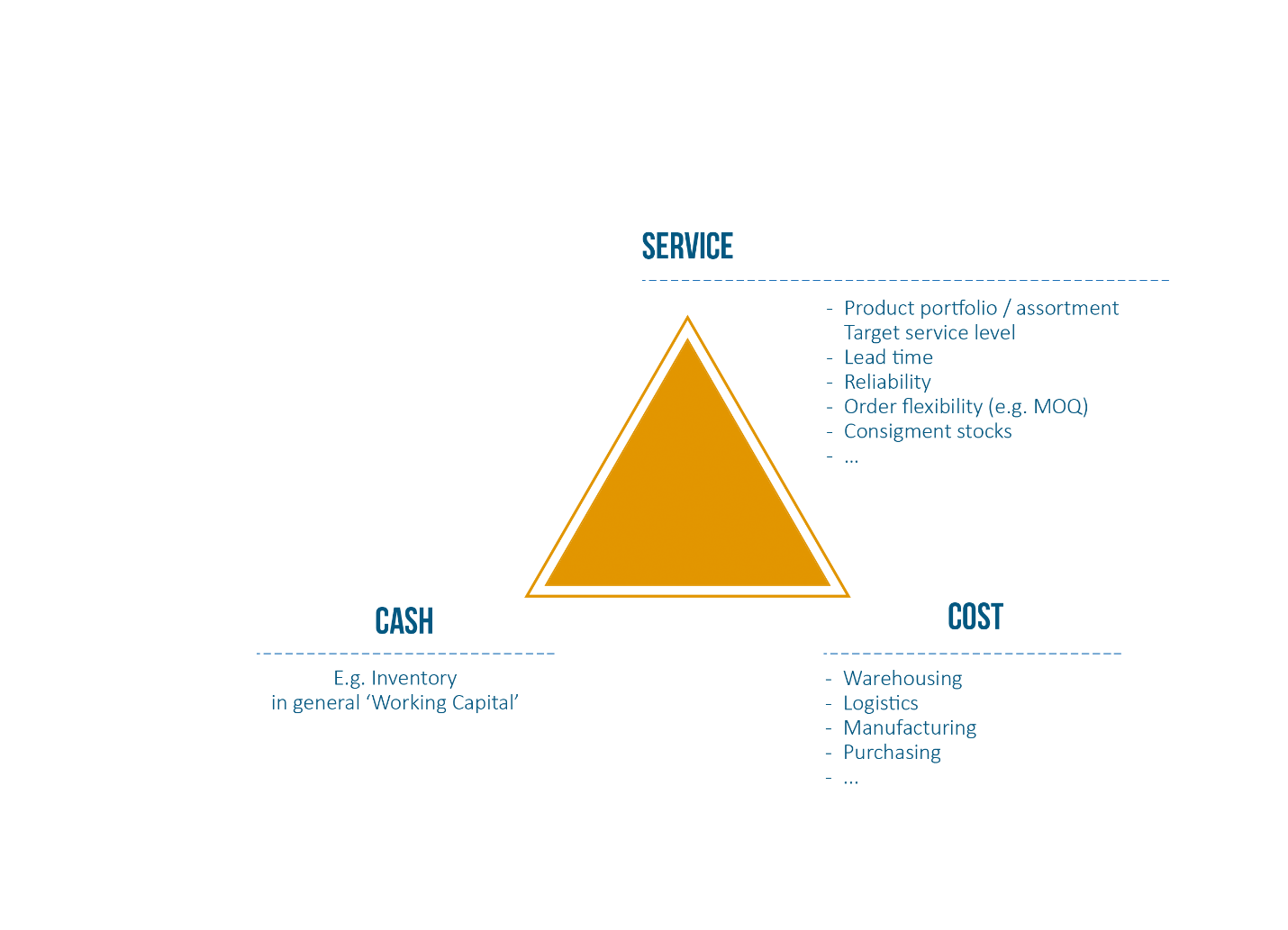

Figure 2 shows a typical executive committee with a CEO, a CFO, a VP of Sales & Marketing, a VP of Supply Chain responsible for planning, customer service, logistics and inventory, next to a VP of manufacturing and a VP of purchasing.

We also show their typical KPI’s. These are the metrics they wake up with. These metrics are linked to their individual bonus schemes.

Figure 2: A Traditional organization with corresponding KPI’s

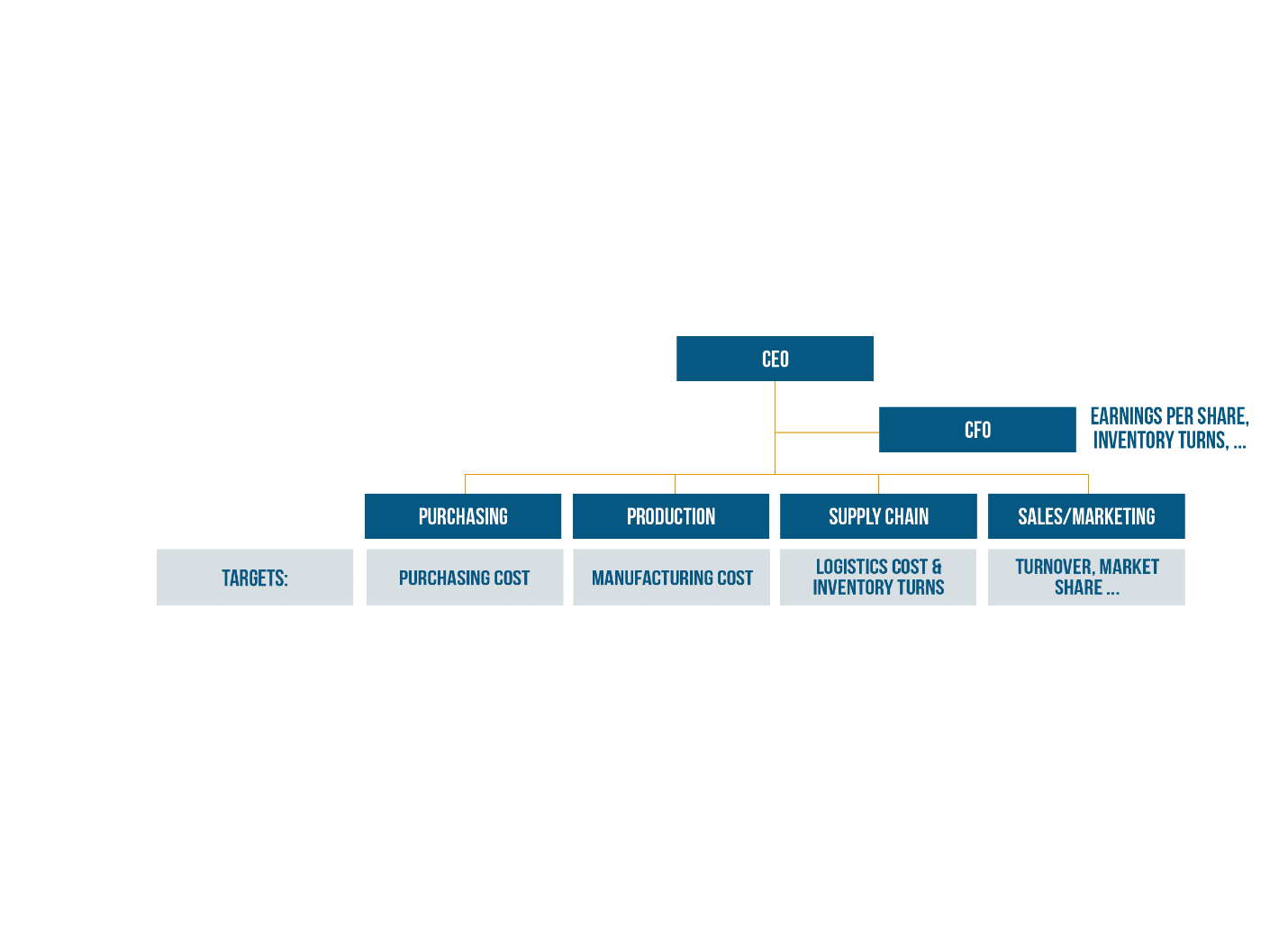

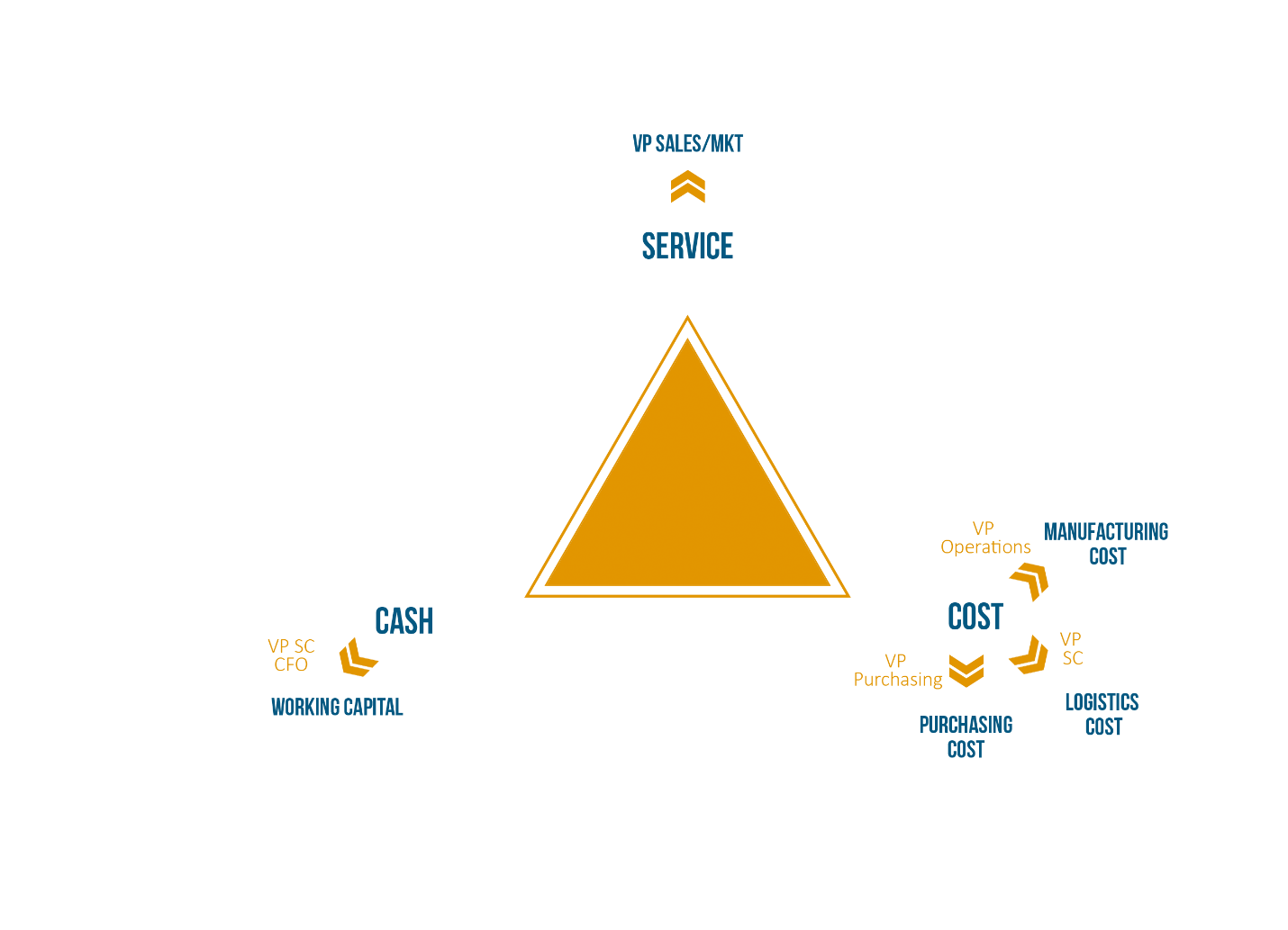

Figure 3 shows the resulting pressure in the Supply Chain Triangle from this traditional organization. As a VP of Sales & Marketing, my main interest is in metrics like turnover and market share. As a result my primary interest will be in the service side of the triangle. For the operational VP’s, the main focus will be on the cost side of the triangle. The CFO may be the only one who is really concerned about the inventory, because of cash, or because of the non-operational costs like write-offs or financing (As an example of the financing: the rent on a loan may depend on how good you put your money at use, e.g. measured by the cash conversion cycle).

Figure 3: Resulting pressures in the Supply Chain Triangle from a traditional organization

In many traditional companies sales and operations are historically strong in the company. The VP Supply Chain may be the new kid on the block. To prove themselves and their role, they gladly accept the challenge of improving the inventory situation, like reducing inventories by 30%.

The VP of supply chain is playing the triangle in Figure 3. If they cannot change the dynamics in that triangle, they are unlikely to succeed.

When Growth Stalls … a Dangerous Catch-22

When the company is growing year-on-year, and has healthy profits, the lack of alignment in Figure 3 is likely to continue. There is little incentive for any stakeholder to change the rules of the game. It would only get more complex … and since we’re doing good, there is no driver for change.

The trouble begins when growth is stalling and margins are eroding. A typical response is Sales will increase the pressure on the Service side. We desperately try to get in any order. We are willing to make any promise that helps, including shorter lead times, expedited shipments, changes in the payment terms, some safety stock at the customers site, etc.

To sustain margins, Operations will start a relentless focus on cost. To lower production costs we prefer big runs and limited changeovers. To lower the purchasing cost, we take more commitment to the suppliers, buying in bigger lots and increasing the inventory risk.

A business in trouble needs cash to turn around the situation. The cash may need to go into the development of new products, exploration of new markets, a rebranding, a take-over, etc., to generate the cash. We assign the unlucky VP of Supply Chain with the challenge of aggressively reducing inventories; the 30%. They have the VP’s back against the wall. Simplifying the product portfolio will go against sales. Stopping production to control inventories will go against Manufacturing. Supplier contracts have just been renegotiated, with a focus on cost instead of cash.

The result is shown in Figure 4. For a business in trouble, the pressure in the triangle further increases. A typical reflex is for each function to pull harder on their side of the triangle. The result is we’ll remain stuck in the middle. We’ll not manage to free up cash, we’ll have a hard time to sustain service and top-line. We’ll continue to struggle with profitability. We risk being divested or taken over, unless an act of God is changing the market.

In difficult times we badly need alignment in the triangle. It’s the only way out. However as we’ve seen there’s limited incentive to create alignment when times are good. It’s a dangerous catch 22.

Figure 4: What happens to the tension in the triangle if the pressure increases?

Creating Aligned Targets. Strategic Trade-offs.

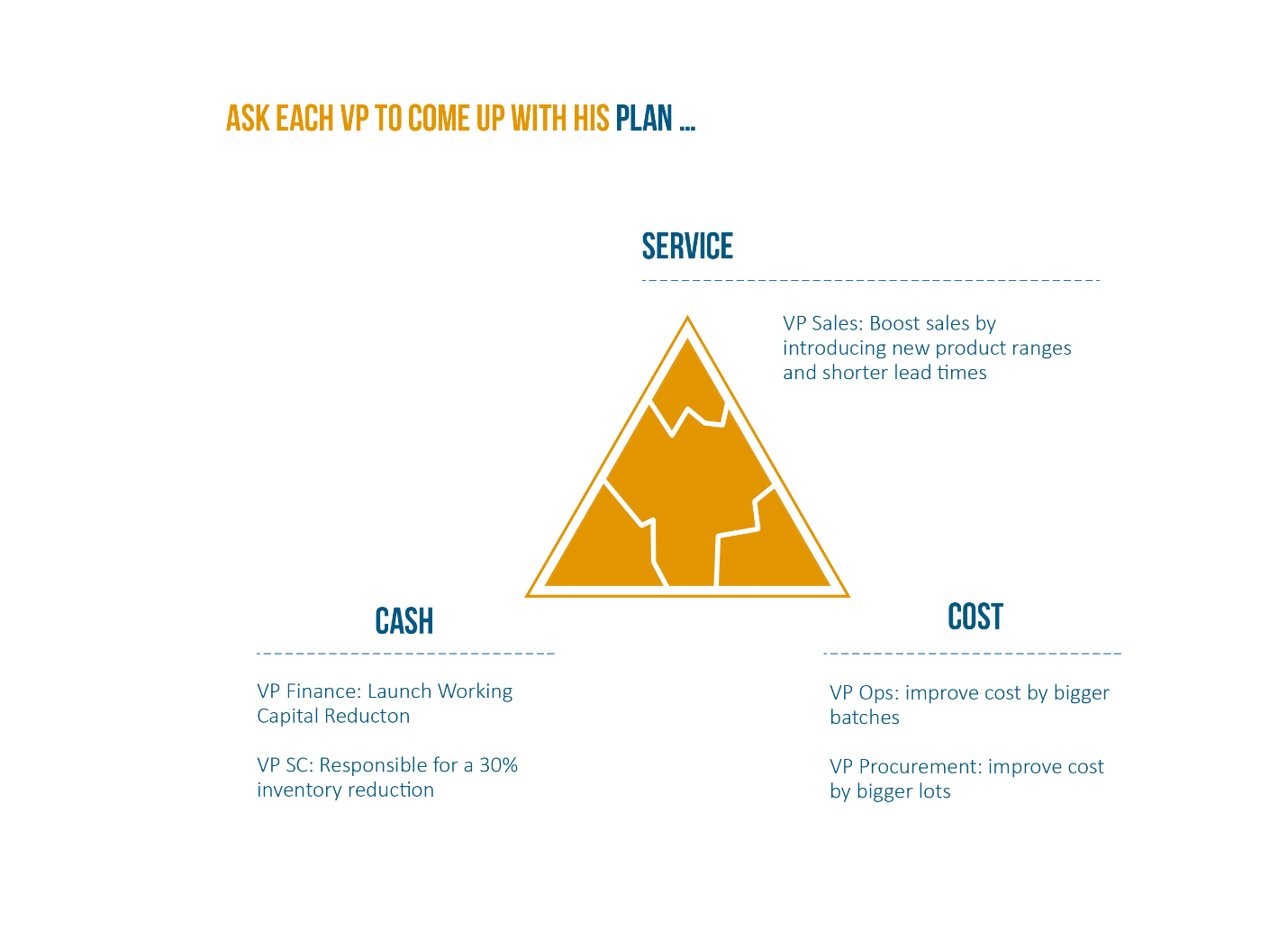

I often see companies defining targets on each of the corners without cross checking their compatibility. Figure 5 gives a typical example. Each of the VP’s is drafting up ‘his’ plan to turn around ‘his part’ of the company. The result can be conflicting. Pushing these targets and plans into the organization will simply create chaos. The one who pushes the hardest will get the best result. But the overall result is unlikely to satisfy the overall business need.

Figure 5: Setting unaligned targets to turnaround the company

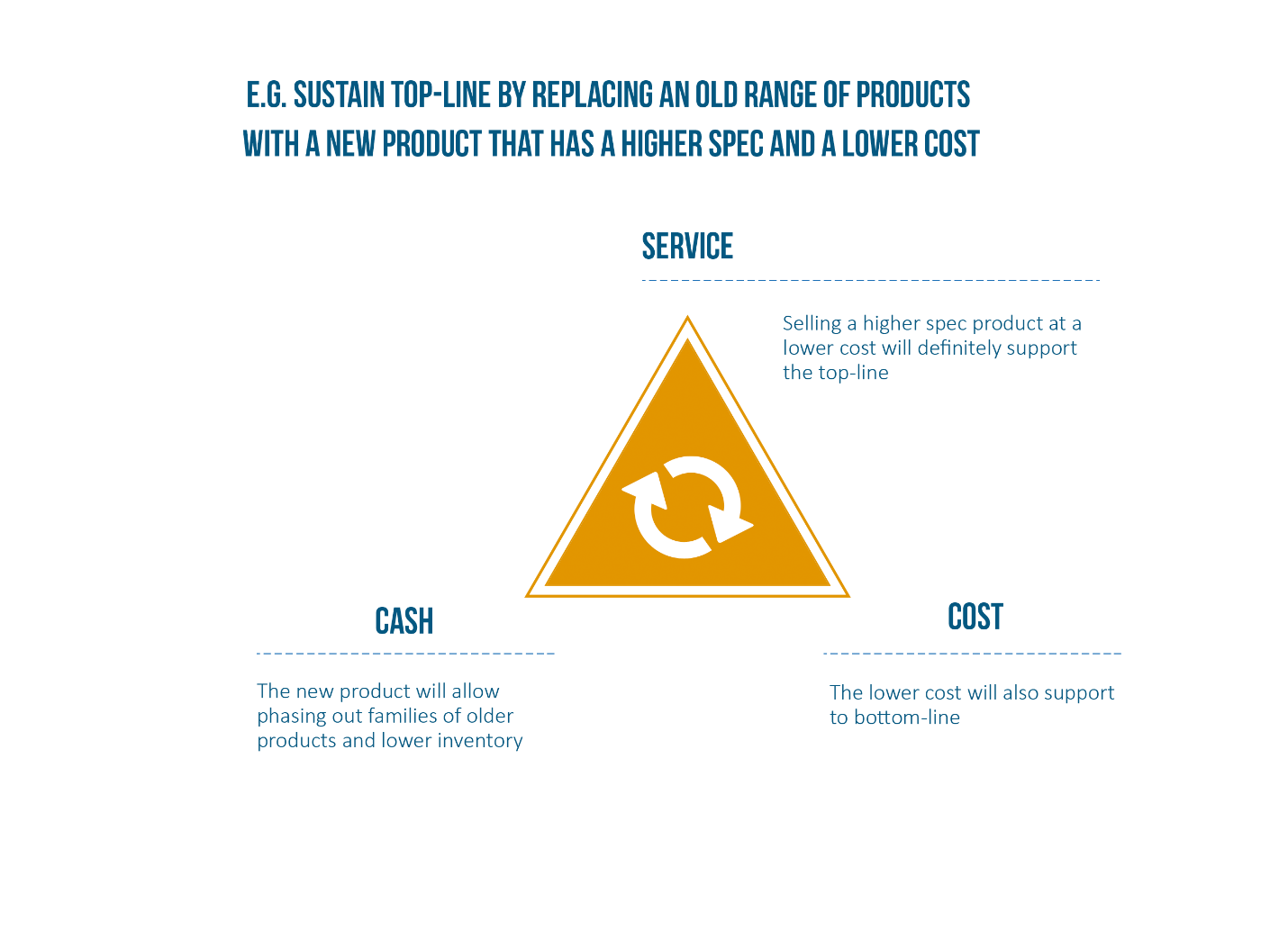

An example of balanced targets is shown in Figure 6. After some discussion, the company has found a way to satisfy improvement on all of the angles. A breakthrough product will sustain both top-line and bottom-line and allows getting rid of older, less performing products. This is a silver bullet.

Figure 6: Setting aligned targets to turnaround the company

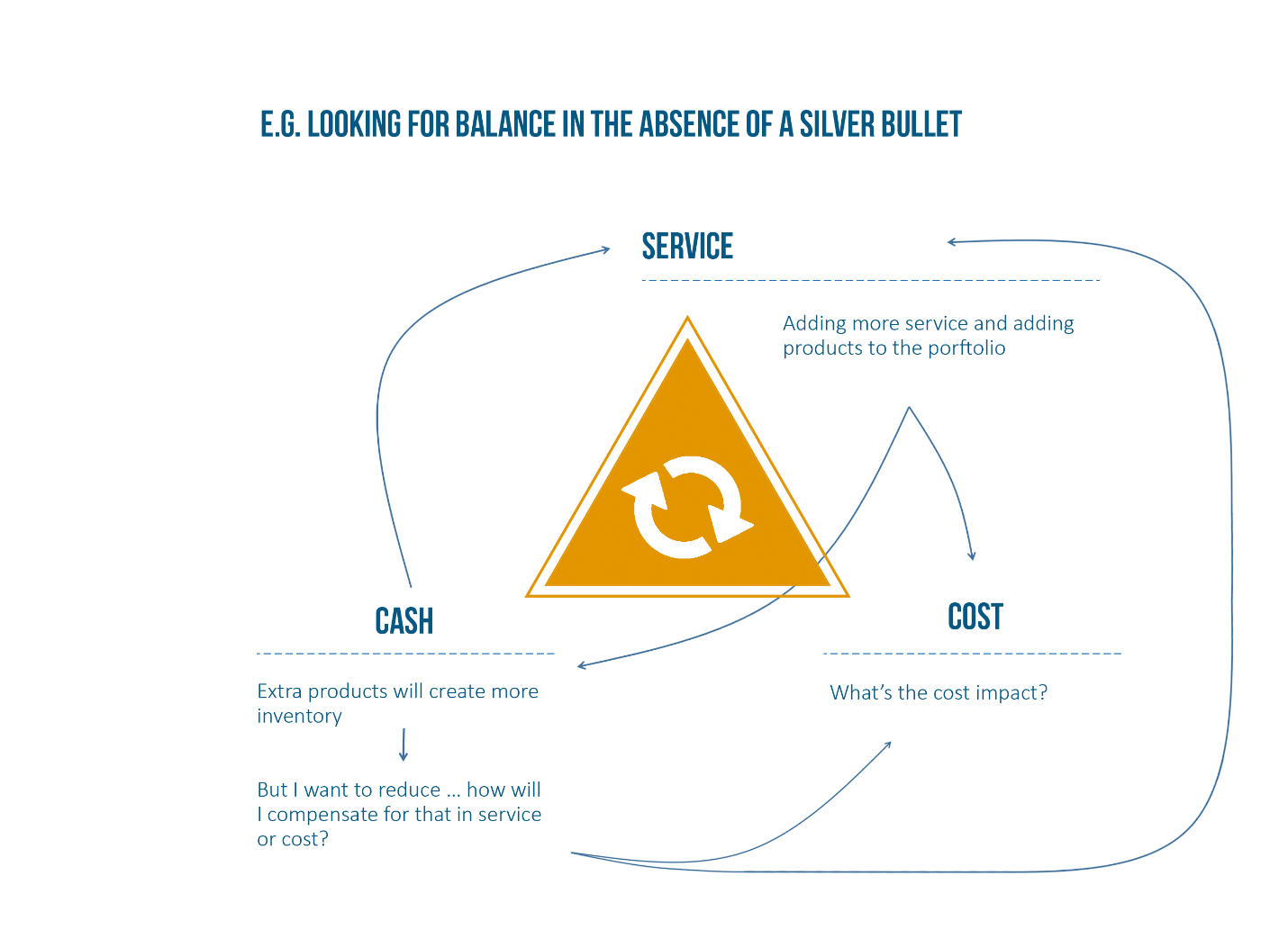

You may not have that silver bullet. In that case you’ll need iterations to come to a feasible plan. If sales wants to add more service and products to sustain the topline, assess the cost impact. Review together with sales, how you will still get to the lower inventories. It may require a double reduction on some of the existing products. That iterative approach is shown in Figure 7.

Figure 7: Looking for target alignment in the absence of a breakthrough

The main conclusion here is: never accept an inventory reduction target in isolation. If the question is no more than “reduce the inventory with 30%”, say NO. Start the discussion, and look for the balance with other targets. Only when you feel that the targets on each of the angles are aligned and add up to a realistic plan, then you commit to the inventory part!!

Inventory Turns as a shared KPI

When looking at ‘inventory ownership’ we have seen different solutions. Within companies it can even be a pendulum. Maybe supply chain was responsible until there were service issues. Then sales became responsible but the inventory ran out of control with too many write-offs. The CFO then defined a target and we had split responsibilities for Raw Materials, WIP and Finished Goods. The targets were based on benchmarking and turned out unrealistic.

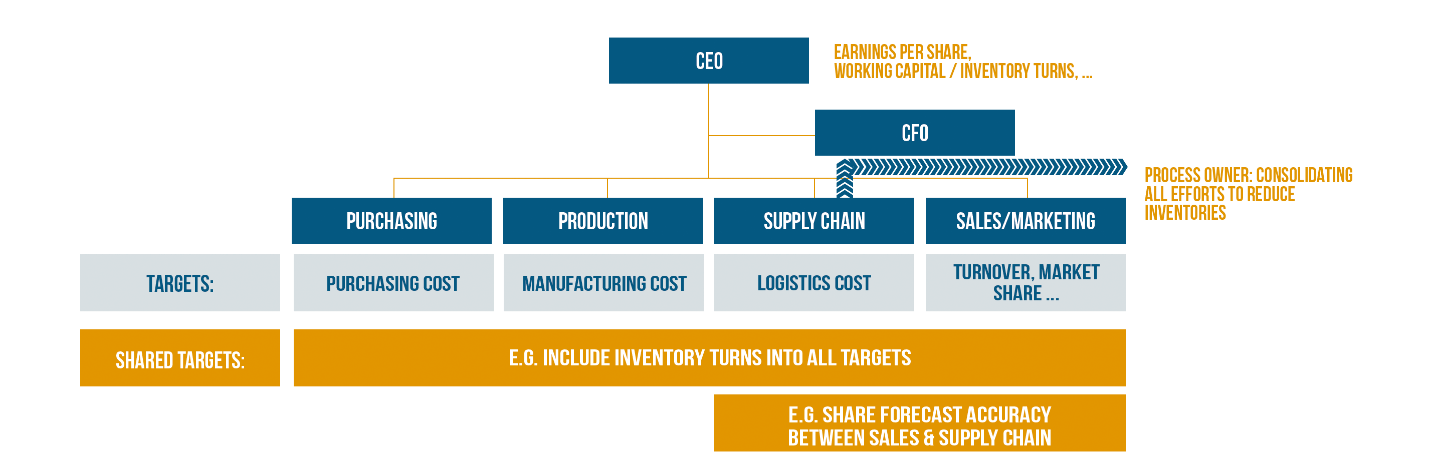

While any of the above functions can be in charge of managing or reducing inventory, none of the functions can do it alone. We firmly believe that inventory turns should be a common KPI shared by all the members of the executive team. That will make it part of the target setting and improve alignment. Share inventory as a KPI (inventory turns, % write-off, …) but assign a single process owner for ‘inventory improvement’, cfr. Figure 8.

Figure 8: Inventory Turns as a shared target, with 1 function as the process owner

As long as inventory is a shared KPI, any function can take the role of the process owner. Of all functions we believe that the Supply Chain function is best placed to do so. Through collaborative processes such as S&OP it has a privileged end-to-end view. It makes an easy spokesperson across functions. Supply Chain is often responsible for Planning. The planning process is key in avoiding the wrong inventories. Setting inventory targets requires analytical skills. In general, these analytical skills are more readily available in the Supply Chain function.

To conclude for the VP Supply Chain: Dare to say NO, if inventory is not a shared KPI, tied into the objectives of the executive team. Don’t go there alone! Claim the process ownership for the inventory improvement. Don’t allow parallel tracks. The challenge is big enough to pool all the resources and create a single initiative.