Operating profits were more than nine times higher for freight brokers in April, compared to the same month in 2017. Total revenue rose 67%, but labor expense increased only 30% and non-labor expense edged up 3%, to 51% and 16% of net revenue, respectively. As a result, 30% of net revenue went straight to the bottom line.

Load counts also set a new record, with a 41% increase in April compared to the same month last year. Average revenue per load was 18% higher, year over year, yielding a 67% increase in total revenues for the group, compared to April 2017.

This report draws data from an aggregate of more than 100 freight brokerage companies, whose 2017 average annual revenue of $19.5 million grew 26% compared to 2016.

Here are more details from the April 2018 Broker Benchmark report:

Gross margin recovered to 13.8%, from 12.6% in March, a slight improvement over the 13.7% gross margins of April 2017. Margins continue to be squeezed due to high rates on purchased transportation, but rates leveled off somewhat in April. For example, van spot rates rose only 0.5% month over month in April, to a national average of $2.15 per mile, which is 29% above last year’s levels.

Freight brokers enjoyed a 30% net operating profit in April, as revenue increased faster than expenses. While labor costs rose 30% year over year, that expense category dropped to 51% as a portion of net revenue, a new low. Non-labor operational costs edged up only 3% compared to April 2017, dropping to 16% of net revenue. An additional 2.7% went to interest, taxes, depreciation and amortization.

Expenses decline to 67% of net revenue, because revenues rose 67% compared to April 2017, but labor costs increased only 30% and non-labor expense added only 3%, year over year. The two expense categories together declined significantly as a portion of net revenue.

Profit per employee soared almost seven times higher (up a whopping 578%) compared to April 2017, despite a 42% increase in the number of employees. Revenue per employee increased 19% year over year.

Brokers moved 41% more loads in April than in the same month in 2017. Load counts rose 7% compared to March, to set a new record.

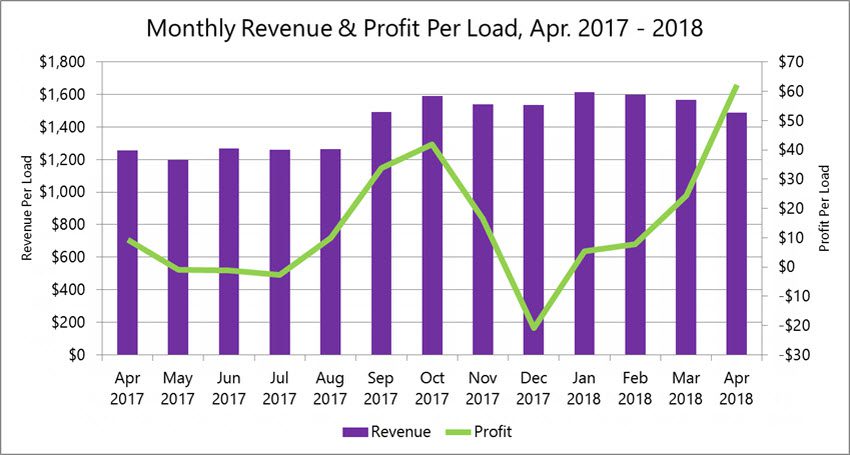

Average profit per load leapt 573% higher on an 18% increase in average revenue, compared to April 2017. Last month’s average profits were the highest in at least two years, on a per-load basis, while revenue per load slipped 5% lower compared to March.