The coronavirus outbreak has the whole global community concerned and hoping for the swift containment of this humanitarian crisis.

In addition to the terrible human cost, the virus is also sending ripples throughout the global supply chain. The two recent crises in global trade – the outbreak and the US-China trade war – show how vulnerable small and medium size businesses (SMBs) can be to shocks to the supply chain, but also point to ways to mitigate that risk.

The (Digital) Rise of SMBs

The digitization of commerce created a path for giants like Amazon and Alibaba to dominate their respective storefront/fulfillment and sourcing roles in the market. It was also a driver of previously unimaginable access and reach for SMBs (though many are looking for options to loosen Amazon’s grip), who could suddenly reach 60% of US households in one fell sweep.

That digital reach extended to importing as well. Recent developments in freight digitization are simplifying the shipping process and giving visibility to freight pricing enabling small players to handle the logistics side of their business more easily, transparently and efficiently.

But while digitization has opened enormous opportunities, turmoil in global trade can often leave SMBs the most exposed – with the coronavirus outbreak in China and the ongoing US-China trade war creating a perfect disruptive storm that is a case in point.

Coronavirus Impact

China’s efforts to control the spread of the virus at the end of January started with shutting down the Yangtze River port city of Wuhan, an industrial city of 11 million people that ships 1.5 million freight containers each year. As the crisis unfolded, in an effort to contain the virus, the government extended the official Chinese New Year holiday first for a few days, then for an additional week.

To date some provinces, cities and companies may not approve a return to work until the beginning of March. Highway and transportation closures, and mandatory 14-day quarantines for people returning home from strongly affected areas, mean that even in places no longer shut down, the return to normal at factories and ports will be slow.

As airlines canceled flights, and ports contended with no cargo to ship and no workers to operate, air cargo and ocean freight have been disrupted, with ocean carriers losing millions each week. The longer the shutdown continues, the more even global players like Apple will suffer from delayed production and delivery.

SMBs relying on Chinese suppliers will be impacted as well: small businesses will not only experience the disruption of delays in supply, but will also pay spiking freight costs. As importers scramble to get their backlogged orders out of China, and as ocean and air carriers have slashed capacity during the shutdown, rates will likely jump dramatically until that backlog is cleared.

The Trade War Impact

The US-China trade war is another troubling example of how unexpected disruption can impact global trade and SMBs’ ability to compete.

Latest developments have the US and China on a path to rapprochement, but tariffs on approximately $360 billion of Chinese goods are largely still in place and new ones are not an impossibility. Tariffs of course have impacted enterprise US businesses in tangible ways including higher costs to purchase imported goods and reductions in US manufacturing.

But smaller businesses often have the least resilience in the face of sudden fluctuations in costs – as the former Kickstarter all-star Coolest Cooler unfortunately demonstrated – and new tariffs can not only impact the price of goods but, just as in the case of the coronavirus outbreak, spike freight rates as well.

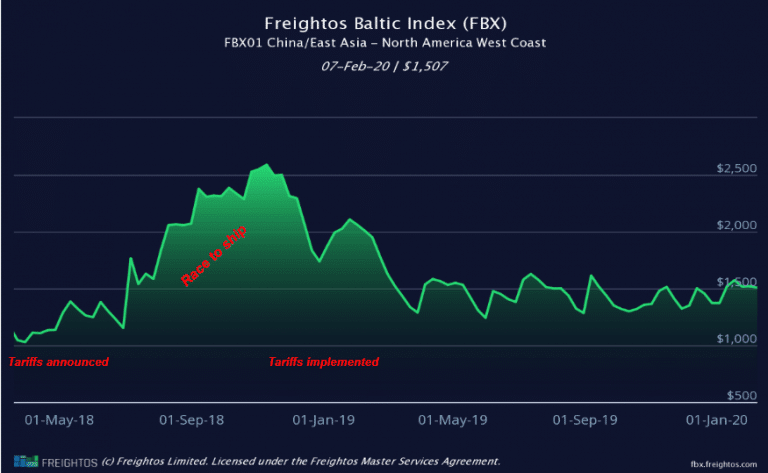

When new tariffs are announced with sufficient lead time before they are implemented – the January 2019 tariffs were announced in spring and summer of 2018 – businesses placed big orders quickly to beat out the new taxes. But this spike put capacity on container ships at a premium, pushing freight rates way up as well.

FBX data shows prices for containerized freight spiked ahead of January 2019 tariffs.

So when new tariffs are announced SMBs have to choose: pay high tariffs on imports throughout the normal ordering cycle, or pay premium freight rates to stock up before the new tariffs.

The Lesson: Diversify

As the fallout from these two recent and coinciding crises demonstrates, something has to change.

US importers are more dependent on Chinese sourcing than ever. From 2000 to 2018 China’s global exports grew tenfold to $2.7 trillion and US importer reliance on Chinese suppliers exploded from $100 billion to $558 billion. In 2019, Chinese imports accounted for 40% of containerized freight arriving in US ports. The bigger the reliance, the greater the exposure, disruption and cost during a crisis.

As previous dramas in shipping prove, savvy importers learn from shocks to the system and will look to diversify as a result.

Big companies and even governments are learning that lesson now. The “China plus one” approach – reducing one’s reliance on Chinese suppliers by adding other countries to one’s supply chain – had been gaining ground in any case as China’s economy matures and production costs have risen. The new trade dynamics mean that even more businesses are looking to diversify their supply chains.

An annual survey of importers who use the Freightos.com marketplace to search and book freight indicates that many SMBs are already looking to diversify, with nearly 20% reporting they’ve started sourcing from East Asian countries other than China.

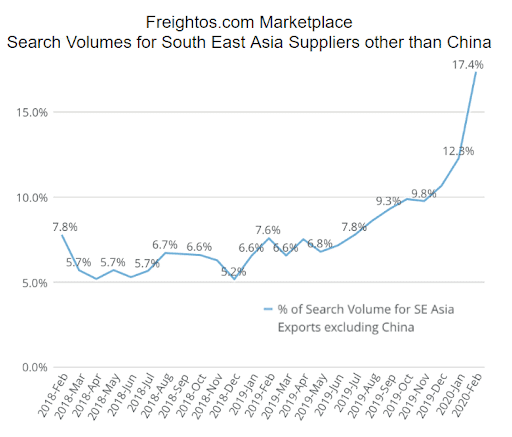

And that’s what the data is showing. Among US importers, coronavirus has intensified a trend that was started by the trade war at the start of 2019: importers are increasingly looking for regional suppliers other than China.

Though China still captures the lion’s share of searches for freight from the region, the share of searches for countries other than China has steadily climbed since the peak of the trade war in January 2019. And during the coronavirus crisis, that share has reached a record of 17% of shipper interest.

So can SMBs pivot in time? Sometimes smaller players prove to be more nimble than the big guys in adjusting to market trends. Though global events can often have broad and far reaching impacts, companies that learn from the past and use all the tools available to respond to new realities will likely also be the ones who reduce their exposure to any future shocks.

To learn more about how coronavirus is affecting shipping, check out our updates page.