Special thanks to Lars Jensen, CEO at Sea Intelligence Consulting and Zvi Schreiber, CEO of Freightos Group for their input and insights for this report.

Shipping containers are like scotch.

It’s hard to predict what demand will be like for products like these ahead of time. Just take a look at pricing fluctuations for Suntory’s Yamazaki 12 Year Old.

But decisions about how many barrels to produce or how many ships to sail have to be made in advance. And the lack of demand visibility is a big contributor to China-US ocean freight rates doubling to the West Coast since June, and passing $4,000/FEU to the East Coast – which was surprising as most analysts thought that rates and profits would freefall.

But spiking rates led many ocean carriers to skyrocketing profits while the drop in trade volumes led to bankruptcies, bailouts, and financial pain for most other parts of the logistics industry. Their “overperformance” quickly prompted accusations of profiteering or price manipulation, and even a couple government inquiries.

Was it profiteering? And if not, why have prices been skyrocketing when demand is not? Is ocean freight pricing broken?

The more likely explanation is that a combination of prudent capacity management and poor demand visibility led to these prices and the resulting profits.

And it can be fixed. But first, how did we get here?

Alliances fill in the blank (sailings)

It starts back in 2008.

As ocean carriers were just signing checks to build massive ships, the global financial crises hit and shipment volumes sunk like a Led Zeppelin.

It took carriers months to adjust capacity to the new low-demand reality. In that span, ocean rates took a dive leading to $15B in industry losses that year, and ultimately to the high profile bankruptcy of Hanjin Shipping.

In the years that followed, consolidation and the formation of the three major ocean alliances allowed carriers to manage ship supply quickly and broadly by cancelling or “blanking” sailings in times of low demand.

Enter COVID-19.

When the pandemic broke out, carriers were able to respond in a matter of weeks to the sinking demand.

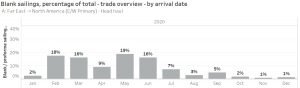

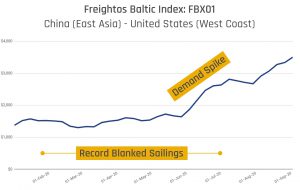

From February to May ocean carriers blanked a record number of sailings on China-US lanes – first as China’s manufacturing was closed and then as COVID-19 impacted the US economy.

It worked.

From March through May rates remained stable enough – and generally on par with the previous year despite significant drops in volumes. Capacity management prevented the expected rate collapse and stemmed carrier losses. In a conversation with Lars Jensen of Sea Intelligence, he rightfully pointed out that “prices in these months were not really level, because oil prices were dropping. So actual rates were going up,” and carriers were capturing profits even early on.

Stay on top of the latest Ocean Rates

June, she changed her tune

Then in June, US demand for South East Asian imports unexpectedly started to recover.

There are likely multiple factors for the rise: More PPE started moving by ocean as supply chains stabilized. Businesses whose inventories ran down slowly since March started restocking. More home purchases and home offices meant new home furnishings. Untapped vacation money shifted to spending more on goods, and the move from brick and mortar to eCommerce required inventories.

But whatever the causes, the carriers couldn’t see them coming – certainly not long enough in advance – and couldn’t be sure how long they’d last.

With 16% of scheduled Asia-US capacity blanked in June, demand quickly outpaced supply. This triggered rolled shipments and a backlog that pushed ocean rates up nearly 60% from the end of May to the end of June from China to the US West Coast.

And all the macroeconomic indicators continued to flash recession, so, as Lars once again highlighted, carriers were hesitant to restore capacity too quickly. But demand kept climbing into September. As capacity was eventually restored and then some, the laws of supply and demand kept pushing ocean rates up: China-US West Coast rates doubled by the end of August and were up almost 160% year over year. Rates to the East Coast rose 50% and passed the $4,000/FEU mark in early September.

The more extreme rise on shipments from China to the US West Coast compared to the East Coast also showed just how much normal patterns were shifting. Importers eager to accommodate the exploding eCommerce market, combined with uncertainty of how long demand would hold up to push BCOs to the quicker route to the West Coast.

Zvi Schreiber, CEO of Freightos Group, added that rates could continue to climb in this way because “ocean freight service has proved to be quite an inelastic good. Door to door shipping costs often only account for a small percentage, perhaps five to eight percent, of a business’ cost of goods.” And because there is also no real alternative to moving large orders across the globe, when demand is present prices would have to increase very significantly (10x?) before any interested shippers are deterred from booking.

Carriers have power, and visibility is key

So where does this leave us?

First: The crisis proved that carriers can now prevent rate collapses through capacity management. Their newfound pricing power means container rates have a floor no matter the market conditions and shippers will likely need to get used to this fact. And unlike ship building, which would mean huge supply chain bullwhips, containers are relatively agile.

But, second: The extreme rise in June, the ensuing backlogs and rollovers, and the decision to restore capacity relatively slowly were a function of poor data visibility (as well as some endemic lag time that can’t be removed from an industry banking on the repositioning of 24,000 TEU vessels). This directly contributed to the speed and possibly the size of the rate spike.

The better carriers become at reducing the lag in matching supply and demand, the happier all players will be. Stabler prices, fewer rolled shipments, and less heartburn. But real improvement can only come through better demand forecasting, and this is where digitization is key.

In recent conversations with industry experts on the direction of logistics technology it was not just the carriers, but leading freight forwarders, BCOs, and even Alibaba, who stressed the importance of innovation for improving visibility of the supply chain.

Each link in the chain talked about the importance of unleashing data to unlock true transparency.

Customized Door-to-Door Pricing Intelligence from Freightos Data

Johnson & Johnson’s Head of Advanced Supply Chain Technology, specifically called out the power of tech to improve their own demand forecasting – based on data from the supply chain and retail outlets all the way to social media – as a major goal.

And each link also talked about how data silos and lack of standards within and between companies on the supply chain hinder the extent of their vision.

But the industry is already eyeing the potential of what happens when those silos are removed and data is shared across the chain. This gold standard is sometimes referred to as pre-emptive logistics, and is built on the premise that all the incremental automation and visibility improvements happening today, can, in a few years, be integrated and combined with AI to trigger orders and shipments ahead of actual consumer behavior.

This end goal will inform the supply decisions for ocean carriers as well.

In the (near?) future, the potential of data will be realized in the form of an optimized supply chain. With it, huge spikes in ocean rates due to poor visibility should be mitigated, providing stability and profitability to the carriers and reliability and stability to shippers.

Which means that when we’re ready for that 16 year Nadura, it will be there.