In the digital age, visibility is key

In our digital age, we want to know everything, in seconds.

We want to be able to see real-time status for flights, take-out delivery and how long we’ll have to wait for our Uber to arrive.

This desire and the importance of visibility is even more pronounced where finances are concerned: businesses need the right information – in near-real-time – in order to make intelligent financial decisions.

The concept of an index, reporting the market price for a specific good, was developed precisely for this reason. Its value explains the existence of the S&P 500 for nearly 95 years, the power of the Baltic Dry Index for determining bulk shipment prices, and even poultry indices.

And though the market index long predates digital computing, computing power combined with huge, aggregated data sets have proved fertile ground to improve visibility. As a result, nearly every industry has created on-demand metrics to gauge market performance, hedge risks, and to power intelligent decisions.

But despite its size, containerized freight’s poor visibility persisted

As containerized freight has been slow to digitize in general, a reliable, data-driven, and actionable index has eluded the industry as well.

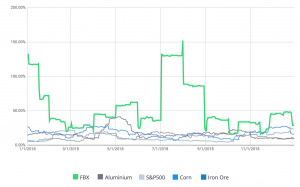

Prices for everything and anything are subject to change and freight rates for containers are no different. In fact, containerized freight is one of the most volatile industries in the world. And this volatility can have a broad and significant impact on consumers, as 90% of products we buy have containerized freight as one component of their bill of materials.

Fluctuation in freight spot rate based on Freightos Baltic Index (FBX) compared to other stock and commodities indices. Sources: FBX and SGX

So decision makers need visibility into prices for three reasons:

- To be sure the price they are paying is fair

- To optimize choices as costs change

- To be able to mitigate risk associated with price volatility.

Freight is somewhat notorious for price opacity. So it is difficult to determine if the rate being offered is fair, and without visibility it is impossible to know when and how to optimize operations.

For example, combining FBX and trucking data, FreightWaves have shown that as prices fluctuate, the cheapest way to ship from Asia to Chicago can flip from US West Coast to East Coast, or vice versa – an insight impossible to take advantage of without real-time price information.

A common response or protection against price opacity and volatility is the long-term fixed price contract.

But a recent Freightos Group survey of industry leaders found that fixed price agreements are far from fixed:

- 75% of forwarders report paying a peak season surcharge to get on the right sailing

- 30% said contracts were regularly subject to renegotiations

- 60% report expecting a seasonal surcharge or BAF to affect their actual price paid

- Carriers report regular breaches of the Minimum Order Quantity agreed to by forwarders in their contracts

In summary, long term fixed-price shipping tenders/contracts do not protect carriers, freight forwarders or shippers from inevitable market volatility.

Enter the Freightos Baltic Index (FBX)

In April 2018, having observed this inefficiency in the market, Freightos partnered with the Baltic Exchange, an independent, trusted institution with deep experience (dating back to about 1750!) managing complex benchmarks for the shipping industry, to create the Freightos Baltic Index (FBX).

Leveraging Freightos’ unprecedented access to real-time freight rates from hundreds of global logistics providers, carriers, and BCOs across a wide coverage of regions and lanes, and across over one billion unique data points, the FBX has published weekly averages for container FEU spot rates for since late 2018.

This week, Freightos and the Baltic Exchange announced that they are taking the FBX even further with the launch of the world’s first daily containerized freight rate index, available on a subscription basis.

The FBX daily is the first containerized freight index fully audited and in compliance with the Principles for Financial Benchmarks set by the International Organization of Securities Commissions (IOSCO). These rules are designed to ensure benchmark quality, integrity, continuity and reliability, and allow an index to be used as a benchmark for contracts and financial instruments.

The FBX Daily Difference

The index’s daily rates will provide for the first time a true pulse of one of the world’s largest and most important industries.

Access to this tool will not only provide shippers confidence when they navigate the spot market, but will prove invaluable in introducing the two components missing from freight’s current contracts – confidence that the rate being paid is fair, and mitigation of the risk of price volatility.

The index will enable these advances through two key developments:

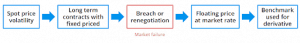

Index-linked contracts – Linking a long-term contract price to a verified, objective index gives both parties protections: forwarders and BCOs are protected from overpaying if prices drop and can have confidence that they are paying the market rate should prices climb. Likewise, carriers are protected from forwarders under-paying or going off-contract when prices drop, and benefit from increased rates when they rise.

A derivatives market – Both carriers and shippers/forwarders will be able to purchase derivatives pinned to the index, and swap their risk with those on the other side of the supply/demand divide to provide insurance against volatility that would otherwise negatively impact their margins.

Index-linked contracts have been adopted by all other sophisticated industries, including bulk shipping and air cargo, and are exactly where container freight is heading: more than half of those we surveyed anticipate index-linked contracts will become common in freight, with estimates that nearly half (44%) of all contracts will be index-linked within the next five years.

Freightos and the Baltic Exchange are proud to be playing a part in this industry transition away from opacity and towards visibility, and toward the building of trust that can benefit all the industry’s players.