Disclaimer: This article is a zoom out for the less freight-inclined. If you have a deeper understanding of freight, you might want to check out our Freightos Baltic Index daily container index instead.

Let’s talk freight.

You’ve seen the Suez Canal memes, you know furniture is taking way longer than usual to get to your door, and you may have even heard about Pelotons shipped by air to reduce delivery times.

While the cure for COVID is well on its way, there is no vaccine for what’s afflicting container shipping.

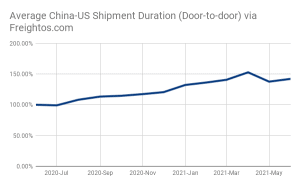

Spoiler alert, it has the cost of shipping a container up from under $3,000 to as high as $16,000 (yes, more than a new Toyota Yaris ) and taking double as long – if not more – to make it across the Pacific.

But first…

So how did we get here?

We can trace the beginnings of the container crunch back to COVID lockdowns when people started spending a lot more on goods instead of experiences and services.

It started with toilet paper hoarding and quickly escalated to horrific reports of hospitals lacking basic medical gear.

And it’s not just ocean freight.

A third of all cargo is carried in passenger planes. When that stopped, the industry found itself in a crunch and within just months, prices took off by some 400%.

So to meet capacity, airlines started to convert passenger planes into cargo planes at scale.

But back to those containers…

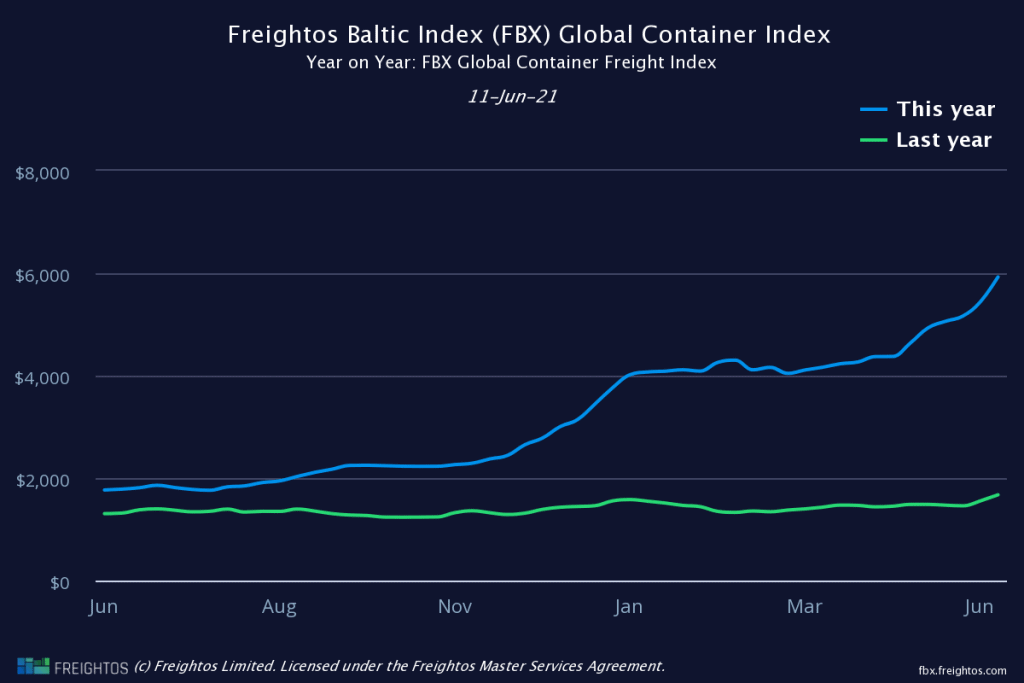

The cost of global shipping rises

Container shipping costs are usually shockingly low. Crazy low. It could be cheaper to put the contents of an apartment in a container and ship it around the world twelve times instead of paying for storage costs for a year.

But that’s changed.

When trying to book a specific slot on a container ship (yes, the ones that can handle the equivalent of 20,000 containers), prices have exceeded $16,000 (!).

Prices climbed even as ocean carriers deployed 99% of all of the world’s container ships to keep up with the demand. Enter, a global container shortage.

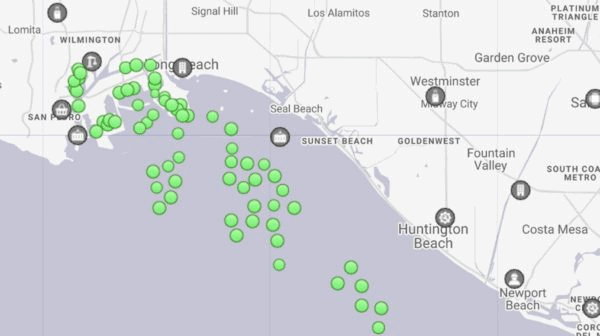

In the last quarter of 2020, it became clear cargo rates weren’t coming down anytime soon. Ships that WERE sailing were stuck in backlogs before unloading due to COVID outbreaks at the ports and not enough capacity to handle record container volumes at the ports.

And, of course, when anyone buys goods in a store, part of that cost is freight. More freight costs, higher consumer costs.

But then it got worse.

Logistics is global. So a backlog of ships off the coast of California means fewer empty containers heading back to Asia, which means fewer ships and containers available for exports, raising the cost to ship a container from Asia to Europe by 400% in November and December 2020. That same backlog has also caused record-high delays.

Then add some serious problems to the mix.

While the Suez Canal blockage got the most media (and Twitterverse) coverage, the impact of the ship itself getting delayed en route was less drastic than the ripple effects over the next few weeks.

With ships queuing up behind the Ever Given, delays on the major trade lane caused prices from Asia to the Mediterranean and Europe to rise and minimized the availability for a quick turnaround on those ships which would expand capacity

So when a COVID outbreak hit the port of Yantian – which services factories in the Shenzhen area and handles about 13 million TEU (20’ containers) a year – supply chains were already teetering. And in a system operating with zero room for error, any extra pressure triggers massive backlash.

But there’s more, and it’ll impact you personally

Even if you don’t care about world economics or how the logistics industry operates, this is important. It impacts how your next phone ships, toilet paper availability, and the cost of food.

As you may have already put together, freight delays mean you may have to wait longer to get your dining room table that was made in China, but the lasting impacts are more far-reaching.

Consumer behavior during the pandemic has pushed demand beyond the available supply, resulting in product shortages and inflated prices for shoppers.

For example, with the current steel shortage, factories aren’t able to produce as many cans as usual. And you know those really good Italian tomatoes foodies insist you need to make the perfect pizza sauce? They come in cans, and can only be canned from July-September, within 36 hours after picking.

So, not only may your favorite Italian tomatoes be harder to find this year, they’re probably also going to be more expensive.

Beyond your silicon baking pan, this has macro-economic ramifications. Small business owners are another hard-hit victim of this.

The e-commerce impact (no free shipping for global freight)

First of all, 97% of US importers are small and medium-sized businesses (SMBs), generally lacking the cash reserves to survive these conditions.

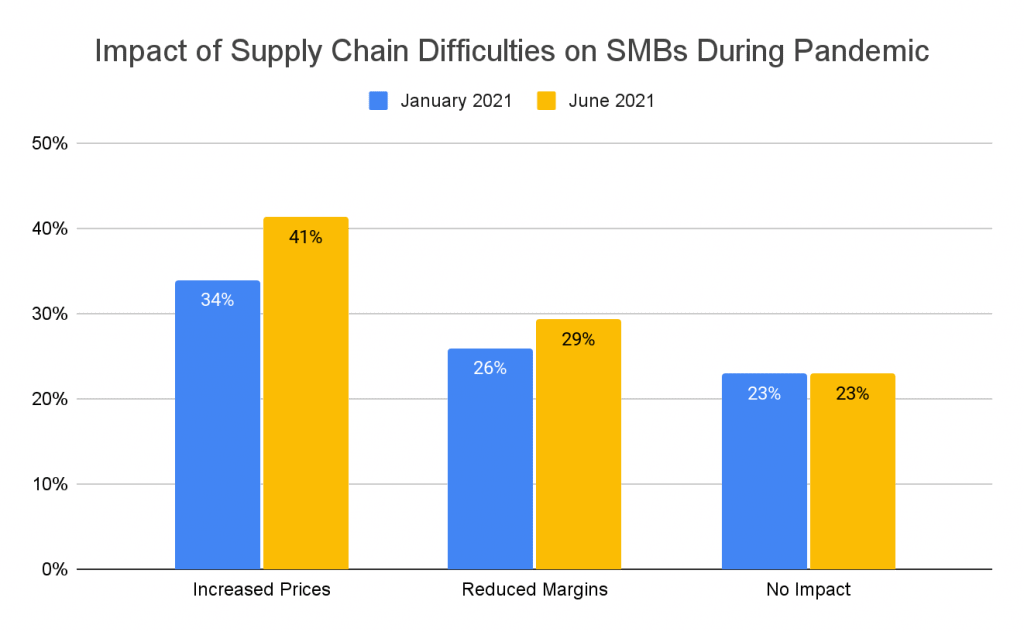

Freightos surveyed hundreds of importers who used Freightos.com’s global freight booking platform in January 2021, and again in June 2021, to see how they’re navigating supply chain challenges.

The answer? With great difficulty.

More than half (53%) of those experiencing supply chain problems, report increasing their prices as a result, compared to only 45% in January. Most (73%) Amazon sellers who’ve raised prices have done so by up to 20%.

But these retailers also report having low inventories, meaning fewer products in stock for consumers due to the supply chain mess.

Many (29%) SMBs (38% of those experiencing disruptions) report reducing their profit margins due to rising freight costs – compared with 26% (34% of those affected) in January. Most (70%) Amazon sellers who have reduced their take have done so by up to 20%.

We can safely say that SMBs are getting crushed, and the consumer is going to feel the impact of that too.

Cool. So that’s it? It’s all bad news?

Sure, on the surface things are pretty rough right now, and even that can sound flippant to someone whose business isn’t going to withstand the current supply chain disruptions.

But freight is a trillion-dollar industry, and no one wants it to collapse anytime soon.

So here are the positive takeaways:

First, the global supply chain hasn’t come to a standstill. Despite delays, products kept moving across the world. It sounds obvious, but it’s actually really important – it means there’s more resiliency from carriers, logistics providers, and supply chain managers than ever.

Moving forward, we’re betting on the industry seeking out more digital solutions that harness transparency to help avoid similar crises in the future.

On our end, Freightos has been working on digitizing the space for the past eight years, helping players within work more transparently and smarter on a global booking platform. We like to think we’re even doing a pretty good job of it. Most importantly though, we work with incredible partners, and together we’re helping to ensure that the future of global freight is better than ever.