The load-to-truck ratio for flatbeds rebounded last week to 28.4 loads per truck, after losing traction for ten straight weeks. The national average flatbed rate dropped 1¢ to $2.66/mile, but it may trend up again before the month ends on Friday. Rates rose last week on half of the top flatbed lanes, while the other half went down, so we haven’t hit bottom yet.

More flatbed loads are moving out of Cleveland and Houston, but the big surprise was a surge in volume and rates out of Roanoke, Virginia. That’s typically a small market for flatbed freight, but a newly expanded steel mill there appears to be generating more freight, and may be benefiting from tariffs on foreign competition. Roanoke is also home to warehouses and distribution centers that take advantage of access to rail service and a 2- or 3-hour driving distance to sea ports.

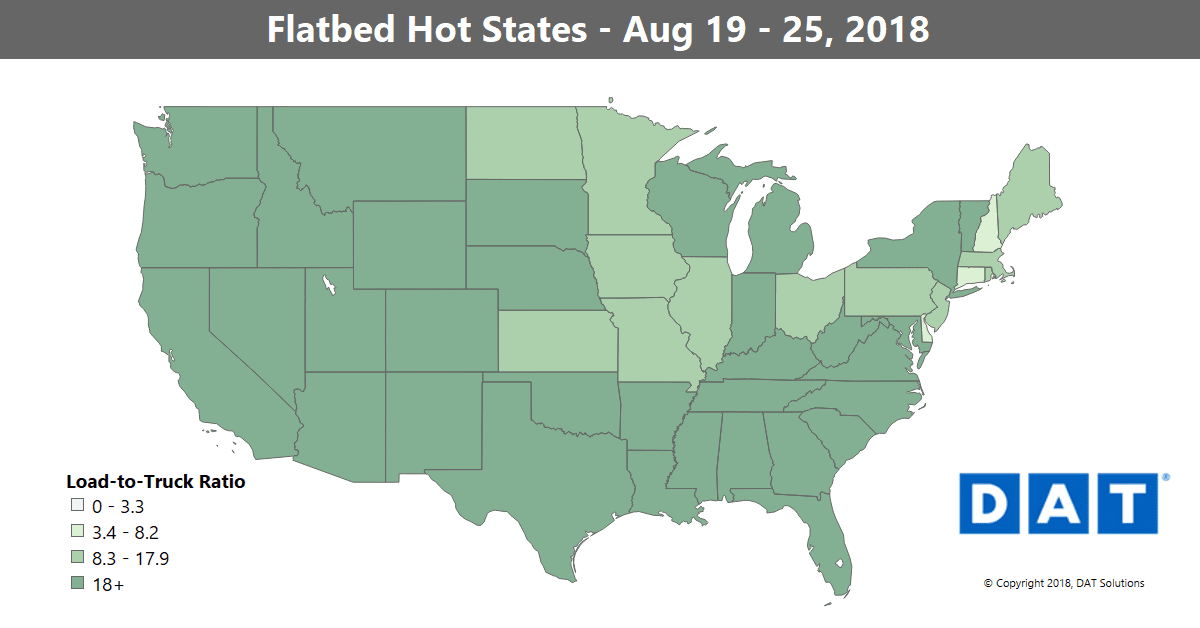

Last week the national load-to-truck ratio for flatbeds was 28:1. That’s high, but just a few weeks ago the ratio was above 100:1. Capacity is tight in all but a few states.

HOT LANES

Four of the top-gaining flatbed lanes were out of Roanoke last week:

- Roanoke to Pittsburgh surged 73¢ to $3.02/mile

- Roanoke to Atlanta rose 65¢ to $3.08/mile

- Roanoke to Cleveland gained 61¢ to $3.43/mile

- Roanoke to Harrisburg added 59¢ to $3.63/mile

These are strong rates for standard-deck flatbed, especially in late August.

NOT SO HOT

Some flatbed sectors, however, are slowing seasonally:

- Raleigh to Miami lost 60¢ to $2.91/mile, but that lane often bounces up and down

- Rock Island, IL to Indianapolis fell 55¢ to $3.30/mile, which is still a solid rate

- Las Vegas to Los Angeles dropped 49¢ to $3.61/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.