What happened in 2016

For decades, international freight’s mantra was a simple bigger is better. Strong economic growth obfuscated the underlying truth that something wasn’t working right. Last year, that something became increasingly clear. Sluggish global trade, reduced import volumes and record overcapacity showed that the global freight industry is in dire need of change.

“The global freight industry is in dire need of change”.

Market Efficiency

The hallmark of a functioning market is information flow, empowering buyers with the knowledge to make a smart choice while enabling sellers to selectively differentiate and compete. But data transparency within the logistics industry is lacking at best.

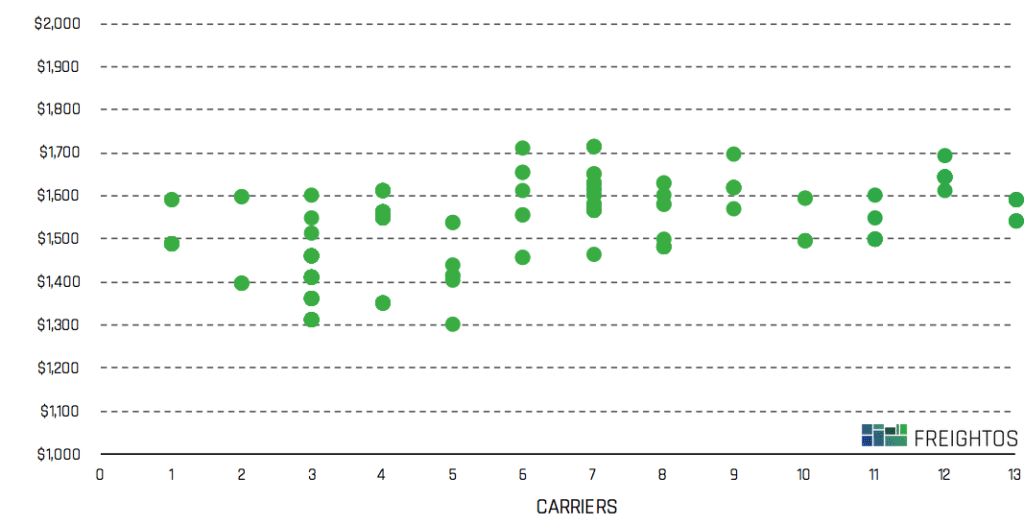

Take a look at the range in carrier prices for forwarders along one the world’s busiest routes (Shanghai to Long Beach, CA), in a data snapshot from mid-December 2016. For top twenty carriers, the price range varied by over 30%. This wasn’t the result of deliberate price discrimination either; the higher prices were not correlated with bigger customers.

In plain English, that means that forwarders and shippers do not know what they should be paying. When someone buys a car, they compare prices, with most prices settling at the nexus of supply and demand, and make an educated decision based on value and cost. In freight, supply and demand can take years to synchronize. For the most part, these costs are simply passed on to the less sophisticated forwarders and shippers.

Selective Volatility

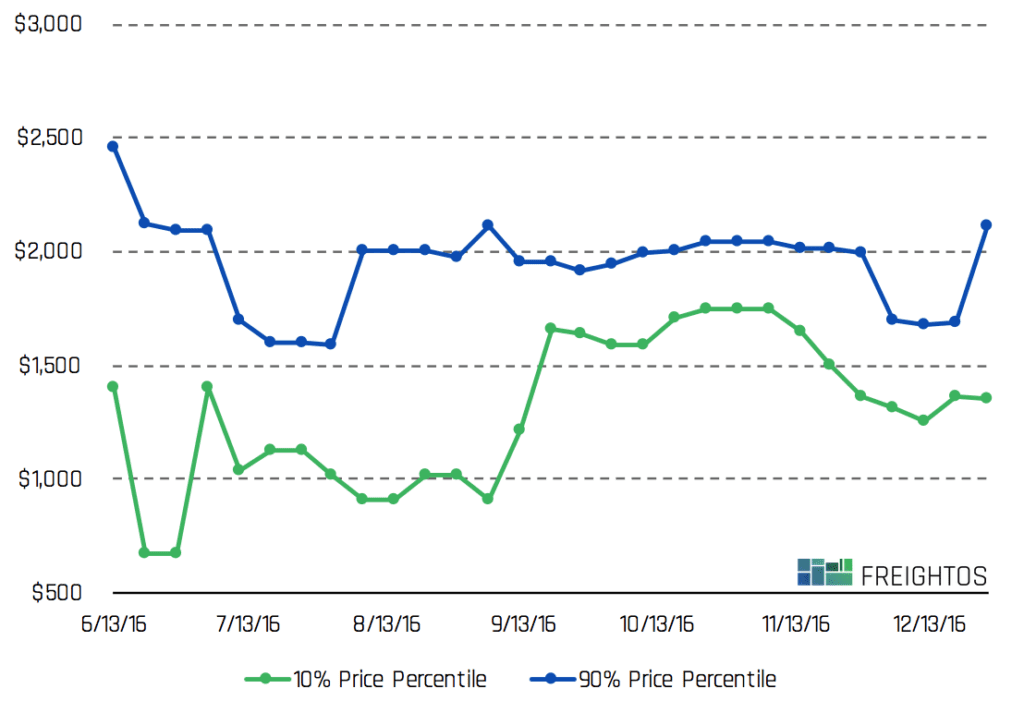

While imports flat-lined in 2016, freight rates were anything but. A range of unexpected factors, like the Hanjin bankruptcy, as well as normal seasonal factors, meant that rates changed dramatically. Observing nearly one million data points from the Freightos database, there’s a clear trend of reduced volatility for the higher tier of rates (Blue) while the lower rate tiers fluctuate much more dramatically (Green). In other words, forwarders and shippers paying high prices are effectively paying the same stable high price – peak season prices – year round. Companies with more aggressive pricing pay for it with increased external exposure to market changes. For example, note how prior to the Hanjin bankruptcy there was a 30% markup from the 10% percentile of pricing to the 90%. Days after the Hanjin bankruptcy, 10% percentile rates shot up. The 90% percentile prices, of course, stayed the same.

“Forwarders and shippers paying high prices are effectively paying the same stable high price – peak season prices – year round”.

Ebbs and Flows

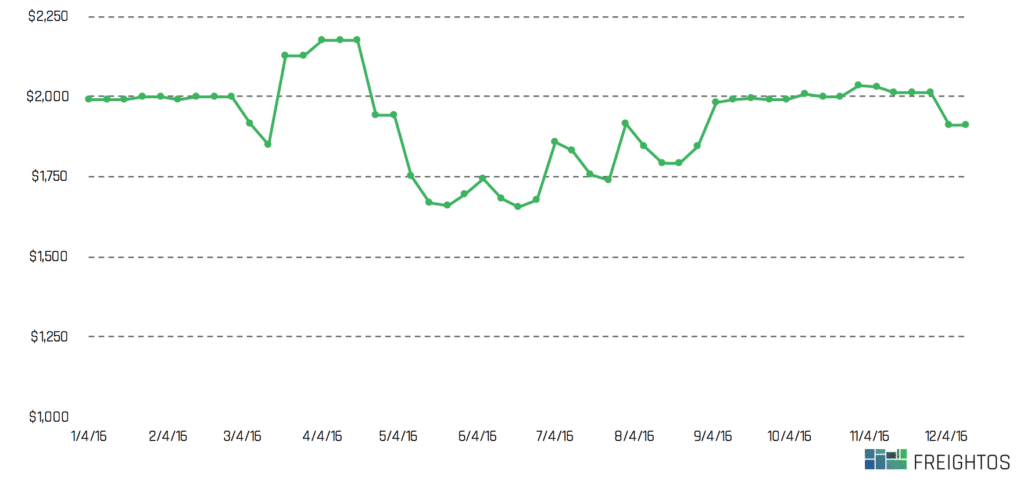

If one word defined ocean freight in 2016, it was overcapacity. A record number of ships were idled or scrapped this year (one number pinned it at 10% of the global fleet idled). From Maersk to Hamburg Süd, and especially Hanjin, no company was immune to change.

One byproduct of this was a premature peak season. The post-Hanjin September spike brought Greater China-US freight shipping prices up to peak season prices, where they stayed until mid-December.

Mode a la Mode

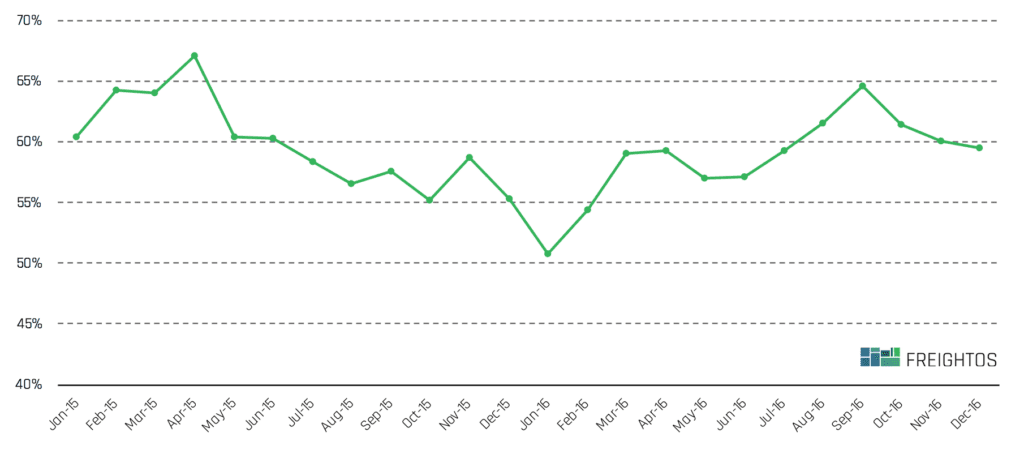

Fast Fashion had its year, borrowing lean methodologies from the startup world to rapidly design, manufacture, ship and sell fashion. Supply chains that constantly shift producers, lead time and volumes need agile data movement to support that degree of flexibility. While ocean shipping may have become more reliable (there’s a reason that electronic companies like Dell are increasingly shifting to ocean), that can change that in a heartbeat. Case in point: when looking at freight quotes, the percentage of air freight quotes compared to ocean quotes among Freightos-powered freight forwarders spiked in the aftermath of the Hanjin bankruptcy – as companies paid more to avoid potential wrenches in their supply chain. Expect more of this as the industry continues to reel.

Logistics, Meet Amazon. And Alibaba. And Uber.

Given the market opportunity, capital-rich companies are looking at logistics inefficiencies and have decided to make their move. This has become more evident every single quarter, from a proliferation of Uber for Trucking companies (including Uber itself) to Alibaba and Amazon sector involvement. The one unifying factor? Driven by either market opportunity (like Uber) or high expenditure on logistics costs (Amazon), tech powerhouses are doing what they do best – developing technology to make a mark.

Fortune 500 tech developments are only the tip of the iceberg though. An army of LogTech startups, focusing on tracking, data analysis, freight marketplaces and more, are emerging: backed by over $5 billion dollars in investments in 2016.

What It All Means

For global forwarders and carriers, 2017 is kicking off with a hesitant excitement, accompanied by some very real worries. A volatile and rapidly changing industry means opportunities to differentiate; like Kuehne + Nagel, which, spoiler alert, emerged as one of the breakaway winners in the Freightos 2017 annual online freight sales study). But volatility also means that there are downsides (just ask anyone at Hanjin).

As the freight industry reshapes itself from the combined influence of tech companies, ocean carriers, enterprise logistics companies and startups; 2017 is the year to assess the role data and transparency can play in supporting once-successful business models that just aren’t doing the trick anymore.