Retail sales in May fell 1.3% seasonally adjusted from April, according to data released by the Census Bureau Tuesday. It’s important to note that the headline decline masked what was the second-highest month on record for core retail sales.

The data showed that on a year-over-year comparison, May sales were 28.1% higher. The comparison to the year-ago number reflects demand weakness at retail stores (notably apparel), many of which were closed due to COVID protocols in 2020.

Part of the recent narrative around consumer spending has been that as vaccination rates increase, consumers will limit spending on hard goods, which require transport, in favor of events and services like dining out. During May, money spent at bars and restaurants increased 1.8% sequentially following a 4.5% increase in March. The category is up 70.2% year-over-year for the recent three-month period.

However, demand for retail products remains at record levels.

The National Retail Federation’s calculation of core retail sales, which excludes auto dealers, gas stations and restaurants, showed sales were up 17.3% year-over-year on an unadjusted basis. The metric is up 22.3% on a year-over-year comparison over the last three months, 17.6% higher through the first five months of the year.

While the year-over-year comps to COVID-impacted conditions are easy, core retail sales topped out at $388.6 billion in May, the second-highest month on record only to December, which logged sales of $414.7 billion.

“Month-over-month comparisons and percentages of change simply don’t tell the story,” said Jack Kleinhenz, chief economist at the NRF. “We are at a highly elevated level of spending, with dollar amounts in recent months some of the highest we’ve ever seen. Long-term trends in the number of dollars spent tell much more about the continuing economic recovery than whether sales were up or down from month to month.”

The NRF recently raised its forecast for retail spending in 2021. The group now expects sales to grow between 10.5% and 13.5% to $4.44 trillion. The forecast is more than double the high end of its initial outlook issued at the end of February.

The NRF’s expectation for “online and other non-store sales,” a proxy for e-commerce, is an increase of 18% to 23%.

“While there are downside risks related to labor shortages, supply chain bottlenecks, tax increases and overregulation, overall households are healthier and consumers are demonstrating their ability and willingness to spend. We are confident,” said Matthew Shay, NRF president and CEO, in a press release discussing May sales results.

Census data showed that the year-over-year comps have been higher in every month since June 2020.

Also telling were the year-over-year increases in categories that were hot at the onset of the pandemic and faced tougher comps. Health and personal care (+25.8%), building materials and garden supply (+10.1%) and general merchandise (+9.3%) saw solid gains compared to 2020.

Categories negatively impacted early on during the pandemic and facing easy comps, like clothing and accessories (+198.7%), electronics and appliances (+90.8%) and furniture and home furnishings (+64.7%) saw huge gains.

Consumer demand still supportive of future freight flows

“Demand has continued to be strong even as the concentrated impact from government stimulus has faded. There is still pent-up demand for retail goods and consumers are likely to remain on a growth path into the summer,” Kleinhenz added.

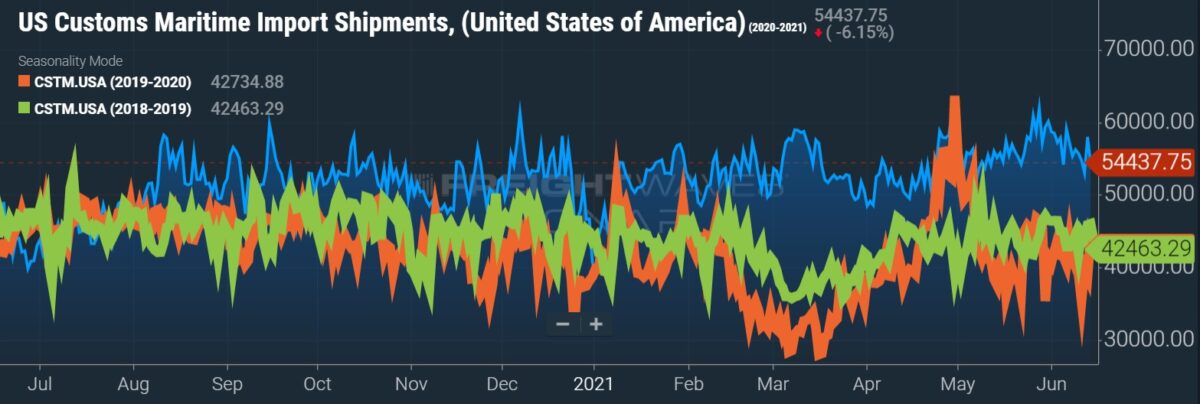

The NRF’s forecast calls for inbound twenty-foot equivalent units (TEUs) at the nation’s top container ports to continue to surge. April was the busiest April on record in the group’s 20-year dataset, up 33.4% year-over-year to 2.15 million TEUs. This followed an all-time high in March of 2.27 million TEUs. The group hasn’t finalized May reporting yet but it expects the month to be 51.1% higher year-over-year, a new all-time record at 2.32 million TEUs.

The forecast appears likely to hold as container imports at the nation’s 10 largest ports were up 51.6% year-over-year to 2.2 million TEUs in May, according to The McCown Report published late Tuesday. Even when comparing to more normalized years the growth is exceptional. May TEUs were up 26% compared to May of 2019, The McCown Report showed.

The NRF expects the record-setting strength to continue through the summer without a decline until fall — June (+32.8%), July (+14.2%), August (+7.5%), September (+1.7%) and the last forecast month, October (-6.5%). It’s important to note that the forecast in October, which is expected to be the lowest level since February, still calls for 2.07 million TEUs.