We will keep this blog updated as we follow the effects of Coronavirus on the supply chain.

On December 31, 2019, China notified the World Health Organization of a new illness, COVID-19, later named ‘coronavirus.’ Since then, the outbreak has shut down thousands of factories in China that serve brands worldwide, causing decreased manufacturing capacity.

Due to this factor, demand has also fallen for ocean carriers, and many brands expect the impact to continue downstream in the supply chain. According to an NRF survey, 40% of retail and supply chain leaders are already seeing disruptions upstream in the supply chain, and another 26% expect to see disruptions as the situation continues.

Retail leaders are employing a number of strategies to succeed in this time of uncertainty. In order to help alleviate the impact, we pulled together our data and best practices for supply chain crisis management as a resource during this critical period. Read on to learn more and get real-time data on North American network performance.

How Retailers Have Managed Risk So Far

Shortages have already started to reverberate throughout the supply chain for several brand verticals. Brands who practice lean supply chain methods, otherwise known as just-in-time manufacturing, may see disruptions earlier than others. Apple, for example, has already announced lowered sales results for Q2 2020 due to ‘strain in supply.’

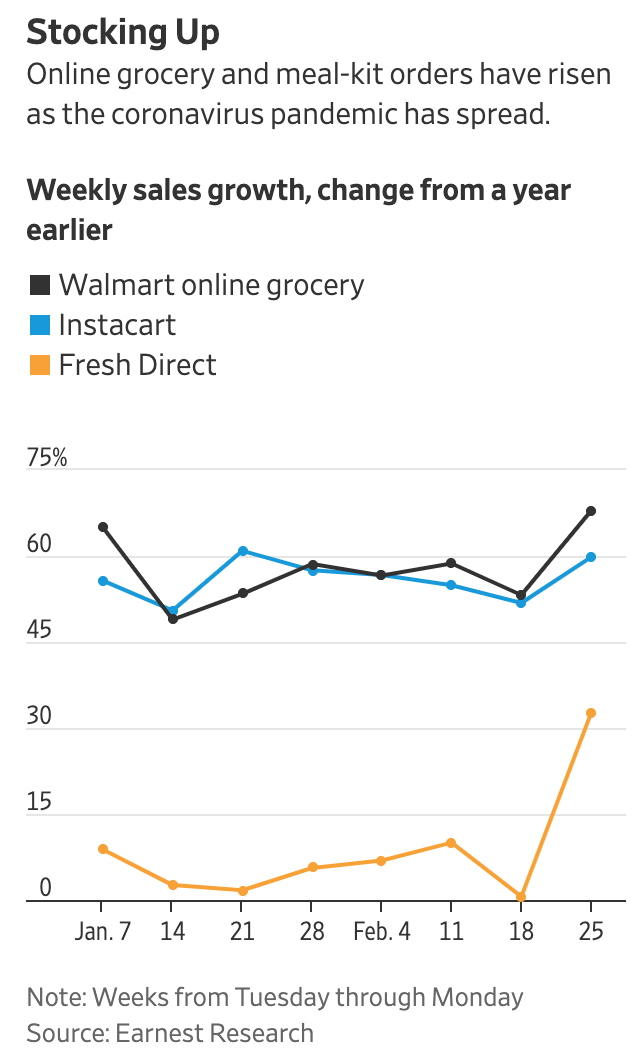

Additionally, buyer hysteria has impacted CPG brands, meal kit services, and grocery, who have already faced challenges and crunches up and downstream in their supply chains. As consumers hurry online and to their local stores, Costco and Target have already reported running out of stock for necessities such as toilet paper, hand sanitizer, and water. Costco is handling this by shifting product SKUs to alternative products, and placing limits on the number of each item that consumers are allowed to buy.

As consumers opt to stay at home for fear of getting sick, retail leaders expect online sales to rise for grocery verticals and brands who focus on cleaning supplies. Meanwhile, Amazon has started to penalize its third-party sellers for taking advantage of shoppers, who have started price gouging customers for high-demand CPG products, raising prices up to 6X.

Other retailers are focused on supply chain risk management down the road. According to Quartz, Amazon is already taking precautions for its annual Prime Day, warning third-party sellers to prepare their inventory now, and allowing them to make larger inventory buys. For all retailers, especially Amazon, avoiding stock-outs is key. A study by ECR Europe suggests that 31% of consumers will abandon their purchase after the first occurrence of an inventory stock-out, and that percentage increases exponentially the more stock-outs they find. As shoppers take to Amazon looking for medical and CPG goods, the behemoth is now exclusively stocking its warehouses and distribution centers with those goods.

Mitigating Customer Delivery Expectations As Coronavirus Affects Last Mile Logistics

Worries around coronavirus continue to grow, and keeping consumer confidence high will be an important challenge in an already rocky market. As shortages ripple into the last mile of the supply chain and delivery volume spikes, it’s paramount for brands to remain nimble in order to meet customer expectations while managing strained carrier capacity. This is especially true for medical and life-sustaining supplies, which could provide massive benefits if delivered on-time.

With over 3 billion shipping events in our system from the world’s top retailers, we put together a list of items to aid transportation, digital and customer experience teams in mitigating supply chain risk from the impacts of the coronavirus.

Navigate Through Driver Shortages And Capacity Crunches

It’s no secret that driver shortages have limited capacity in the past, but a coronavirus outbreak may leave drivers sick, unable to drive, and unable to deliver goods to customers in the future. On March 3, Amazon finally sent out guidance for drivers to stay home if they have fevers, and other companies are likely to follow. In other words, delays may be inevitable as retailers and carriers race to find available drivers to carry their loads and warehouse teams who can still work.

In addition to delays, shippers should also expect an increase in pricing. In the past, when hurricanes have caused supply chain disruptions, shipping costs rose 5-22% and impacted 10% of the nation’s trucking capacity.

For this reason and many more, it’s crucial that retailers plan ahead in their network designs, and diversify their carrier mixes. Many supply chain managers know that single-sourcing their carrier networks can result in danger during a fluctuating market. Adding on regional carriers to your network design can give your team more options to deliver items on-time, and to the standard that your brand upholds. [Download a free carrier RFP template here.]

Understand And Resolve Bottlenecks In Your Network Efficiently

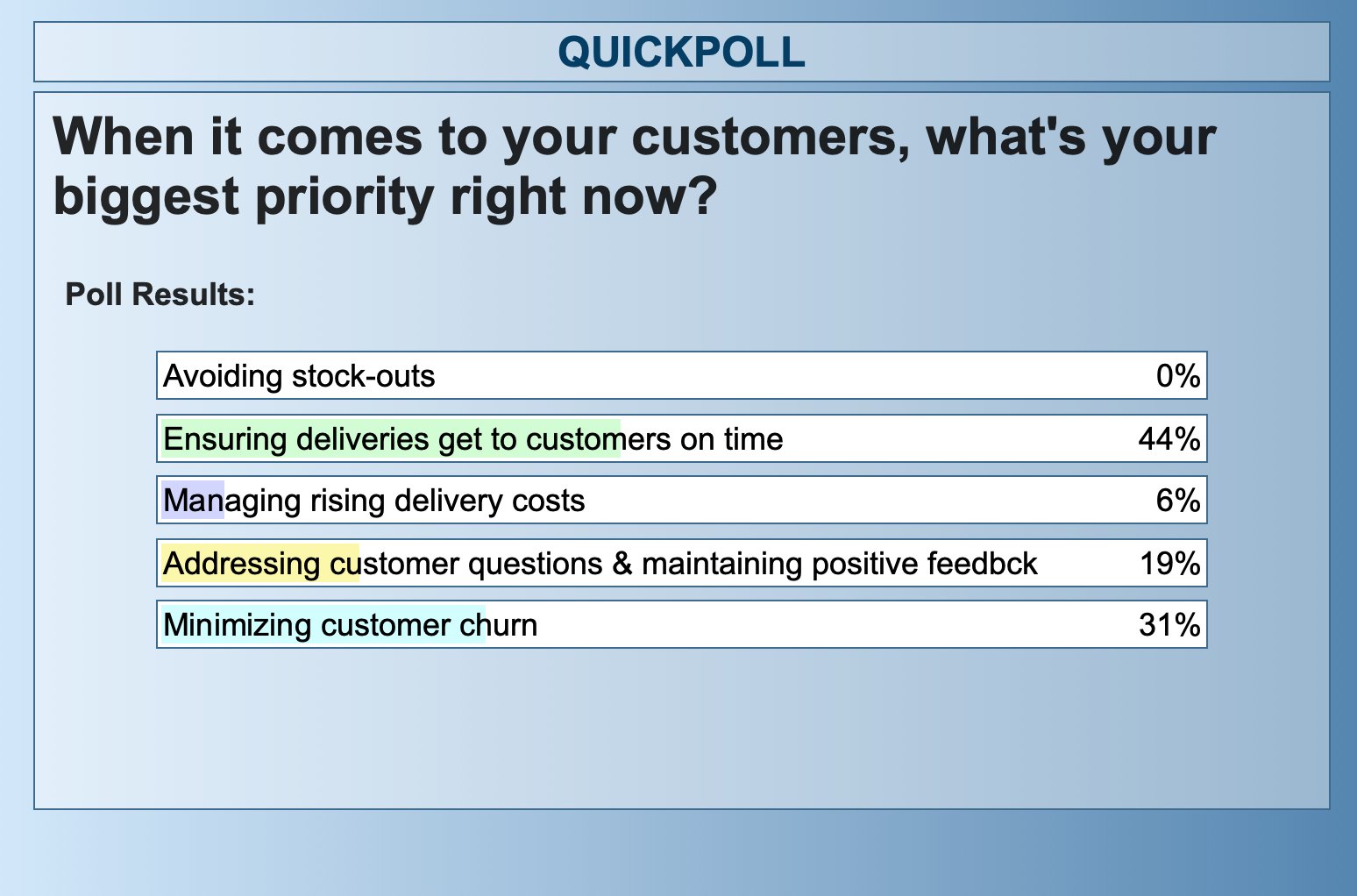

As more shoppers go online to shop rather than venturing outside, spikes in delivery volume, paired with the capacity crunch may leave many retail stores empty and customers wondering where their orders are. Right now, the top concern for retailers is ensuring that items get to customers on time, according to a poll of over 40 retail executives in our COVID-19 webinar panel. This is followed by minimizing customer churn.

If other disasters, such as hurricanes or the winter storms of 2019, have indicated anything, it’s that delivery delays and exceptions are sure to follow a break in the supply chain. During peak season, we found that 17% of shipments did not arrive when customers expected them.

During Peak Season 2019, many brands leveraged real-time visibility data and supply chain AI to their advantage, understanding which areas suffered the largest delays, and predicting delays before customers reported them. With accurate data, they could quickly work to mitigate delays, avoiding delivery disasters.

Our real-time reports indicate that since February 23, 2020, fulfillment time has increased by up to 40% (as measured by the length of time between when a shopper hits buy to when the order is picked up by the carrier for delivery). Fulfillment time is noticeably larger for big and bulky (LTL) shipments, which retailers do not typically keep in inventory.

The real-time charts below indicate up-to-date historical data of delays by carrier and geography across millions of Convey tracked shipments. Combine data and collaboration with your carrier partners to understand where disruptions have happened in your fulfillment network, and use it to manage your supply chain risk.

Live Updates of Historical Delays By Percentage And By Geographic Location – All Data Is Proprietary. Reproduction, Alteration, and Distribution Without Written Permission Is Prohibited

Supply Chain Crisis Communication With Customers Becomes More Important Than Ever

Last, and possibly most crucial, while coronavirus causes kinks in the supply chain, it’s imperative to give customers transparency into what’s happening with their orders. Similar to the effect with stock-outs described above, customers lose trust and confidence in retailers who do not deliver items on time. In fact, according to our consumer research, 98% of customers agree that brand loyalty hinges on the last mile experience and 73% of customers will not return after just one poor delivery.

Communicating with customers is especially important in the event of a shipping exception, such as a delay, and we’ve even found that proactive handling of a delivery issue can both save brands costs in WISMO calls (when customers call in asking “Where Is My Order?”) and help brands strengthen bonds with their customers. [See how Bodybuilding reduced WISMO calls and raised NPS]

This can be done in a variety of ways:

- At the very least, give customers basic tracking pages where customers can monitor, track, and leave feedback on the status of their shipments. This will give them a page to go back to and understand if there are any issues with their orders, or when the shipment will arrive.

- Real-time alerts leveraging predictive data or even Revised EDD statuses can both let customers know that there may be an issue with their shipment and reassure them a plan of action is in place to resolve the problem. 93% of customers want some form of alert in the event of an exception, and customers prefer to receive these alerts via email or SMS.

- If possible, tailor or segment messages to fit customer needs, expectations, and value. VIP customers, for example, may expect a different line of communication for customer service, or expedited shipping when errors occur, or else they may churn. [Get more information on when and how customers prefer to receive communication.]

Understanding The Full Impact Of Coronavirus On The Supply Chain

In the coming weeks and months, as the retail and supply chain community gather together during this outbreak, it’s crucial for all to maintain the mindset of resilience. Retailers, take note of price increases in carrier pricing as shortages begin, understand how your networks can function with agility and speed, and most of all — keep customers in the loop. While the outbreak will have ripple effects throughout the supply chain, retailers who keep best practices in mind can mitigate the impact.

All of us here at Convey extend our sympathy and support to those impacted by the outbreak, and we’re dedicated to sharing our data with the community in order to help mitigate risk. As we get data, expect to see updates on this blog. If you would like more information on symptoms of COVID-19, or how to handle outbreaks in specific communities, please check out the official site of the Centers Of Disease Control And Prevention (CDC).