The mainstream press is now awash in articles on global supply chain breakdowns, exorbitant shipping costs, clogged ports, emptying store shelves and rising inflation. That’s good news for sentiment toward many (but not all) ocean shipping stocks.

After a summer lull, shares of bulker owners, container lines, container-ship lessors and liquefied natural gas (LNG) carriers are moving up again and hitting new peaks. Stocks of crude and product tanker owners — who are heavily exposed to delta variant fallout — have yet to join the party.

Big day for dry bulk stocks

Shares of three dry bulk shipping stocks — Safe Bulkers (NYSE: SB), Diana Shipping (NYSE: DSX) and Genco Shipping & Trading (NYSE: GNK) — attained 52-week highs on Monday. Other dry bulk equities are near annual tops.

The Breakwave Dry Bulk Shipping ETF (NYSE: BDRY), an exchange-traded fund that purchases freight futures, traded Monday at the highest level since the ETF’s inception in March 2018.

Rates for Capesizes (bulkers with capacity of around 180,000 deadweight tons or DWT) surged 15% on Monday to $52,900 per day, with rates for Panamaxes (65,000-90,000 DWT) and Supramaxes (45,000-60,000 DWT) at or near decade highs, at $32,400 and $34,900 per day, respectively. Even so, dry bulk rates are still nowhere near pinnacles reached in 2007-2008.

Shares of Safe Bulkers jumped 17% in five times the average trading volume on Monday. In general, shares of dry bulk stocks have risen by around 200%-400% over the past year, in several cases outpacing container stocks.

Container stocks’ September peak

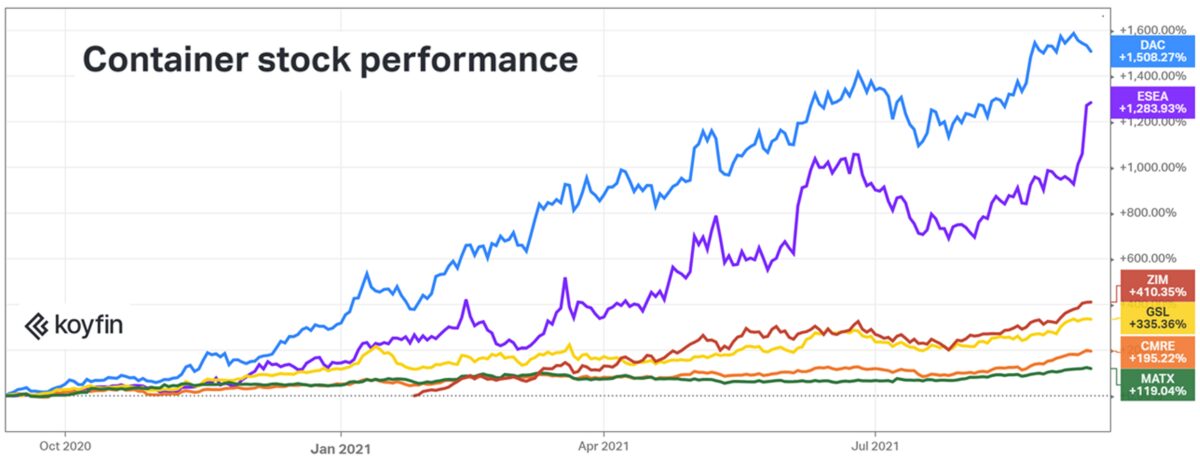

Container-ship lessor Euroseas (NASDAQ: ESEA) hit its 52-week high on Monday, although most container stocks pulled back by the low single digits during that trading session. Many of the other container shipping equities reached 52-week highs this month: Global Ship Lease (NYSE: GSL) and Costamare (NYSE: CMRE) on Friday, ZIM (NYSE: ZIM) and Matson (NYSE: MATX) on Sept. 6, and Danaos (NYSE: DAC) the week before that.

Most container liner and ship-lessor stocks are up around 100%-400% over the past year, with Danaos and Euroseas being outliers, up 1,508% and 1,204%, respectively.

Tankers tread water — except for LNG carriers

The pandemic has been a positive for container stocks due to higher U.S. consumer demand and widespread port congestion reducing effective transport capacity. Freight rates and charter rates remain at record levels. COVID has also been positive for dry bulk stocks as pandemic precautions at ports have tied up capacity.

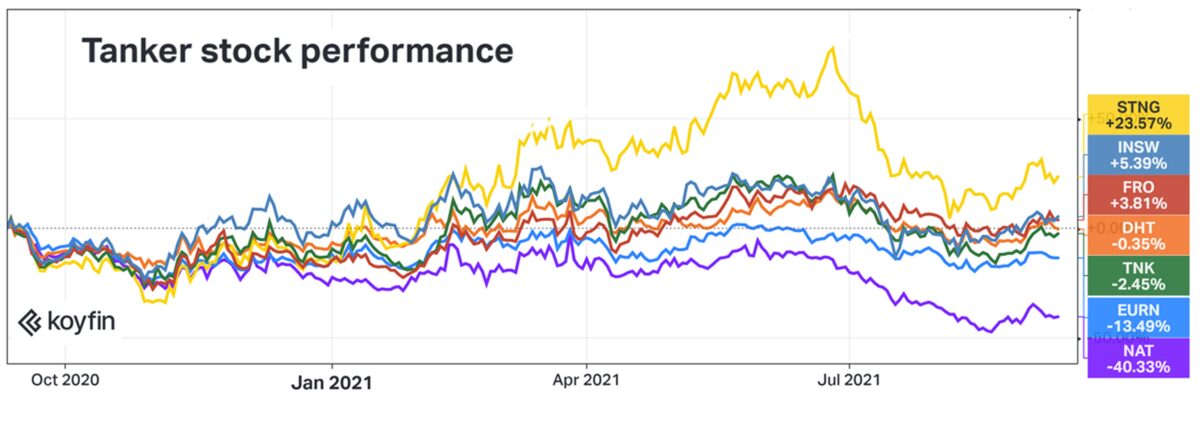

In contrast, COVID has been negative for crude and product tanker stocks, with global oil demand taking longer to recover than expected due to the delta variant.

Most tanker stocks have been treading water over the past year. Scorpio Tankers (NYSE: STNG) is the best performer, up 24%, albeit underperforming the S&P 500. Nordic American Tankers (NYSE: NAT) — a longtime favorite of retail traders — is the worst performer, down 40%.

But not all is doom and gloom in energy shipping. Specialized tankers that carry LNG are enjoying strong demand.

The spread is now exceptionally high between the U.S. natural gas benchmark on one hand and the benchmarks in Europe and Asia on the other. A wide spread incentivizes LNG shipping demand as traders and energy companies profit from buying gas in the U.S. and selling it overseas. According to Cleaves Securities, the spread between the U.S. and Japan hub prices is almost $17 per million British thermal units and the U.S.-U.K. spread is over $15.

Flex LNG (NYSE: FLNG), the LNG shipping company backed by shipping tycoon John Fredriksen, debuted on Wall Street in June 2019. The stock is up 185% over the past year. On Monday, it not only hit its 52-week high, it hit its highest price since it began trading in the U.S.

Click for more articles by Greg Miller

Related articles:

- Battle of the shipping booms: Containers ‘21 vs dry bulk ‘07-‘08

- California port pileup shatters record and imports still haven’t peaked

- Why stratospheric container rates could rocket even higher

- Supply chain ‘anarchy’ is gold mine for ocean carriers like ZIM

- Inside container shipping’s COVID-era money-printing machine

- A cruel summer for shipping stocks as tide turns