[This blog is part of a four-part series. Using SurveyMonkey, we surveyed 2,000 shoppers to understand sentiments around Amazon, and uncovered key trends revealing that the key to Amazon’s success is its industry-disrupting shipping offering.]

Over the last 25 years, Amazon has revolutionized the retail industry as we know it – currently holding 50% of the U.S. ecommerce market share. Among the company’s many innovations, one of the most powerful is the introduction of fast and free shipping.

Why? Because today, we’re living in the experience economy – where the memory of an experience with a company has become the product. The infrastructure that made this experience economy possible has been under construction for quite some time, with Amazon, Ebay, PayPal, Google Adwords, and Amazon Prime (with free two-day shipping) all launching between 1995 and 2005.

With this new retail landscape, transactions, purchases, and deliveries all happen at a much faster rate than ever before. Our increased velocity of commerce has created an environment where every single interaction with a brand impacts customers..

Respondents in a June 2019 FocusVision study said that the way a brand makes them feel is 1.5X more important than all other inputs they use to make purchase decisions. And Convey’s 2020 survey on consumer sentiment towards Amazon also found the following:

- 42% of respondents said they chose Amazon because it is “the best online shopping experience.”

- Nearly half of respondents reported that they were more likely to expect other retailers to keep up with Amazon.

So what can retailers do to win customers in the experience economy? The first step is understanding how consumers feel about Amazon’s shipping offerings.

Amazon’s Fast And Free Shipping Is The Cornerstone Of Consumer Expectations

Don’t get us wrong: Nearly two-thirds of shoppers still look to Amazon for their broad selection of items. But with the introduction of Amazon Prime and free two-day shipping, consumers have become attached to not paying for delivery in the shopping cart, even if it involves paying a membership fee each year.

With 15 years of Amazon Prime, the company has had time to test and refine all facets of the program with consumers. Today, shoppers are hooked: 80% of Convey survey respondents say they shop at Amazon because of fast, free shipping. However, “fast” and “free” must come in a specific combination or consumers will buy elsewhere:

Those first two points mean that a combined 64% of shoppers might buy from another retailer without free shipping. Amazon stands to lose almost two-thirds of customers if free shipping goes away. That’s a huge weight on shipping as a part of the customer experience.

And even with free shipping, there’s a threshold for how long delivery can take (4 days) before customers go elsewhere. Free, no-rush shipping may continue to be an option, but the delivery timeframe still has to be somewhat fast in order for shoppers to use it. That’s quite a lot at stake for any retailer, especially given that 40% of consumers expect all retailers to keep up with Amazon.

Meet Ever-Rising Customer Delivery Expectations Without Compromising Your Brand

Given all the resources at Amazon’s disposal, retailers may feel that there’s just no competition. Not only is the company willing to throw resources at the last mile delivery problem, even at the risk losing profit in its retail segment, but the company has recently severed ties with FedEx and is planning to build its own delivery network, at a projected $122 billion investment. That’s not even in the realm of possibility for retailers. However, there are ways retailers can improve upon their current infrastructure to mimic Amazon’s delivery experience — without such a massive investment.

Communicate With Customers With Accurate Estimated Delivery Dates

Amazon’s detailed delivery expectations are a big part of the positive shopping experience. The Prime logo on the product page tells shoppers they can get their coveted free 2-day shipping on an item. Other offerings might be free same-day shipping (a subset of Prime), free delivery with a minimum cart order, a lower ‘Subscribe & Save’ price, and free returns.

Amazon has good reason to offer all these details upfront. Almost half of shoppers will abandon their cart if the delivery timeline doesn’t match their expectations, and more than 50% of shoppers want a guaranteed delivery date at checkout.

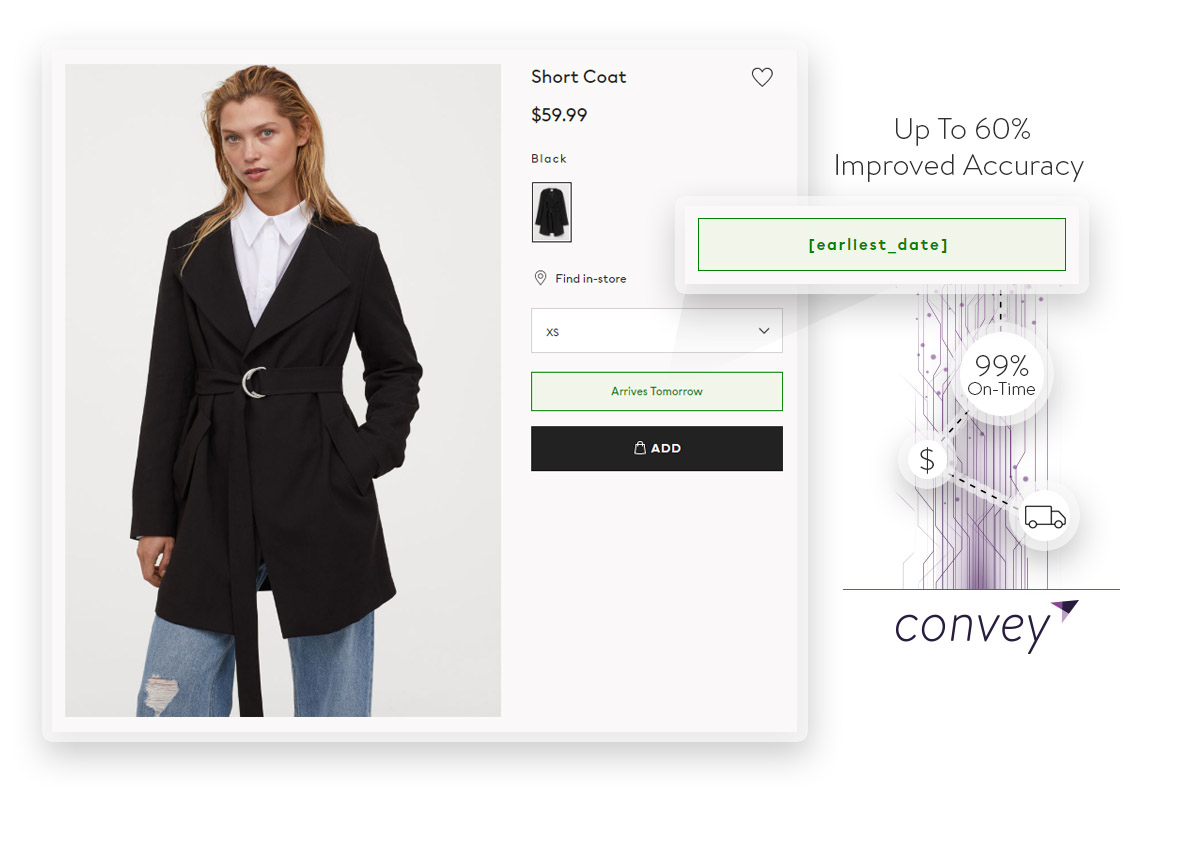

Retailers can step up to the plate by providing shoppers with the earliest delivery date on the product page. By linking carrier data directly to product details, retailers can provide accurate delivery estimates (EDD) and increase sales as a result.

[Learn how faster delivery dates drive conversions.]

Integrate Carrier Data To Better Manage The Shipping Experience

According to a Morgan Stanley report, Amazon delivered almost half of the packages ordered on its website in the last year (roughly 2.5 billion packages). For those packages, Amazon has control all the way down to delivery at the doorstep.

While we won’t see smaller retailers starting their own shipping networks in the near future, they can still achieve higher levels of visibility and control of shipments than they have today. For many retailers, the current scenario is a one-way conversation. A customer places an order, the product is packaged, and the shipment is handed off to the carrier. The retailer only hears about it when the customer contacts the company with a problem (otherwise known as a WISMO call).

Retailers can opt to create a two-way conversation with carriers by integrating real-time shipping data into their current processes. Having this easily-accessible data allows retailers to resolve exceptions before they happen. And that positive resolution has a real financial impact: almost two-thirds of shoppers are more likely to shop with a retailer again when the issue has a positive outcome.

Reduce Unnecessary, Systemic Shipping Costs With Data Insights

Amazon is a case study for experimentation in retail. The company is constantly running thousands of tests on its offerings, analyzing the resulting test data, and making decisions on how to move forward. By working to drastically reduce the cost of those experiments, Amazon can run more of them and produce a higher rate of innovations.

Retailers can take the same experimentation approach to shipping by regularly evaluating carrier data related to customer shipments. How many shipments are at risk of missing their estimated delivery date? Why were 300 packages damaged in transit? Maybe they’re all in the same city, or being delivered by the same carrier. Whatever the case, retailers can learn from carrier data and take steps to reduce costly shipping errors – and prevent a negative customer experience before it happens. [Learn how Convey Discover can surface insights for fast decision making.]

Shipping Expectations Will Continue To Drive Consumer Behavior

Amazon has forever changed the retail landscape, and the resulting consumer expectations are not going away. In fact, according to our annual research, they only continue to increase over time, and customers will continue to value “free delivery.”

To compete in this new environment, retailers need to understand their own customers’ wants and needs and pull resources accordingly. By driving increased visibility in delivery timelines, carrier communication, and shipping insights, retailers can strive to meet customer delivery expectations with a much smaller investment of time and resources, driving top-line revenue and improving growth.

This blog is part of a series around how Amazon grew its logistics arm, why consumers enjoy its services, and how the eCommerce fulfillment behemoth drives customer delivery expectations sky-high. Read the rest of the blogs in the series below, and download our retail consumer research to learn more about last mile delivery and Amazon.

- Consumer Research: Amazon Guilt: Why Shoppers Love To Hate The Online Behemoth

- Amazon Power Shoppers: How And When Consumers Want Their Last Mile Deliveries

- Overcome Amazon Guilt: Win Over Shoppers Throughout The Customer Journey

- Porch Piracy: A Hidden Cost Of Last Mile Delivery

- The Rise of The Amazon Logistics Machine And How It Impacts Retail: A Timeline