Congratulating the Supply Chains to Admire Winners

Supply Chain Shaman

JUNE 19, 2018

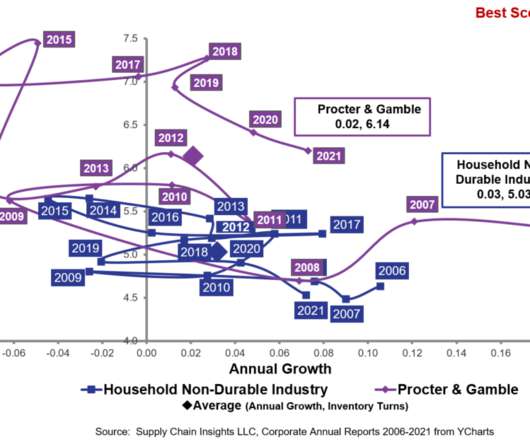

It is now our fifth year of analyzing balance sheets to understand which companies are outperforming their peer groups on the metrics of growth, operating margin, inventory turns and Return on Invested Capital (ROIC) while driving improvement. Wal-Mart and TJX Orbit Chart for Operating Margin and Inventory Turns for the Period of 2006-2017.

Let's personalize your content