Supply Chain Performance Declined In the Last Decade. The Question is Why?

Supply Chain Shaman

APRIL 9, 2021

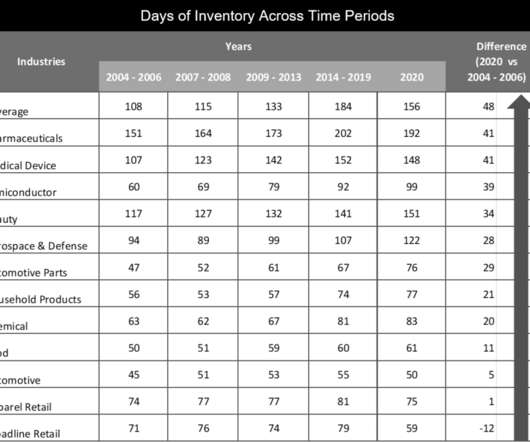

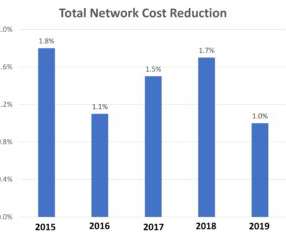

of revenue on information technology (IT), only six percent of manufacturers drove performance at the intersection of growth and margin. Rise in Inventories. Less Effective at Inventory Management. Inventories grew twenty days over the decade. Sadly, most of it is the wrong inventory. Despite spending 1.1%

Let's personalize your content