4 min read

What is the Corporate Sustainability Reporting Directive (CSRD)?

Gain insights into the Corporate Sustainability Reporting Directive (CSRD) and explore its purpose, scope, and implications for businesses. Stay informed about this pivotal EU regulation with our overview of the CSRD.

Introduction

In a drive for more substantial environmental commitment, the EU has prepared the Corporate Sustainability Reporting Directive (CSRD) that will replace NFRD, its predecessor in ESG reporting. The CSRD requires large companies to adhere to European Sustainability Reporting Standards (ESRS) provided by the European Financial Reporting Advisory Group (EFRAG).

The main objective of these regulations is to improve reporting on social, environmental, and governance considerations by promoting transparency and uniformity. By using ESRS, CSRD intends to enhance the quality of sustainability reports to assist the European Green Deal in achieving the ambitious goal of carbon neutrality by 2050.

Keep reading about:

- Who is affected by the CSRD directive?

- What is the timeline for the implementation of the CSRD?

- Consequences of inaction. French example

- Idea behind CSRD

Who is affected by the CSRD directive?

The CSRD directive applies to EU-based public companies, except for micro-enterprises (micro-enterprises are defined by having fewer than ten employees, a balance sheet of €250,000 or less, and revenues totaling €700,000 or less.), and to EU-based private entities classified as "large," meeting specific thresholds such as having 250 or more employees, generating annual revenues of €50 million or more, or possessing a balance sheet totaling €25 million or more.

For non-EU parent companies, their EU subsidiaries must comply with CSRD reporting requirements if they meet the criteria above. Alternatively, some companies may voluntarily consolidate their reporting efforts globally.

In the future, the CSRD will mandate consolidated reporting for non-EU parent companies with annual EU revenues exceeding €150 million and at least one branch or subsidiary meeting specified criteria. This includes branches with annual EU revenues of €50 million or more or subsidiaries meeting the "large" criteria outlined earlier. The parent company must also incorporate disclosures related to their non-EU activities in such instances.

If the parent company prepares consolidated reports, subsidiaries may be exempt from direct reporting, although certain information must be provided. However, large listed companies are ineligible for this exemption.

Additionally, SMEs will have reduced reporting obligations, with consideration given to the size of European subsidiaries and branches. Similarly, non-European companies must only disclose information about their socio-environmental impacts.

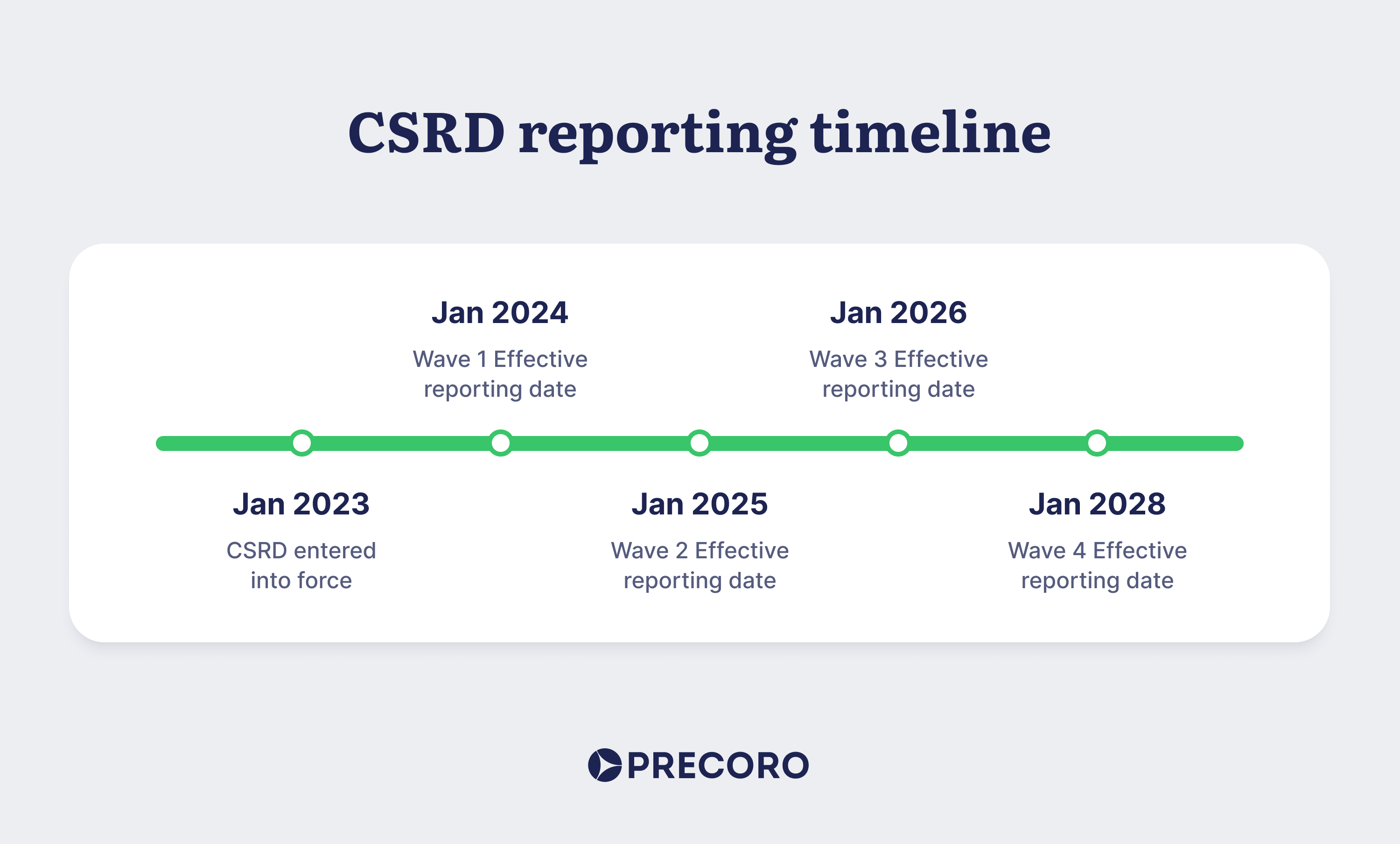

What is the timeline for the implementation of the CSRD?

Wave 1: Effective reporting date January 1, 2024

- Large companies with over 500 employees that are already reporting in accordance with the Non-Financial Reporting Directive (NFDR)

Wave 2: Effective reporting date January 1, 2025

Newly included companies not previously under NFDR regulations, meeting at least two of the following criteria:

- More than 250 employees

- More than €50 million in turnover

- More than €25 million in total assets

Wave 3: Effective reporting date January 1, 2026

Small and medium-sized enterprises (SMEs) listed on EU-regulated markets exceeding at least two of these thresholds:

- More than 10 employees

- More than €700,000 in net turnover

- More than €350,000 in total assets

Enterprises with less than 10 employees or with a turnover below €2 million are exempt from the requirement.

Wave 4: Effective reporting date January 1, 2028

Non-EU companies meeting the following criteria:

- Net turnover exceeding €150 million in the EU

- At least one subsidiary or branch in the EU.

Consequences of inaction. French example

France has become the first member state to implement the Corporate Sustainability Reporting Directive (CSRD) law, which came into effect on December 6, 2023. This is a significant step towards achieving an EU-wide harmonized system for sustainability reporting. The implementation of this law sets a precedent for other member states to follow in interpreting the legislation and aligning their sustainability reporting practices with the EU's standards.

In addition, France has introduced strict penalties for non-compliance with the CSRD law. Companies that fail to comply with the requirements of the directive could face fines of up to €75,000 and even imprisonment for up to five years for various infringements. This should serve as a warning to executives, compliance officers, and legal teams with operations in France.

If your company falls under the scope of this legislation, it is essential to fully comprehend the implications of non-compliance. It is crucial to ensure that you are meeting the reporting requirements of the directive to avoid any penalties. This will require a thorough understanding of the CSRD guidelines and the data that needs to be reported. Companies may also need to make significant changes to their current reporting processes to ensure that they are in compliance with the directive.

Idea behind CSRD

The Corporate Sustainability Reporting Directive is crucial to enhancing transparency and sustainability reporting among EU companies. The directive has been designed to improve businesses' environmental, social, and governance (ESG) information quality, comparability, and reliability. With the implementation of standardized disclosure frameworks and expanding the scope of reporting requirements, the CSRD aims to address gaps in existing reporting practices and hold corporations accountable for their impact on society and the environment.

The CSRD is a response to the growing recognition of the importance of ESG factors in investment decisions and the need for reliable and comparable information to assess the sustainability of businesses. The directive will require large companies operating in the EU to disclose a wide range of sustainability information, including environmental impacts, social policies and practices, and governance structures and practices. Moreover, the CSRD will also introduce mandatory reporting requirements for sustainability risks and opportunities, climate-related risks, and the alignment of business strategies with the Paris Agreement.

By enhancing the quality and comparability of sustainability reporting, the CSRD hopes to enable stakeholders, including investors, consumers, and regulators, to make informed decisions and promote sustainable economic growth. The directive recognizes that businesses are responsible to society and the environment and seeks to hold companies accountable for their impact on these areas. The CSRD aims to foster a culture of sustainability reporting among businesses, where companies are incentivized to improve their sustainability performance and engage with stakeholders on sustainability issues.

Conclusion

The Corporate Sustainability Reporting Directive represents a significant milestone in the journey towards a more sustainable and transparent business environment. It empowers stakeholders to make informed decisions that drive positive societal and environmental outcomes by standardizing reporting requirements and promoting greater accountability. As businesses adapt to these regulatory changes, embracing sustainability as a core business imperative will be essential for long-term success in a rapidly evolving landscape.