This Week in Logistics News (February 12 – 18)

Logistics Viewpoints

FEBRUARY 18, 2022

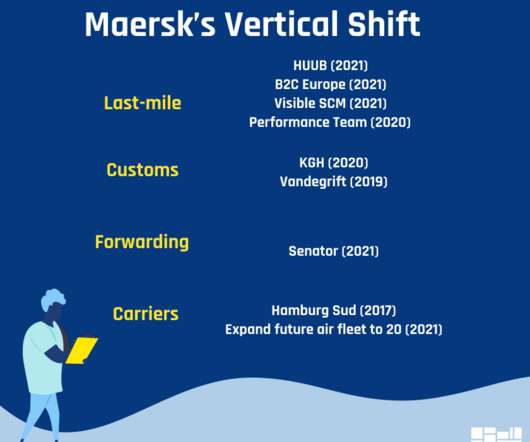

What Berglund is referring to is the advantage that shipping lines hold for negotiations with cargo shippers for 2022 and beyond. Xeneta currently puts the Asia-West Coast spot rate at just under $10,000 per FEU, with some cargoes paying additional priority shipment fees of $1,400-$7,500. By October, it was up to $6,000-$6,500 per FEU.

Let's personalize your content