The Impending Ocean Carrier War on Last Mile Fulfillment

Freightos

NOVEMBER 11, 2021

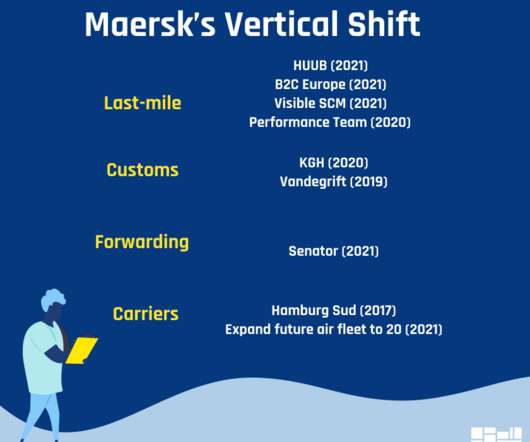

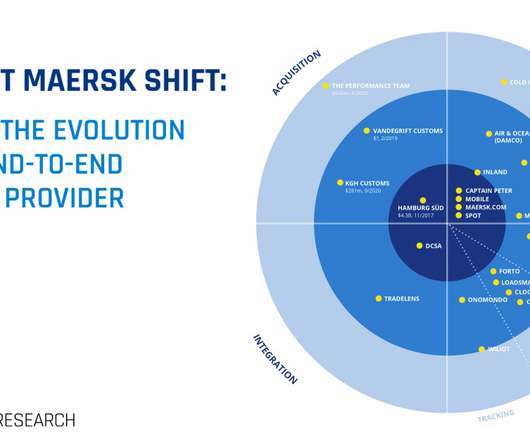

For a forwarder, refraining from working with Maersk today is expensive because it removes 17% of global shipping capacity. B2C Europe is operationally present in four key European E-commerce countries (Netherlands, France, United Kingdom, and Spain), and has offices in China. Enter Big Tech. But what does this mean for shippers?

Let's personalize your content