The global economy has gone through an incredibly tumultuous time since 2020. From lockdown-induced purchasing highs, soaring logistics costs and supply chain snarls to waning demand, soaring inflation, and fears of recession – there has never been a dull moment.

The sheer influx in demand, combined with the variety of supply chain stressors, also catapulted global freight to new levels of infamy (although none perhaps as famous as the Suez Canal blockage). The role logistics costs have played in increased or decreasing inflation is now more relevant than ever.

This deserves more exploration.

Historically, ocean container costs have been so low that for many commodities, they only account for a fraction of the cost of goods sold. However, the sheer scope of price increases – and ensuing decrease – changed that dynamic. More than 80% of goods – by volume – are moved by ocean freight globally, so shipping costs directly impact the price level of imported goods. These same goods account for about 20% of the items measured in the Consumer Price Index, or CPI. So, at least in the United States, with roughly half of those consumer goods being imported, ocean logistics costs had a significant impact on inflation

Freight rates as a forward looking indicator of CPI

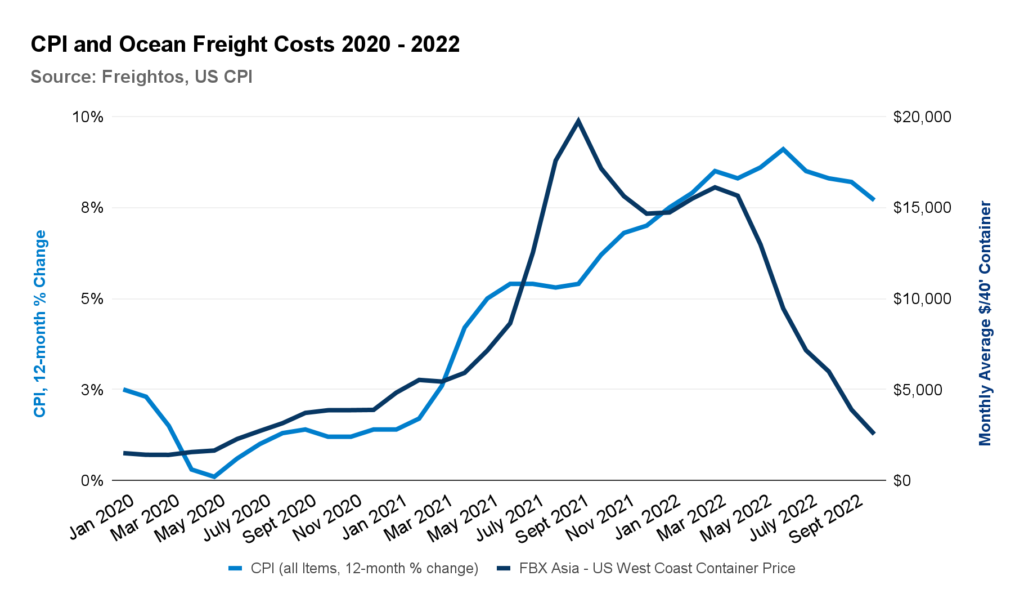

Let’s start by taking a look at global ocean freight prices. The Freightos Baltic Index (FBX), our global container index based off of actual market rates for 40’ containers, shows the tale of increasing prices.

After fairly stable pricing in the early months of COVID’s supply chain journey, the indicative spot rate to ship a forty foot container from China and East Asia to the US West Coast increased 14X from less than $1,500 per container pre-COVID to more than $20,000 in September 2021. Between May and September of 2021 alone rates tripled.

Sources: U.S. Bureau of Labor Statistics, Consumer Price Index; Freightos Baltic Index.

Rates remained about 10X higher than pre-COVID through April of 2022, leading most importers to pass on at least some of those increased costs to consumers in the form of higher prices. By June of this year, the CPI was increasing at an annual rate of 9%, or 4.5X the Fed’s 2% per annum target, with the rate of inflation nearly doubling from September 2021 to June 2022 following the freight rate peak.

What impact could these increases (and later decline) have had on consumer prices and inflation? Well, an analysis of US import container volumes1 as a share of consumer spending2 in 2021 and 2022 to date implies that every $1,000 in ocean freight costs per forty-foot container accounts for 0.09% of personal consumption expenditures each year.

In other words, each additional $1,000 per container costs could represent almost 0.09% increase in costs to consumers, also accounting for a 0.09 percentage point increase in the CPI rate.

The Inflation Ramifications of from record high freight rates – October 2021

For example, when ocean costs spiked from May to September 2021, rates from Asia to the US climbed by more than $14,000 per container.

Taking smaller increases in transatlantic and in long term contract rates (under which about half of volumes are shipped) for container imports into account as well, monthly ocean logistics costs in October 2021 increased by an estimated $6.7B compared to a year earlier, representing nearly 0.5% of total personal consumption expenditures that month, implying am ocean cost contribution of half a percentage point to the CPI rate of 6.2%.

One important note: this analysis takes contract rates into account, but in actuality as demand surged many carriers did not honor long term contract rates, and shippers with contracts had to pay thousands of dollars in premium surcharges on top of their contract rates in order to actually ship their containers.

So assuming all contracted volumes also shipped at about spot rate levels, the total increase in October 2021 could have reached as high as $12B or 0.87% of personal expenditures that month – so the actual increase in ocean costs likely represented somewhere between 0.5% and 0.87% of consumer spending and between 0.5 to 0.87 of a percentage point of the 6.2% CPI rate in October 2021.

What Goes Up Must Go Down – October 2022

And falling rates this year should similarly account for some easing of inflationary pressure.

Asia – US West Coast container rates decreased by $13,000 or more than 80% from early May through October, and Asia – US East Coast rates fell by $11,000 per container while by October the CPI fell more than 10% or 1.4 percentage points from its 9% June peak.

This significant container rate drop would account for a more than $3.6B decrease in monthly logistics costs in October 2022 compared to October 2021, representing 0.25% of monthly consumer expenditures.

These savings would also approximate about 0.25 a percentage point decrease in the rate of inflation meaning prices in October would have been about 8% higher than a year earlier instead of the actual 7.7% increase in CPI if not for savings from falling freight costs.

This analysis likewise takes contract rates into account too, but in actuality as demand dropped many shippers were able to renegotiate and reduce their contract rates closer to the spot market level.

Assuming those contracted volumes also shipped at about spot rate levels, the total ocean costs savings in October 2022 could have totalled $9.9B or 0.68% of monthly personal expenditures – so the actual savings from falling ocean costs likely represented somewhere between 0.25% and 0.68% of consumer spending and between 0.25 and 0.68 of a percentage point easing of pressure on the rate of inflation.

Some of the easing of the inflation in recent months, then, is likely already attributable to declining logistics costs. But as inflation rate increases lagged ocean rate increases by several months in late 2021 falling ocean rates may likewise take some time to be felt fully in inflation measures.

And just as it took some time for increased logistics costs to be felt fully by the consumer, the decrease in costs will likely also take some time to impact inflation fully, especially as the unexpected buildups in retail inventories carry not only the higher ocean costs with which they were imported earlier in the year, but higher inventory costs as well.

1 Import volumes based on Descartes Datamyne data.

2 Consumer spending data based on quarterly personal consumption expenditures as measured by the U.S. Bureau of Economics as part of annual GDP.