Today, we published The Supply Chains to Admire for 2023.

Congratulations to the 34 winners. (For a more detailed analysis, check out the Power point summary.)

The companies that outperformed industry sector performance while driving improvement and sustaining value are: Apple, Assa Abloy AB, BorgWarner, CCL Industries, Celanese, Cummins Engine, CF Industry, Decker Outdoors, Gilead Sciences, Intuitive Surgical, Hubble, Huntington Ingalls Industries, Leggett & Platt, Lockheed Martin Corporation, LyondellBasell, Koninklijke Ahold Delhaize NV (Ahold), Monster Beverages, Nike Inc., Nvidia, Northrup Grumman, PACCAR Inc, PCA (Packaging Corporation of America), ResMed, Rockwell Automation, Ross Stores, Taiwan Semiconductor Manufacturing (TSMC) Company, Tempur-Pedic, TJX, Toro, Toyota, West Pharma, United Tractors, and Urban Outfitters.

The companies with the strongest year-over-year performance (placing in the winner’s circle for six more times in ten years) are Apple, L’Oreal, Nike, Paccar, TJX, and TSMC.

Figure 1. Supply Chains to Admire Winners 2023

Examine Your Own Paradigm. How Do You Define Excellence?

Humility exudes from my fingers as I type this post. Most supply chain leaders are stuck in their own paradigms. I admit it. Lora was as well.

As an old gal, with over forty-years of supply chain experience, writing this report for ten years taught me many lessons. Simply put, I do not know what I do not know. I never questioned the status quo enough.

Lora was stuck in a paradigm fed to her for twenty years by technologists that supply chain planning improves balance sheet improvement. And, that the same techniques used in planning for a regional company could work for a global multi-national. In retrospect, I find that technology is an enabler, but only if we are clear on what defines supply chain excellence. Most companies are not clear.

The industry struggles with groupthink. Many believe that an ex-supply chain exec knows the definition of supply chain excellence. The industry is awash with ex-execs advising companies, speaking at events, and consulting. Please use caution, few led a Supply Chain to Admire Award Winner.

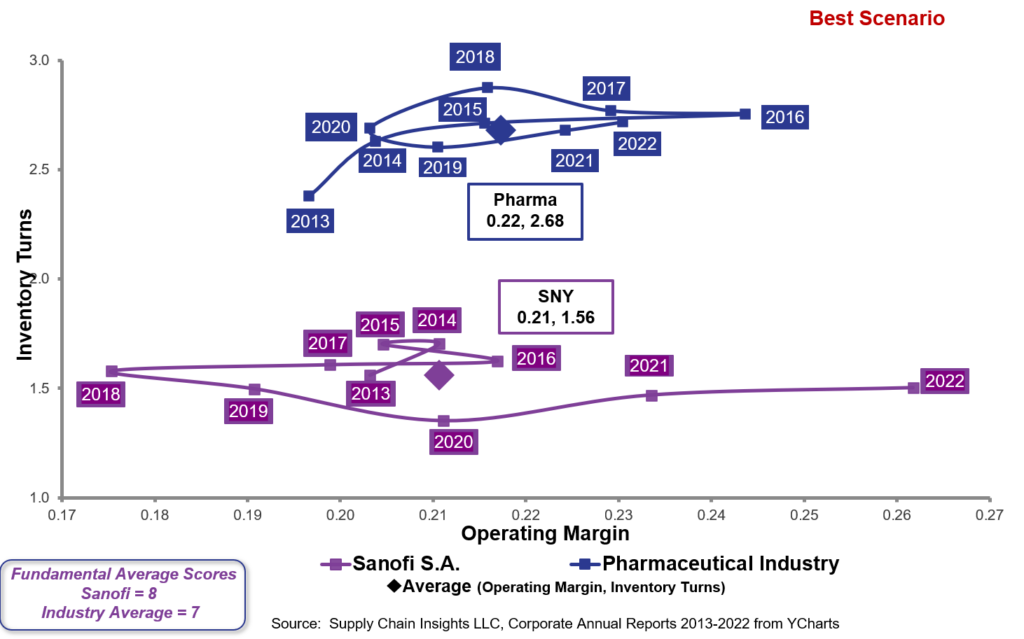

I find in the orbit chart analysis that 45% of companies in the report are unconsciously incompetent. They are unconscious that they are underperforming their peer group and have not driven industry improvement. Struggling, they are not sure what to do next. For example, in Figure A, we share on orbit chart on how Sanofi is underperforming the industry. An average margin of 21% with inventory turns of 1.58 show a clear gap in performance. However, the key part of this comparison is the fact that Sanofi never drove improvement. Yet, you will find the past executives from Sanofi speak openly on event stages about their journey on supply chain excellence as winning performance. (Please do not see this as a slam on ex-Sanofi execs. The issue is ubiquitous. The industry assumes that since the person led a supply chain that they are clear on the definition of supply chain excellence. Challenge this paradigm.)

Figure A. Sanofi Performance Versus Peer Group for 2013-2022

Similarly, I find 35% of companies following the pack not able to drive resilience in the face of market shifts. Eleven out of twenty-eight sectors do not have winners. In these sectors, companies are following traditional processes not questioning the outcomes.

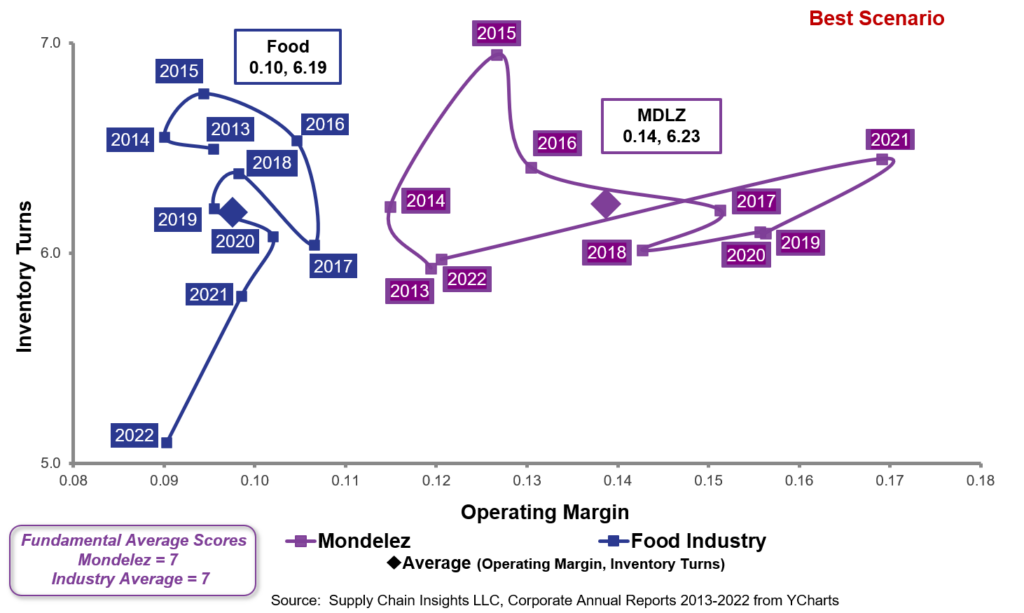

For example, while the University of Tennessee features the story of Mondelez as a journey in supply chain excellence, and features Daniel Myers, past Supply Chain Leader, as a lecturer, I do not see Mondelez as a Supply Chain to Admire. As shown in Figure B, the company improved cash-to-cash through the extension of payables, but never improved inventory levels after the spin-off from Kraft. As shown in Figure B, the Company outperforms their peer group but lacks resilience. The performance in 2022 is almost the same as that in 2013 (note the circular pattern).

Figure B: Orbit Chart Performance of Mondelez Versus Peer Group

What I Learned

I am always glad to see this report publish. Here, I share my insights:

- Companies Struggle with the Definition of Supply Chain. When I share the insights from the Supply Chains to Admire with companies, sometimes the first response centers on the balanced scorecard. The group’s response is, “Are these supply chain metrics?” For many stuck in the myriad of functional metrics, like Operational Efficiency (OEE), Purchase Price Variance (PPV), or transportation cost, a focus on growth, operating margin, inventory turns, and Return on Invested Capital (ROIC) is a stretch. The sad reality is that is a focus on functional metrics throws the supply chain out-of-balance reducing balance sheet performance. Similarly, a focus on cost of goods seldom translates to improved operating margin.

- There Is No Perfect Measurement System. While I believe that customer service and ESG should be included in the balanced scorecard, I cannot find a set of data across industries good enough to drive this comparison. Only Apple and L’Oreal make both the Supply Chains to Admire and the Gartner Top 25. I encourage all to spend the time to understand these two very different methodologies. Make your own choice but clarify the goals for the organization.

- The Winning Companies Are a Surprise for Me. The winning companies are not the ones that I would have picked without doing the analysis. They are not the companies touting supply chain excellence, and constantly working the analyst groups for PR to write their stories. Most will be surprised when I share the data. The reason? The winning companies are heads down. The focus is on internal teamwork to drive balance sheets. You will seldom see them on an event stage. The group is pragmatic. As a result, they will not be in the market touting new initiatives. They may not be the best at supply chain planning, but they drive great S&OP processes.

- Outperformers Focus on Customer-centric Innovation. Intuitive Surgical, Monster Beverages, and Urban Outfitters defined new models through customer-centric innovation. This focus aligns the organization and reduces political internal strife.

- Not as Simple as a Triangle. I used to think that supply chain performance could be defined by the trade-offs between customer service, cost and inventory strategies. This perspective is overly simplistic and dangerous. Typically, the inventory values used in the triangle are safety stock. Unfortunately, safety stock is usually less than 20% of total inventory, cost seldom translates to margin, and there is no place in existing systems to execute customer service rules. Bottomline, this simplistic view is just not sufficient. be careful.

- Sustained Performance Is Difficult. Over the past ten years of analysis, ninety-five companies made it to the winner’s circle. Only twenty percent made it for four or more years. Outperforming is hard and requires consistent leadership to balance the scorecard. Executive changes, new projects, M&A, and market shifts can easily throw the supply chain out of balance.

- Groupthink. Groupthink in the industry is pervasive. There is no winner in 11 out of 28 Sectors. Within these peer groups, businesses follow the herd believing that historic practices are best processes or listening to an ex-supply chain executive’s story without vetting the leadership performance.

Wrap-up

Spend time with the report. Question your own paradigms. There is no silver bullet. Use the methodology in the report to build orbit charts of your divisions, product lines, and regions. Gain an understanding in your company of improvement, performance, value, and resilience. Use what makes sense. Throw away the rest.

Be patient. Supply chain improvement takes three-to-four years. Sustained improvement requires consistent leadership and direction. After you build the orbit charts, your first step is to align to a balanced scorecard. Use the information in the report to set performance targets.

Lastly, I want to share a story. I believe that the journey for supply chain excellence is analogous to physical fitness. When I started to work out in my 50s, the effort drove quick improvement. The work in the gym helped me reverse osteoporosis. I was excited to see early results of the effort.

However, sustaining improvement with an aging body, twenty years later, is work. I show up in the gym four days a week even though I do not want to. I walk my dog two miles a night in the rain and snow. I have a trainer that forces me to stay the course. I cross-train with ballet, weightlifting, running, pickleball, swimming, and spinning. I focus on blood pressure, weight, and stamina. However, if you see me speak on a stage, you will never view me as an athlete. I constantly fight weight. I lost twenty-five pounds during the pandemic, and I have twenty more to lose. I must continually push my body to establish my own potential. When I feel down and question my journey, I pull up old pictures.

So, in closing, let’s use the analogy. Start by understanding your supply chain’s potential. Consistency is a major part of the battle. Sustaining the journey is not easy. Avoid fads and stay the course. Results happen slowly. Use the orbit charts to help your executives understand the journey.