One of my supply chain and logistics predictions for 2015 was that 3PLs and software vendors would focus more on acquiring small and midsized business (SMB) clients this year. As I wrote back in December:

For a variety of reasons (the high cost of sales being one of them), most 3PLs and software vendors have historically underserved the SMB market, focusing their sales efforts on large companies instead. But as the top end of the market becomes more saturated and competitive — and as new competitors emerge with hybrid business models, offering customers more flexible, faster-to-deploy, and more cost-effective solutions — the race is on to win market share in the SMB market, and to do so profitably.

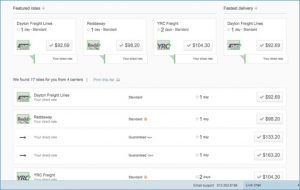

Transportation management system (TMS) vendors have been in that race for some time, and earlier this week, C.H. Robinson (a Talking Logistics sponsor) picked up the pace for the field by introducing Freightview®, “a neutral, cloud-based transportation management system (TMS) software platform which cuts the time and money small and midsized businesses (SMBs) spend on freight shipping by streamlining quoting, booking, tracking, and reporting.” Here are some additional details from the press release:

Freightview was created to provide an innovative and valuable communication tool to SMBs who remain underserved by the TMS software market and use multiple less than truckload (LTL) transportation service providers.

Through an intuitive three-step startup process, Freightview allows a shipper to be completely setup with the system in 24-48 hours. Freightview facilitates automated communication between a shipper and their service provider utilizing a patent pending Application Program Interface (API) workflow process. API eliminates the need to connect electronically with carriers through the intensive and drawn out Electronic Data Interchange (EDI) process.

To aid in the sales process, Freightview can easily integrate into a shipper’s website and sales applications to provide shipping rates on internet purchases or incorporate freight quotes into sales bids. New Freightview users are afforded a free 30-day trial period, followed by a standard $99 per location monthly fee.

I was given a demo of Freightview a few weeks ago and my immediate takeaway was that it brings the TMS industry a step closer to Software-as-a-Self-Service, a concept I put forward more than five years ago as online app stores and marketplaces (such as Apple’s App Store, Google Play, Amazon’s Appstore for Android, and Salesforce.com’s AppExchange) started to take off. What I envisioned back then was the ability for a shipper to visit a website, enter their credit card information, go through a setup wizard, and within an hour or two be up and running with a TMS. If done right, this self-service approach would enable solution providers to reach, in a more scalable and cost-effective manner, all of those SMB companies currently using spreadsheets and fax machines to manage their transportation operations.

As I wrote back in April 2010, the success of Software-as-a-Self-Service is dependent on several factors, including:

- A vendor’s ability to significantly reduce cost-of-sales. Using social media for lead generation and credit cards/PayPal for payment are some approaches.

- Having a solution that is simple to activate, configure, and use. This may require vendors to re-architect their solutions. Using online videos for training and live chat for support services will also be required.

- The solution has to deliver value. Sounds obvious, but in their quest to make a solution that is simple to download and configure, a vendor may end up with a solution that is relatively useless.

- The business model has to be profitable. This one is linked to the first point, and since price points are relatively low, making money means bringing thousands and thousands of customers on board as quickly as possible.

Getting set up on Freightview is relatively quick and intuitive, aided by its patent-pending API workflow processes that significantly automates the uploading of contract rates from LTL carriers and other on-boarding activities. There is very minimal effort required by the shipper to get started, and when they visit the signup page, a live chat box appears to assist them with any questions. The application’s user interface is also very intuitive and easy to use and configure, with a look-and-feel similar to consumer apps and websites. Couple all that with a free first month and a very low $99 per location monthly fee, it’s easy to see why Freightview approaches my vision of a Software-as-a-Self-Service TMS.

The biggest challenge for C.H. Robinson is lead generation and reaching a critical mass of Freightview customers. As noted above, for this business model to be profitable and sustainable, Freightview has to go from hundreds of customers to thousands of customers in a reasonable time frame — and ideally grow over time to hundreds of thousands of customers. The company will have to leverage social media, partnerships, and other creative, non-traditional channels to get there, as well as opportunities that emerge from its brokerage, TMC, and Freightquote operations.

The other challenge is that many SMBs don’t believe they need a TMS — that is, as long as they are getting shipments out the door each day using faxes and spreadsheets and telephone calls to manage their transportation operations, or visiting multiple carrier websites to rate and execute shipments, they don’t see a problem — or more accurately, they don’t see the money they’re leaving on the table by not operating more efficiently using a TMS. Many of Freightview’s early customers fell into this category, but once they started using the solution and realizing its benefits, they couldn’t imagine going back to their old ways of doing things. The free 30-day trial period aims to address this challenge, but is it enough to entice small and midsized businesses to overcome their inertia and make a change?

C.H. Robinson’s announcement raised some other questions and ideas for me:

What defines the SMB market? Many of us (myself included) tend to think of small and midsized businesses as a homogenous market segment, but in reality, it’s a very diverse group of companies. Small businesses (whether you define them by revenues, freight spend, or shipment volume) are often very different than midsized businesses, yet many solution providers approach this market with a one-size-fits-all SMB solution. Maybe we need to stop lumping small and midsized businesses together and instead make the effort to better understand and address their unique needs and characteristics separately.

What defines a TMS for the SMB market? Or better yet, per my point above, what defines a TMS for small companies and what defines a TMS for midsized businesses? And while we’re at it, how do you define a transportation management system today? The reality is that TMS is not a homogenous market segment either — a very diverse set of applications fall under this umbrella today, some with very broad capabilities and others with more targeted and specialized functions, such as the Freightview solution with its focus on streamlining “quoting, booking, tracking, and reporting” for LTL shippers.

I plan to explore those questions further in future posts, so stay tuned. In the meantime, what are your thoughts on TMS in the SMB market and the evolution toward Software-as-a-Self-Service? Post a comment and share your perspective!