Prices surged in the major van markets last week, despite the fact that the national average van rate dipped 1¢ per mile. The annual Roadcheck inspection blitz also happened last week, and rates have risen in the past during Roadcheck week. A lot of truckers prefer to take those days off, and others lost time because of the inspections.

Retail freight is driving rates up in Memphis and Columbus, especially on lanes heading into the Northeast. Prices are still strong in Stockton, CA, and Los Angeles, while Chicago continues to improve. Atlanta and Houston are still the top two markets for outbound loads on DAT Load Boards.

Reefer freight is also looking up, but geographic shifts are underway. Harvests have slowed in Florida, and rates continued to drop on the lanes heading out of Lakeland and Miami. Things are heating up in California, with lots of loads rolling out of Fresno, and a big rebound under way in Sacramento.

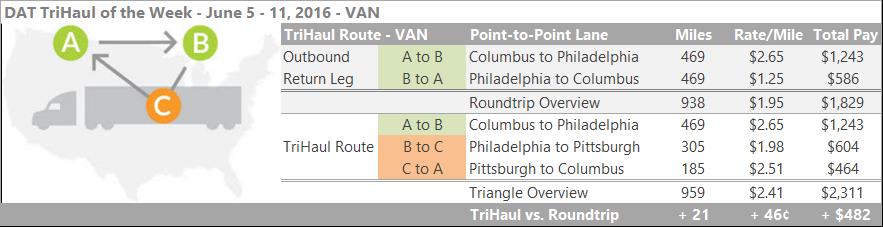

Columbus is heating up, and loads from there to Philadelphia paid $2.65/mile last week. Unfortunately, the backhaul only paid $1.25/mile. You can get back to Ohio with more money in your pocket by putting together a TriHaul (triangular) route.

From Philly, find a load to Pittsburgh. That lane paid an average of $1.98/mile last week. From there, Pittsburgh to Columbus is a relatively short trip that paid $2.51/mile. If you can make it work with your hours of service, the TriHaul would pay $482 more than the roundtrip, with only 20 additional loaded miles.

Daily maps, along with detailed information on demand, capacity and rates for individual markets and lanes, can be found in the DAT Power load board. Rates are derived from actual rate agreements and contracts, as reported in DAT RateView.