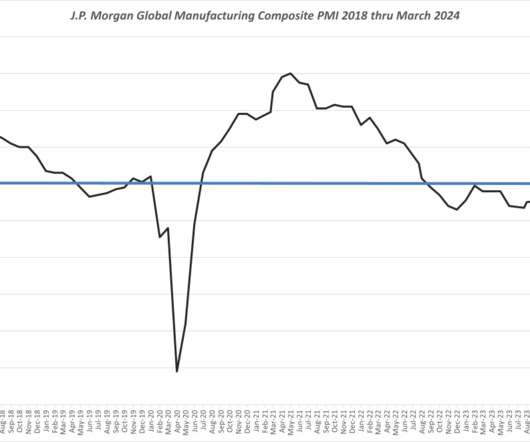

Global Wide Manufacturing Output Strengthens in March 2024

Supply Chain Matters

APRIL 5, 2024

India has again demonstrated the highest level of PMI growth and the report authors point to Greece, Indonesia, Russia and Brazil as demonstrating stronger rates of expansion. Observed was that manufacturing conditions across Greece have improved to the sharpest extent in two years. along with Vietnam, Thailand and Indonesia.

Let's personalize your content