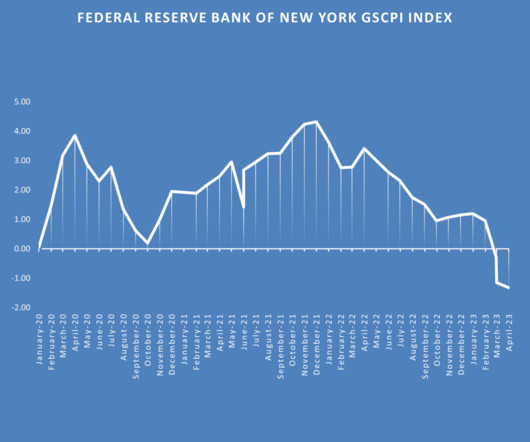

Continued Disruption and Added Cost Inflation Reflected in Key Global Transportation and Logistics Indices in March and Q1 2022

Supply Chain Matters

APRIL 7, 2022

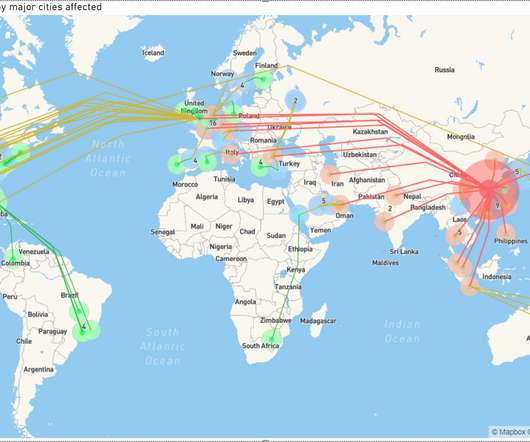

We now add highlights of March and Q1-2022 key global transportation and logistics indices. Global and Domestic Transportation and Logistics Indices. For the specific routing of Shanghai to New York , the index was $11, 531, reflecting a six percent decline. . Global Shipping. Shipping Transit Timeliness.

Let's personalize your content