Today we’re excited to announce that (drumroll…) Freightos is going public! The official announcement is here. This is an exciting milestone that accelerates our vision of a digital platform that modernizes international freight and improves global trade.

First, some background.

I started Freightos a decade ago, in 2012. Why? Because I believe that world trade is important. Really important. I can walk into a local shop and purchase products from all around the globe.

This isn’t just about consumerism; it’s inspiring to think that in purchasing an imported product, we are, in a tiny way, helping provide employment for people across our planet, often in developing countries. World trade is an important part of how the modern world functions, both in terms of consumer choice, and job creation.

I also believe that trade supports peace. The evidence shows that when countries trade with each other, they are less likely to war with each other. Trade cannot guarantee peace, but it certainly contributes. It increases interaction and understanding between different nations, and creates an economic incentive for maintaining peaceful relations. It is no coincidence that world trade has ballooned in the 75+ years since WWII. It’s worth remembering that despite tragic events we’re seeing in the headlines, overall these were the most peaceful 75 years in history.

But it doesn’t always work

World trade is built on a foundation of global shipping. And while outsiders might assume that it operates like a Swiss clock, the foundations are surprisingly rickety.

In the two years prior to starting Freightos, I witnessed, as CEO of a company called Lightech, how international shipping is offline, opaque and inefficient, adding cost and uncertainty to cross-border trade. We paid the price for inefficient shipping, both in direct costs, and the cost of maintaining buffer inventory to cover for all the unpredictability. We passed this cost on to the lighting fixture manufacturers, who no doubt passed on these costs to the consumers.

While passenger travel was going digital, the more complex “travel” of goods remained offline with multiple layers of intermediaries communicating manually. 90% of goods are imported and each imported product bears what you could call an offline shipping tax. If ever there was an industry in need of a digital revolution, it is international shipping, whether by ocean, air or land.

Enter Freightos

This inspired me to found Freightos, as a “booking.com” for the travel of goods.

In retrospect I’m pleased that I was blissfully ignorant of the fact that it would take so many years for even a single cargo airline, or container ocean liner, to provide an API (that is digital computer to computer connection) for instant rates, capacity, and electronic bookings.

I assumed, after all, that freight carriers would publish APIs simply because they wanted to fill their vessels efficiently. If you have a service to sell, you want to make it as easy as you can for customers to get a quote and place a booking.

However, back then, many carriers were traditional companies who preferred IPAs to APIs.

Between 2012 and 2019 we made the most of what we had. We ingested tens of thousands of Excel sheets with static carrier rates into a database and built sophisticated technology to automate routing and pricing. We helped thousands of freight forwarders automate quoting and thousands of importers and exporters to receive quotes and book online.

But it was all based on static carrier rates.

The Carrier Digital Revolution

Since around 2019, carriers – first airlines and now also ocean liners – have started to provide APIs for instant price quoting, capacity availability, booking and tracking. As expected, this is making their pricing more dynamic, their bookings more efficient, and eliminating various back office costs and errors. As a platform already used by thousands of forwarders and importers, Freightos, specifically WebCargo by Freightos, was a natural partner for the airlines. For Freightos, carrier APIs were the missing piece of infrastructure that allowed us to start fully delivering on our vision of a digital freight experience with transparent pricing and predictability.

This unleashed hyper growth of bookings bought and sold by third parties via the Freightos Platform, which includes WebCargo and freightos.com. I have shown this graph before without actual numbers. Now that we’re going public, we will be more transparent about our growth with specific values. Here is our gross bookings value (GBV), which has grown at a compound annual growth rate of over 200%!

This “hockey stick” is not some rosy future prediction. This is our actual growth and a textbook example of the marketplace flywheel where sellers attract buyers and buyers attract sellers. To be sure, we still have a long way to go to fully digitalize a very large industry. But it’s thrilling to see that the process now has seemingly unstoppable momentum, with new forwarders and importers/exporters joining every single day, and new carriers joining every month.

But we’re just getting started…

Now that we have achieved predictable growth momentum, and given that the world’s supply chains are creaking at the edges, and need digitalization more than ever, it seems like a highly opportune time for Freightos to go public.

We have very clear drivers for going public, despite unfavorable market conditions (to say the least). The first is that we embrace transparency. Platforms for pricing and booking are key for any industry. We believe that being a public company will help the carriers, forwarders, and importers achieve heightened visibility into our strategy and operations, reinforcing confidence in our platform.

Going public also provides access to public market capital that will allow us to further scale. Scaling includes more research and development, expanded sales and marketing, and entering new adjacent segments of the market by building or acquiring. The past few years have thrust supply chain issues into the general news headlines; I am confident public markets will share our enthusiasm for a vendor-agnostic, international freight platform.

Why go public via a SPAC?

We chose the SPAC route because an IPO will often attract short-term investors, looking for a quick IPO pop. Now whilst some SPACs also have issues with capital that is redeemed at closing or sold on the market shortly after, we believe Gesher I offers a very different proposition. Ezra Gardner and the team have come to the table with some outstanding long-term investors led by M&G Investments, the UK-based half-a-trillion dollar asset manager. Represented by Carl Vine, M&G has taken a long time to get to know Freightos deeply and has spent time with the Freightos team in Jerusalem. This is the kind of investor we need.

At the same time one of our key strategic airline partners, Qatar Airways, is doubling down and investing in the transaction too. We are pleased to have other airlines as shareholders as well, whilst we value all our airline partners whether shareholders or not.

The clearest indication of the nature of this deal is the extended lock-up periods agreed by the SPAC sponsors, key new and existing investors, and the team, beyond those of a typical IPO or SPAC. These key investors are not taking money out as part of this transaction. We are not exiting – we’re building. Our vision of digitalizing freight and improving world trade will take some years more, but going public will help to accelerate growth and attract new partners on our journey. This is an important milestone along our journey. It is not a destination.

The people who made this possible

Reaching this milestone required a lot of hard work and skill, as well as some good luck. I want to share a heartfelt thanks to our stakeholders for their support so far, and to appeal for their ongoing support as we continue our journey.

First and foremost, our 330 employees around the world, plus former employees (sorry this pic is a little dated due to COVID).

I am fortunate to be part of such a talented, dedicated team, especially a uniquely diverse team that collaborates seamlessly across cultures. Our employees receive competing job offers regularly, and choose to stay in the Freightos Group. Thank you for choosing Freightos as the place where you bring your energy and talent each day, and where you choose to develop your careers. Thank you for all working together to create an atmosphere of professionalism, respect and trust in each other and in our common goal. Thanks also to those who came to Freightos through acquisition, but picked up the Freightos flag and stayed as part of an expanded team. I am proud to be part of such an outstanding team.

Thanks to our investors led by Aleph, More VC, Annox Capital, Qatar Airways, SGX, FedEx, MSR, OurCrowd, Sadara, Portline, Master Toys, and Gold Lion Ventures, for their support and patience. Thank you for understanding that this is a challenge that requires time and capital and for sticking with us for the long run. In 10+ years at Freightos, our board never had a split vote. Not that there’s anything wrong with a split vote, but the unanimous decisions are testament to the fact that we are all pulling in the same direction. We will need your support and patience going forward. And we look forward to welcoming new investors in the public markets and hope that most of them will sign up for the long-term journey.

And to our customers…

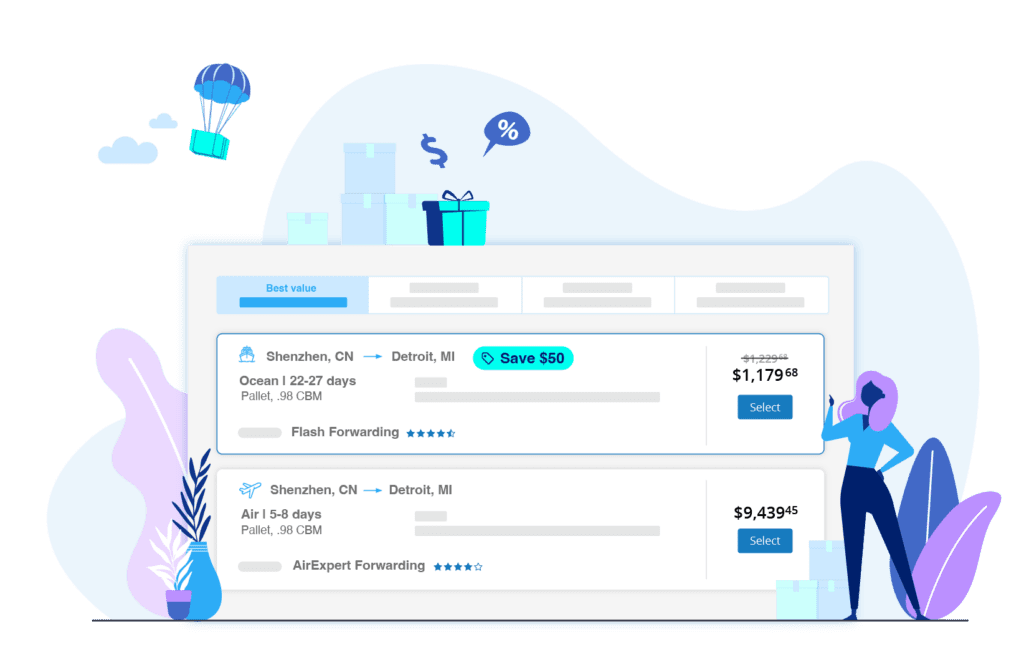

Our 3,500+ freight forwarding customers across 10,000+ branches are central to our business. Thank you for trusting Freightos and WebCargo technology for your own rate management, pricing and quoting needs, for your procurement from carriers, and thanks to those who chose freightos.com as a marketing channel for the critical logistics services that you offer. Thank you to the airlines, ocean liners and LTL trucker carriers who trust Freightos as a platform for connecting with existing customers and for sourcing new customers.

And finally thanks to the importers and exporters, big and small, who use Freightos to procure freight services in a more modern, automated and transparent manner. I’ve been there myself. I feel the pain you experience every day when you buy freight services and don’t actually know when your goods will arrive or how much you will pay. We have started to show you a more modern way to buy freight services. But the best is yet to come, as we work to create digital connections between you and more and more service providers to bring you better transparency, predictability, efficiency, and visibility.

To our team, investors, customers and partners, I believe you will find that this transaction makes Freightos better by allowing us to be more transparent and to be financed for even faster growth.

On a personal level, I’ve had varied experiences as an entrepreneur, but never before had the opportunity to build the same business for 10 years and all the way to going public. I want to take this opportunity to thank my wife Rina and my family for their unwavering love and support.

We’re only leaving port now

Our job of digitalizing freight has a long way to go. I am determined that the focus on quarterly financial results, while critical, will not distract us from continuing to make the right long term strategic decisions. Freightos going public is certainly not the end of the process of digitalizing of international freight. To paraphrase Churchill, it is not even the beginning of the end. But it is, perhaps, the end of the beginning.

You can learn more about Gesher I by visiting their website and please join our investor relations distribution list here.

Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Freightos Limited’s (“Freightos”) and Gesher I Acquisition Corp.’s (“Gesher”) management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Freightos and Gesher. These forward-looking statements are subject to a number of risks and uncertainties, including the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed business combination; the outcome of any legal proceedings that may be instituted against Freightos or Gesher, the combined company or others following the announcement of the proposed business combination; the inability to complete the proposed business combination due to the failure to obtain approval of the shareholders of Freightos or Gesher or to satisfy other conditions to closing; changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed business combination; the ability to meet stock exchange listing standards following the consummation of the proposed business combination; the risk that the proposed business combination disrupts current plans and operations of Freightos as a result of the announcement and consummation of the proposed business combination; the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition and the ability of the combined company to build and maintain relationships with carriers, freight forwarders and importers/exporters and retain its management and key employees; costs related to the proposed business combination; changes in applicable laws or regulations; Freightos’ estimates of expenses and underlying assumptions with respect to shareholder redemptions and purchase price and other adjustments; any downturn or volatility in economic conditions; the effects of COVID-19 or other pandemics or epidemics; changes in the competitive environment affecting Freightos or its users, including Freightos’s inability to introduce new products or technologies; risks to Freightos’s ability to protect its intellectual property and avoid infringement by others, or claims of infringement against Freightos; the possibility that Freightos or Gesher may be adversely affected by other economic, business and/or competitive factors; Freightos’ estimates of its financial performance; risks related to the fact that Freightos is incorporated in the Cayman Islands and governed by the laws of the Cayman Islands; and those factors discussed in Gesher’s final prospectus dated October 12, 2021 [and Quarterly Report on Form 10-Q for the quarter ended March 31, 2022], in each case, under the heading “Risk Factors,” and other documents of Gesher filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Freightos nor Gesher presently know or that Freightos and Gesher currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Freightos’ and Gesher’s expectations, plans or forecasts of future events and views as of the date of this communication. Freightos and Gesher anticipate that subsequent events and developments will cause Freightos’ and Gesher’s assessments to change. However, while Freightos and Gesher may elect to update these forward-looking statements at some point in the future, Freightos and Gesher specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Freightos’ and Gesher’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Important Information About the Proposed Transaction and Where to Find It

The proposed business combination will be submitted to shareholders of Gesher for their consideration. Freightos intends to file a registration statement on Form F-4 (the “Registration Statement”) with the United States Securities and Exchange Commission (the “SEC”) which will include preliminary and definitive proxy statements to be distributed to Gesher’s shareholders in connection with Gesher’s solicitation for proxies for the vote by Gesher’s shareholders in connection with the proposed business combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Gesher’s shareholders in connection with the completion of the proposed business combination. After the Registration Statement has been filed and declared effective, Gesher will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed business combination. GESHER’S SHAREHOLDERS AND OTHER INTERESTED PERSONS ARE URGED TO READ, ONCE AVAILABLE, THE REGISTRATION STATEMENT, THE PRELIMINARY PROXY STATEMENT / PROSPECTUS AND ANY AMENDMENTS THERETO AND, ONCE AVAILABLE, THE DEFINITIVE PROXY STATEMENT / PROSPECTUS, IN CONNECTION WITH GESHER’S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF SHAREHOLDERS TO BE HELD TO APPROVE, AMONG OTHER THINGS, THE PROPOSED BUSINESS COMBINATION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT GESHER, FREIGHTOS AND THE PROPOSED BUSINESS COMBINATION.

Shareholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the proposed business combination and other documents filed with the SEC by Gesher, without charge, at the SEC’s website located at www.sec.gov or by directing a request to Gesher I Acquisition Corp., Hagag Towers, North Tower, Floor 24, Haarba 28, Tel Aviv, Israel.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE PROPOSED TRANSACTION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in Solicitation

Gesher, Freightos and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from Gesher’s shareholders in connection with the proposed business combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Gesher’s shareholders in connection with the proposed business combination will be set forth in the Registration Statement when it is filed with the SEC. You can find more information about Gesher’s directors and executive officers in Gesher’s final prospectus dated October 12, 2021. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will be included in the Registration Statement when it becomes available. Shareholders, potential investors and other interested persons should read the Registration Statement and other relevant materials to be filed with the SEC regarding the proposed business combination carefully when they become available before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

- Implement new features to the existing projects, using PHP, HTML/CSS, JavaScript, MySQL …

- Maintain the web application (refactoring, improving performance, fixing issues, migrating code to new solutions)

- Refactor the software to meet modern standards: SOLID, DDD, Hexagonal Architecture, Unit Test, etc…

- Work on code optimization.

- Work in a cross-functional agile team