Onfleet, provider of a last-mile route optimization platform for grocers, restaurants, food service and pharmacies, has raised $23 million in a Series B round to hire engineers, enhance its platform and expand into retail and enterprise accounts while looking to create a European presence in 2023.

The new round was led by Kayne Partners, with participation from existing investor Savant Growth, bringing the total raised to over $40 million. Kayne Partner’s Robert Shilton will join Onfleet’s board of directors.

The company, founded in 2015, has experienced significant growth since the pandemic took hold, said co-founder and CEO Khaled Naim. He said demand for its same-day/last-mile services is being driven by increasing ecommerce sales and companies looking to diversify their delivery portfolios.

Naim said the bulk of Onfleet’s customer base is in grocery, pharmacy, food, alcohol and cannabis, but it’s seeing more traction in retail and ecommerce. One focus of the new funding is to grow its enterprise accounts, like Kroger and Zumiez. Other named clients are Total Wine & More, EQ3 and United Supermarkets. The company also partners with provider networks like recent UPS acquisition Delivery Solutions, which routes orders from its clients with private fleets through Onfleet.

“(Retail and ecommerce) is a category that has seen a lot of growth for us,” Naim said. “There are a lot of supply chain issues and labor shortages that have led companies that traditionally relied on UPS or FedEx to explore other options. Whether they build their own capability for same day or work with local providers, we can help them do both of those.”

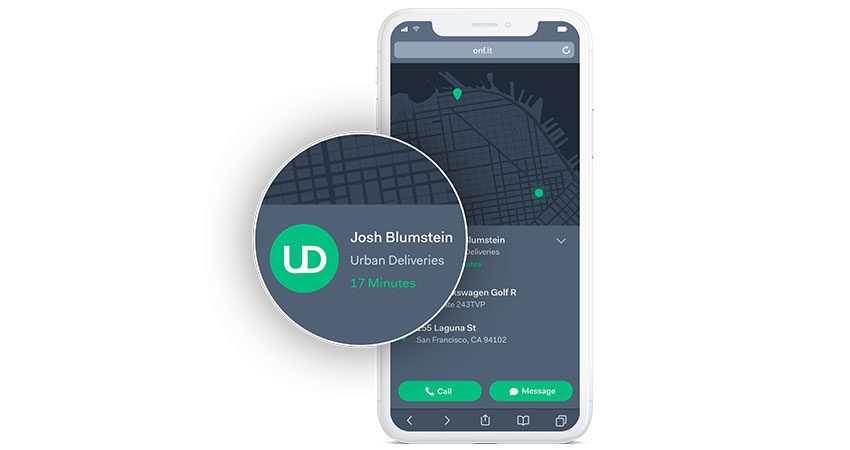

Onfleet’s platform optimizes routes based on factors like traffic and time of day, helps dispatch drivers more efficiently for delivery and pickup, and provides a dashboard view of their performance metrics. It also features real-time tracking and delivery confirmation.

The company will use the funding to hire engineers to improve its route optimization capabilities. For instance, new algorithms can provide drivers with better information on available parking to speed up delivery and cut dwell time, and improve navigation of the “final feet” to a customer’s door.

Other enhancements will help companies who hire outside firms to manage those assets through the Onfleet platform. About 90% of the company’s 1,300 customers have their own delivery fleets, Naim said, but Onfleet is looking to better support those that opt for 3P services, either to enhance or replace internal fleets.

“Onfleet helps them connect with a local courier, using the platform as a collaboration tool,” he said. “Expanding that product is definitely something we’ll be doing this year and next.”

Heightened customer expectations are also a key growth driver, Naim said, having only been exacerbated since the pandemic as millions of new consumers discovered the convenience of ecommerce. And the last mile can be extremely expensive if not managed properly.

“We want our deliveries same day if not faster, and we don’t want to pay much if anything for it,” he said. “But that is a trend that has just continued from the early days of ecommerce. You can’t go wrong by providing faster, cheaper delivery to your customers. Amazon figured this out a long time ago and we’re helping other retailers keep up.”