Weekly highlights

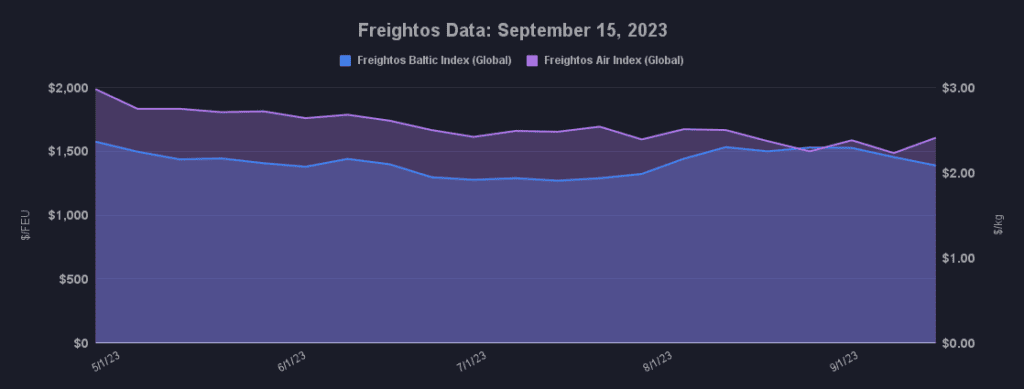

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) decreased 1% to $1,866/FEU.

- Asia-US East Coast prices (FBX03 Weekly) fell 5% to $2,884/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 6% to $1,517/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 9% to $1,818/FEU.

Air rates – Freightos Air index

- China – N. America weekly prices decreased 11% to $4.25/kg

- China – N. Europe weekly prices increased 13% to $3.46/kg.

- N. Europe – N. America weekly prices fell 1% to $1.66/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Transpacific rates dipped 1% to the West Coast last week, with East Coast rates decreasing 5% last week and falling further to about $2,600/FEU so far this week. It is not unusual for ocean prices to decline in mid-September – West Coast rates fell 19% in the first three weeks of September in 2019 – as demand falls in the last weeks before Golden Week. But reports of increases in transpacific blanked sailings in October after the holiday suggest that carriers are expecting volumes to continue to decline.

Asia – N. Europe rates fell 6% last week and look to be continuing their slide this week. And while capacity is not typically removed after Golden Week, this year a record 14% of scheduled sailings have been blanked on this lane so far, indicating falling demand here as well. Asia – Mediterranean prices fell 9% to $1,818/FEU last week, their lowest level since July 2020, with carriers announcing additional capacity reductions on this lane too.

Falling demand is one factor in the climbing blanked sailings. But with transpacific volumes projected to be above 2019 levels in October, the scale of these capacity reductions may be more a reflection of the overcapacity in the market caused by record fleet growth as new, often larger, vessels continue to be delivered. For the year, global volumes are expected to decline by just 0.5% compared to 2022 while capacity will climb 8%.

Overcapacity will continue to put downward pressure on rates, which carriers will attempt to stabilize through blanked sailings and other capacity reduction measures. And though shippers will welcome the likelihood of lower rates after sky-high prices endured during the pandemic, blanked sailings – often announced at the last minute – will mean poorer schedule reliability. And unreliable schedules are already starting to impact US exporters in the form of delays and higher costs from containers waiting in container yards.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.