Weekly highlights

Ocean rates – Freightos Baltic Index

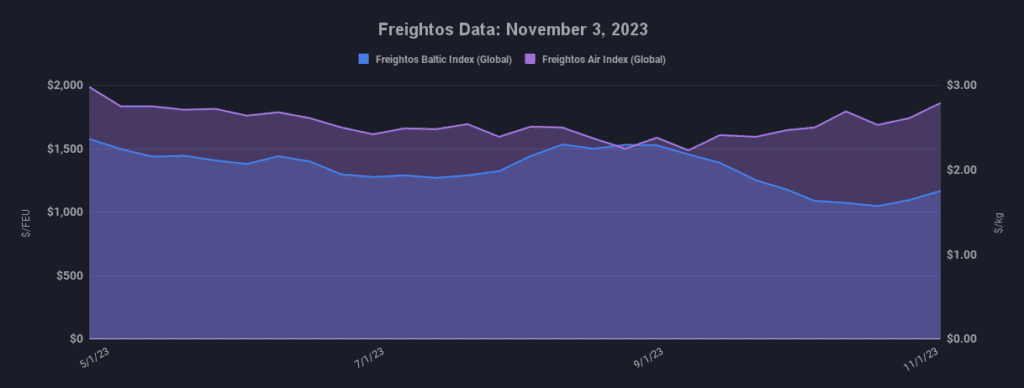

- Asia-US West Coast prices (FBX01 Weekly) increased 3% to $1,609/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 7% to $2,357/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 18% to $1,249/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) increased 13% to $1,551/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices increased 21% to $5.72/kg

- China – N. Europe weekly prices fell 2% to $4.21/kg.

- N. Europe – N. America weekly prices increased 2% to $1.82/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Ex-Asia ocean rates climbed across the board last week on early-month GRIs and further capacity reductions. Transpacific prices increased 3% to the West Coast to about $1,600/FEU, 12% higher than in 2019, and 7% to the East Coast to $2,357/FEU, a level still 14% lower than pre-pandemic.

The Panama Canal Authority will reduce daily transits to about half their normal level over the next three months as the drought there stretches on, raising the possibility of reduced capacity and higher rates to the East Coast or diversions to the West Coast.

However, though there have already been examples of carriers offloading containers to meet draft restrictions, for the most part container flows have not been impacted significantly to date as container ship transits are prioritized through reserved slots booked in advance.

In terms of the impact of the upcoming restrictions, an average of about five of the very large container ships that account for a big share of transpacific container traffic to the East Coast pass through the larger, neopanamax, canal each day. Authorities will reduce daily neopanamax transits to five by February, suggesting that even at their most extreme, restrictions could still accommodate container traffic reasonably well.

Other shipping segments that depend on the larger locks, mostly natural gas and petroleum carriers, will likely bear the brunt of these reductions. Many gas carriers started using longer alternatives to the canal earlier in the year, and spiking spot rates for those markets suggest that those accommodations will increase as restrictions intensify.

Starting in January, the Suez Canal will increase northbound fees by 15% or up to $100,000 per vessel, which could increase costs for Asia – Europe shippers or lead to some additional West Coast or Panama Canal traffic from transpacific volumes as carriers seek to reduce costs.

Carriers are especially under pressure to push Asia – Europe rates up, as ocean contract negotiations need to be finalized before the end of the year and long-term rates typically are set relative to spot levels (transpacific contracts renew in May). Indeed, Asia – N. Europe rates climbed 18% last week to $1,250/FEU, with increases so far this week bringing prices about level with 2019. Asia – Mediterranean rates increased 13% to $1,550/FEU, back to 5% above 2019 levels.

But carriers are announcing Asia – Europe December GRIs that would push prices to the same $1,750 – $2,000/FEU level hoped for through November’s GRIs, suggesting they don’t expect to reach those levels this month.

Normalizing demand levels, overcapacity and inflationary pressure on costs are already negatively affecting carriers’ financial performance, meaning restoring rates to pre-pandemic levels may not be enough to avoid losses. Maersk announced that its ocean division lost $27M in Q3 and plans to reduce its headcount by 10,000 by the end of the year. Some anticipate downsizing among forwarders for the same reasons.

In air cargo, recent increases in volumes and rates out of Asia have many hopeful that we’re seeing the start of an air peak season this year and a good indication for retailer expectations for Black Friday and beyond. Freightos Air Index rates for China – N. America spiked 21% to $5.72/kg last week. Prices for China – N. Europe dipped 2% to $4.21/kg though both lanes are now at their highest levels since April.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.