Weekly highlights

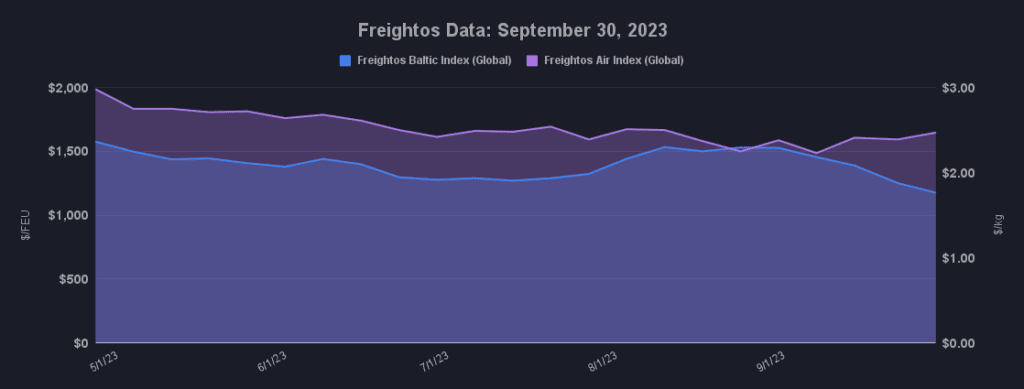

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) decreased 5% to $1,687/FEU.

- Asia-US East Coast prices (FBX03 Weekly) decreased 8% to $2,434/FEU.

- Asia-N. Europe prices (FBX11 Weekly) ticked up 2% to $1,020/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 9% to $1,587/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices increased 8% to $4.75/kg

- China – N. Europe weekly prices increased 6% to $3.94/kg.

- NN. Europe – N. America weekly prices were level at $1.67/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Ocean spot rates fell nearly across the board last week on a mix of a Golden Week lull, a more general easing of volumes, and persistent capacity growth.

Asia – N. Europe rates were below $900/FEU as of yesterday, despite indications of a gradual improvement in volumes on this lane. Some carriers have already announced November rate increases aimed at pushing these rates back up to profitable levels. Asia – Mediterranean prices are below $1,500/FEU so far this week, their lowest level since 2019.

Asia to N. America East Coast prices fell 8% last week and continued their slide so far this week with daily rates at $2,249/FEU, 18% lower than in 2019 and their lowest level since mid-2018.

Transpacific rates to the West Coast fell last week as well, and slipped below $1,500/FEU as of yesterday. Nonetheless, this is the only major lane with prices still above 2019 levels and that have retained some of the summer GRI-driven gains, with prices still 13% higher than in mid-July.

Ocean rates across these lanes are sinking despite high levels of blank sailings and record-slow sailing speeds, which are expected to persist into next year.

There were more reports of upticks in ex-Asia air cargo demand the last few weeks, and Freightos Air Index data saw China – N. America rates increase 8% last week to $4.75/kg, and Asia – N. Europe prices climb 6% to $3.94/kg. Despite this recent trend, many in the industry remain pessimistic that a significant air cargo peak season will materialize this year.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.