Weekly highlights

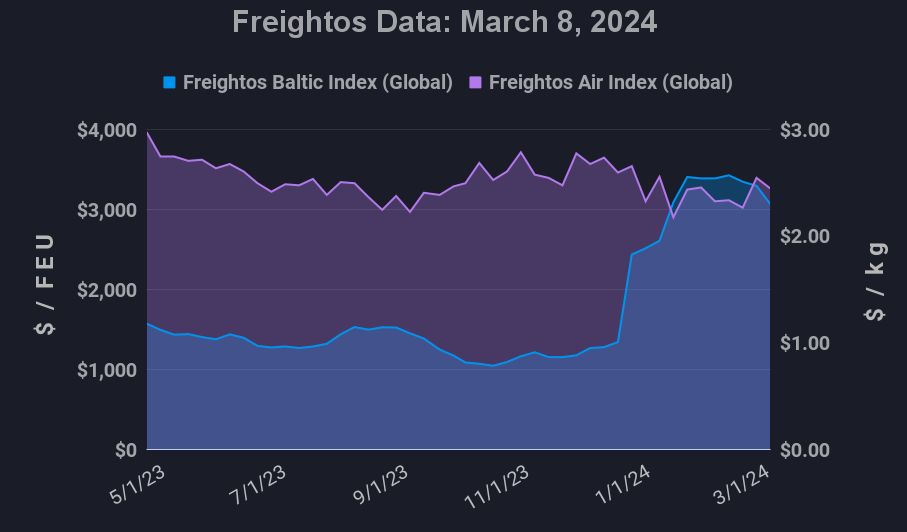

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) fell 7% to $4,419/FEU.

- Asia-US East Coast prices(FBX03 Weekly) fell 8% to $6,107/FEU.

- Asia-N. Europe prices(FBX11 Weekly) fell 4% to $4,313/FEU.

- Asia-Mediterranean prices(FBX13 Weekly) fell 10% to $4,479/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices fell 20% to $3.97/kg

- China – N. Europe weekly prices increased 35% to $2.97/kg.

- N. Europe – N. America weekly increased 4% to $2.08/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Hostilities in the Red Sea intensified last week and included the first seafarer casualties. But with most container traffic already avoiding the Suez Canal, demand easing as the market enters its slow season, and operations settling into a new routine, rates continued to ease across the major tradelanes.

Asia to N. American ocean rates are down 10% from their peak, with Asia – N. Europe prices 22% lower and Asia – Asia-Mediterranean rates 34% below their high in late January. Ocean logistics out of India had been the hardest hit by the Red Sea disruption, but even on this lane rates are beginning to decline and some carriers are postponing surcharges or increases that had been planned for March.

Last week at TPM, Sea Intelligence’s Alan Murphy estimated that rates should settle around 1.5 to 2X above the long-term average, which would mean prices still have a way to go to their new floor as Asia – N. America West Coast and N. Europe prices are more than triple 2019 levels and East Coast and Mediterranean rates are still more than double.

The latest National Retail Federation report shows that N. American ocean import volumes in January were 8% higher than last year and February imports were 23% higher than a year ago. H1 totals are projected to be 8% higher than in 2019, suggesting modest growth and also showing that container volumes continue to flow despite the Red Sea complications.

As ocean expert Lars Jensen recently put it, the diversions are really a challenge, not a crisis, and the extra vessels needed to service the longer routes are absorbing extra capacity and leading to a balanced market.

But when Red Sea traffic resumes we can expect overcapacity to return, rates to fall, and blank sailings to increase, though not all observers agree on how significant overcapacity will prove to be.

In air cargo, Red Sea disruptions to ocean freight have led to some shift to air and increased volumes in February. And though there were reports of congestion at hubs like Bangkok and Dubai in early March, rates on most lanes are subsiding, with China – N. America Freightos Air Index rates at $4/kg last week and China – Europe rates at $3/kg.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.