Weekly highlights

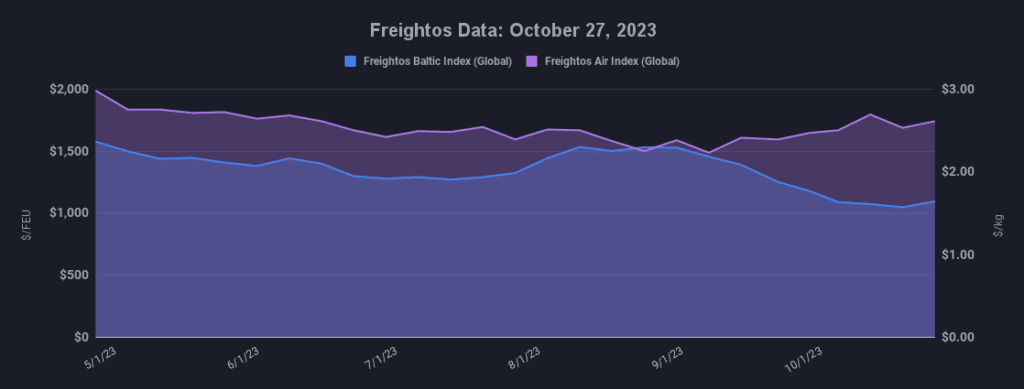

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) increased 4% to $1,564/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $2,213/FEU.

- Asia-N. Europe prices(FBX11 Weekly) increased 8% to $1,056/FEU.

- Asia-Mediterranean prices(FBX13 Weekly) fell 2% to $1,370/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 2% to $4.73/kg.

- China – N. Europe weekly prices climbed 11% to $4.30/kg.

- N. Europe – N. America weekly prices increased 4% to $1.78/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Transpacific ocean rates ticked up slightly last week with prices level overall since early October. This relative stability shows carriers are having some success creating a new price floor through capacity reductions even as volumes ease and fleet sizes grow.

West Coast rates of $1,564/FEU are 15% higher than 2019 levels while prices of $2,213/FEU to the East Coast are 17% lower than in 2019. Likewise, West Coast rates remain 17% above mid-July, pre-peak season, levels while East Coast prices are now lower than in July, possibly reflecting reports of some shift of volumes back to the West Coast now that labor issues there have been resolved.

And though, so far, low-water restrictions in the Panama Canal haven’t seemed to impact container flows significantly, the Panama Canal Authority just announced that it will reduce daily transits from 34 – their level since July – to 24 in November, 20 in January and down to just 18 by February. This significant reduction could increase the likelihood that more ex-Asia volumes will go to the West Coast or via the Suez Canal in the coming months.

Asia – N. Europe rates increased 8% last week and are just 5% below 2019 levels but remain in loss making territory as carriers continue to struggle with overcapacity on the lane as reflected in reports that carriers will push planned early-month GRIs to later in November.

Carriers are facing similar difficulties on the transatlantic where some daily rates dipped below $1K/FEU last week. Some carriers announced planned GRIs for mid-November to push rates to $1,600/FEU, but these increases will only stick if liners can finally bring capacity down to the level of demand.

On the industry level, overcapacity is estimated to peak next year, after which some carriers expect the market to balance out, while some analysts expect the market to be in some state of oversupply through 2028.

In air cargo, there are signs that global volumes are increasing. Freightos Air Index

China – N. America rates dipped by 2% last week, but at $4.73/kg are 36% higher than in early August. Recent increases in e-commerce volumes and significantly fewer passenger flights than in 2019 are likely contributing to rising rates. Asia – N. Europe prices increased 11% last week to $4.30/kg, a 40% increase since early September and their highest level since April.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.