This post has already been read 3312 times!

Despite many challenges, pharma supply chains are now poised to use new technologies to improve multi-tier visibility, collaboration, and resilience

It is well-known that pharmaceutical supply chains are under immense pressure on all fronts.

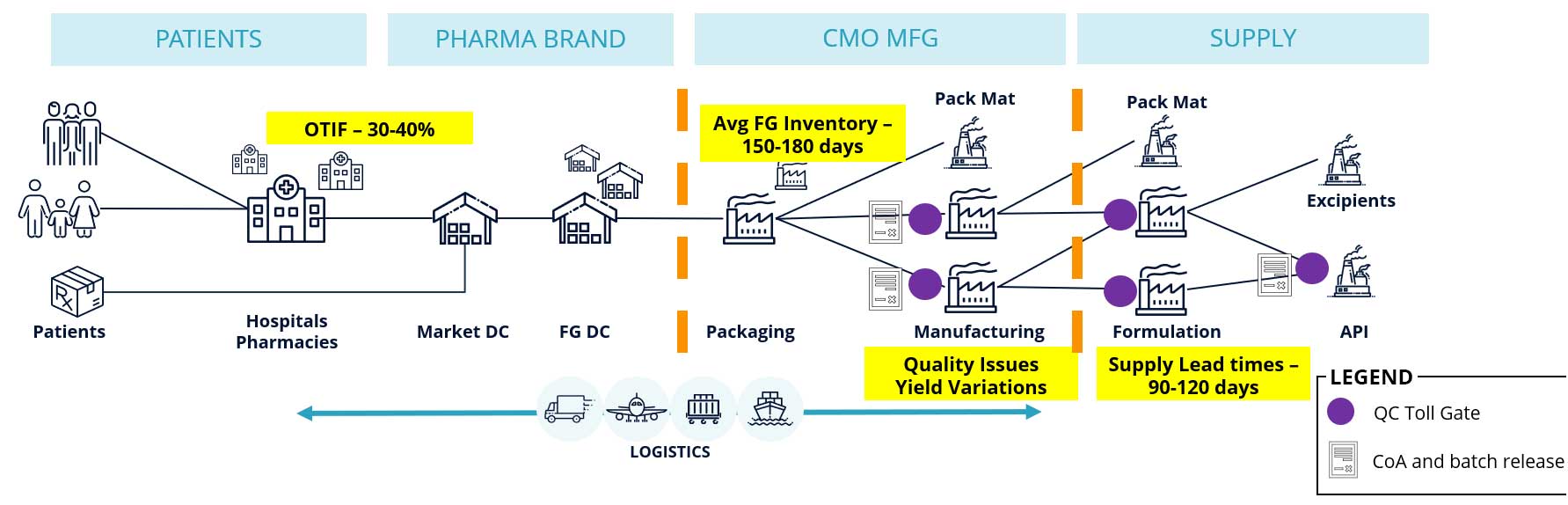

They are grappling with fulfillment issues (OTIF being as low as 30-40%), high inventory hold-ups (150-180 days) and long supply lead times (90-120 days) are making material availability a big concern. The problem is aggravated with shifting disease areas, new product introductions (NPI), and mergers and acquisitions common in this sector. Supply assurance becomes especially critical to support successful product launches as new supply chains and networks are being designed.

Pharmaceutical supply chains are highly outsourced with complex multi-party relationships. 61% of the manufacturing is controlled by contract design and manufacturing organizations (CDMOs). In recent WBR research 64% of the respondents stated upstream multi-tier visibility was their biggest challenge, and that’s preventing pharma brands from optimizing outcomes end-to-end.

The Challenge of Upstream Visibility in Pharmaceutical Supply Chains

Why is gaining upstream visibility such a big challenge? There are a number of contributing factors and reasons.

- Digital maturity is low with each node using hub-and-spoke solutions

- Visibility past the 1st tier of supply is almost non-existent

- Collaboration with Contract Manufacturer (CMO) is at a basic level (if exists at all), and with T2+is non-existent

- Difficult to share data as capacity is managed by the CMO who is manufacturing for multiple customers and often there are non-compete clauses that make data sharing even tougher

- Complexity is increasing with multi-tier production processes which would require access to granular real time batch related production and quality data

At root, the pharmaceutical value chain is missing fundamental prerequisites for obtaining real-time, multi-tier upstream visibility, namely:

- Single Version of Truth – Every node in the supply chain has a data structure and model that doesn’t always marry with the next node. This makes transaction monitoring across the value chain virtually impossible. A common master and transaction data model across a pharma brands’ upstream supply chain that includes CDMOs, intermediate suppliers, packagers and API vendors designed and enabled through a single unified data model.

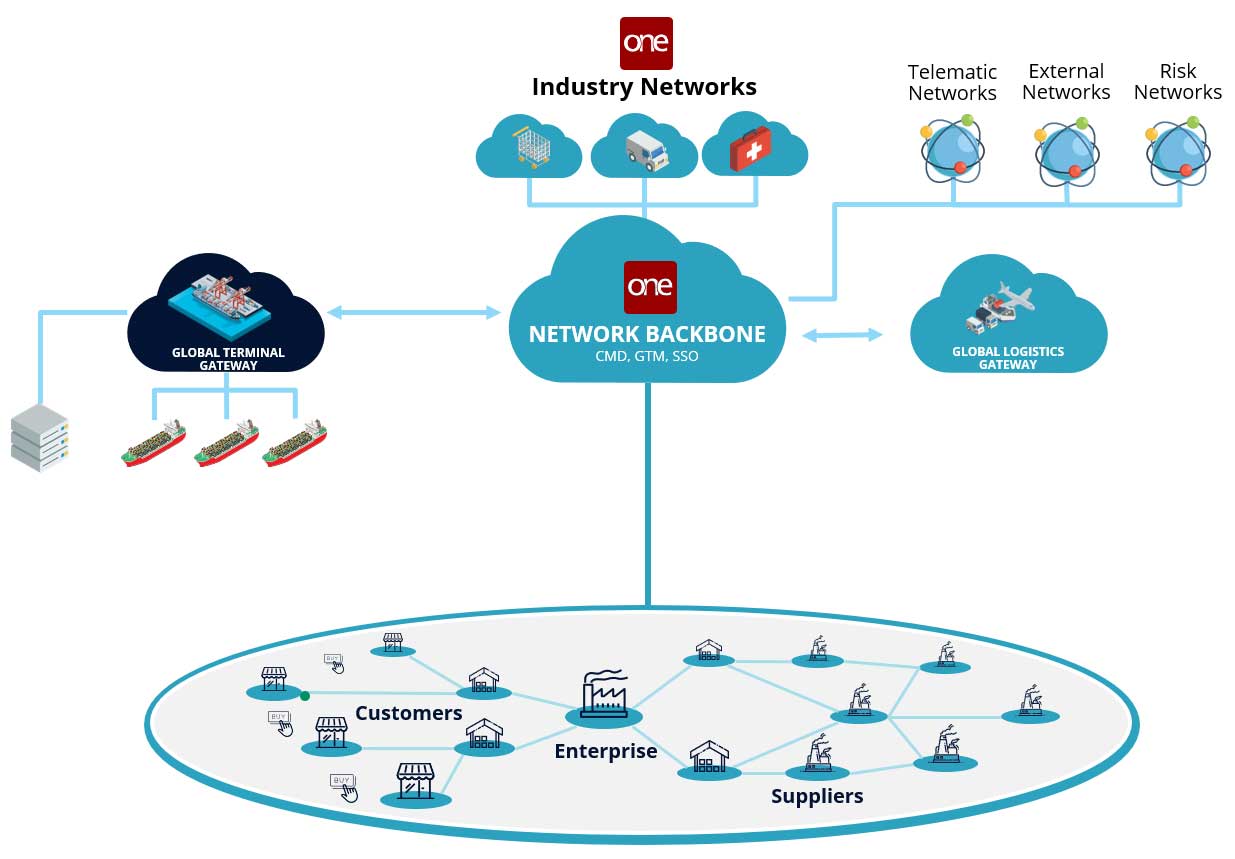

- Real Time Layer of Orchestration & Intelligence (Network of Networks) – Given the disparate parties on the network and their disparate data models and integration standards, a common layer of orchestration that imbibes real-time data from internal and external sources is needed. This must be paired with robust data-sharing permissibility framework, with rules built in and that filters out the relevant visibility and output that each party is entitled to interact with in the network.

The Ubiquitous “Network of Networks”

It is widely accepted that a network is required to enable real-time, multi-tier visibility across the pharma supply chain. But different types of networks vary in their effectiveness.

Most existing networks in the market are mostly hub and spoke where the hub (which is the pharma brand in this case) benefits while the individual spokes (could be CDMOs, suppliers, carriers) are islands providing siloed datasets to the hub. The hub has direct tier 1 visibility of data pertaining to its own products, shipments and SKUs. However, it has no visibility into other critical constraints such as tier 2 excipient shortages at the CDMOs which could be a bottleneck on the finished product. The hub also has no visibility into capacity/line/network-wide constraints at the CDMO especially when the CDMO is trying to optimize its product mix for multiple competing brands.

A federated network of networks model solves this in the most elegant way while adhering to strict data privacy rules such as HIPPA et al.

The network’s adapters are designed to support all major enterprise and legacy partner systems, including planning solutions, risk networks, other third-party networks, blockchain (Hyperledger and Ethereum), and healthcare data repositories.

The network also incorporates third-party live data sources such as Internet of Things (IoT), telematics, weather, traffic, and geopolitical data. A unique feature of the network, is that pharma brands, CDMOs, suppliers and carriers need to onboard just once, and they can connect and transact with carriers and suppliers, or any of the other 90,000 organizations already on the network supporting over a trillion USD worth of transactions.

The network includes master data management tools, including a databot, that enables organizations to quickly gather, cleanse, reconcile, and publish their master data to the network. Access to data is strictly controlled by a patented permissions framework. With a chain of custody solution, the network enables the tracking of complex, lot splitting and merging moves across regions. Solutions on the network also comply to the newly promulgated DSCSA guidelines including GS1 and EPICS standards.

Ecosystem That Provides Value for All Supply Chain Partners

In this network of network model everyone in the entire ecosystem wins. The key value drivers are cost, cash and improving product margins. Working with pharma brands we see companies reduce close to 40-50% of their upstream supply chain costs through higher planning accuracy, real-time issue resolution by all parties, . and reduced expedited freight.s. Real-time visibility and orchestration also helps network players reduce channel inventory by between 15-20% thus improving working capital.

Product margin improvement is significant, in the range of 5-10%. This is achieved primarily through alignment of production capacities to product sell-through ratios, optimizing product mix based on network-wide constraints, and predictive identification of supply issues, including capacity constraints and quality failures.

| Value for the Brand | Value for the CDMO | Value for the Suppliers (all tiers) |

| Earlier visibility to multi-tier supply issues and impact on ability to get drugs to patients Able to track critical production and QA processes in external supply Make quick decisions on changes to supply or batch releases | Reduce lead time and variability Can collaborate with all customers in one place, reducing IT cost and cost to serve Improves visibility and reduces latency Can intelligently optimize and share data with customers, improving service | Near real-time visibility to demand changes improves their own supply planning Better collaboration with CDMOs and/or Brand if they are purchasing supply, improved customer service Reduced manual overheads to collaborate |

Networks Enable Effective Collaboration and Execution Across Multi-Tiered Pharma Supply Chains

With today’s network technologies, it is possible for pharmaceutical companies, contract manufacturers, API/excipient/packaging suppliers to effectively collaborate and execute across all tiers of the supply chain. The technology is here today. It combines with AI to anticipate and workaround constraints and disruptions and thus optimizes the supply chain to generate value for pharma companies and their CMOs.

A real-time network of networks creates value for all players in the ecosystem.

This spans from basic collaboration around forecast, PO, ASN and commits between brands and CDMOs, to tracking multi-tier, multi-party shipments, production monitoring, to understanding material and capacity constraints across all tiers of suppliers. This enables the system to incrementally adjust production plan and capacity allocations downstream.

This significantly improves fulfillment for pharma brands and helps them tide over product availability especially with fluctuating demand trends and shifting epidemiological landscapes. This also creates the foundation for AI algorithms to optimize outcomes across tiers and manage decision making through Smart Prescriptions™.

One Network works with pharma and life science clients to drive better upstream collaboration with real time network visibility coupled with optimized execution. The system is easy to deploy, supports rapid partner onboarding and self-funding six monthly sprints that drives greater speed to value for pharma brands and their CDMOs. This ultimately drives down cost, improves margins and patient outcomes.

If you’d like to know more, I highly recommend you watch Shirell James’ deep dive on the topic:

Recommended Posts

- What is on the Horizon for Supply Chain Management?

- What Constitutes a True Network?

- Real-World Supply Chain Robotics

- Supply Chain Trends to Watch

- Fielding Software to Defense: A Journey of Ineffectiveness, Inefficiency, and Frustration

- The 4 Top Challenges in Deploying AI in Healthcare and Pharmaceutical Supply Chains - January 7, 2024

- How to Achieve Patient-Centric Supply Chains - October 20, 2023

- How to Achieve N-Tier Orchestration in Upstream Pharmaceutical Supply Chains - October 3, 2023