Weekly highlights

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) were level at $1,620/FEU.

- Asia-US East Coast prices (FBX03 Weekly) were also level at $2,367/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 3% to $1,243/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) rose 12% to $1,670/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices were level at $6.30/kg

- China – N. Europe weekly prices fell 5% to $4.24/kg.

- N. Europe – N. America weekly prices rose 2% to $2.14/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

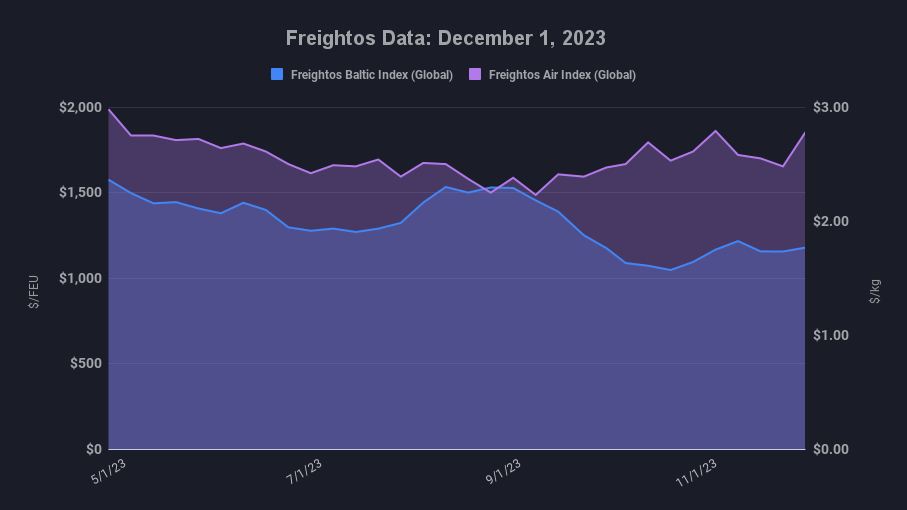

Transpacific ocean rates were level to close November and about even with the start of the month, with prices to the West Coast 22% higher than in 2019 and East Coast rates 9% below the 2019 mark.

Though rates haven’t responded yet, other signs have started emerging that tightening Panama Canal restrictions are starting to impact the container market. Two more carriers announced upcoming surcharges for containers transiting the canal due to climbing operational costs, and in addition to a handful of vessels that have already taken alternate routes, THE Alliance announced that three Asia – East Coast services will start rerouting via the Suez canal.

The Suez is facing a different set of challenges though, as Houthis in Yemen attacked three more vessels – two bulk carriers, and an OOCL container vessel they determined to have links to Israeli-ownership – and a US Navy ship on Sunday. Some of the ships were slightly damaged by rocket fire, and the Navy destroyer shot down three approaching drones.

With the threat focussed on Israel-linked vessels there has not been a significant impact on vessel flows through the Red Sea yet. However, there have been a handful of examples of Israeli owned vessels diverting from passage through the Suez Canal and Red Sea in favor of sailing around Africa’s Cape of Good Hope, including two car carriers, two container vessels operated by Maersk, and at least one by ZIM.

US officials are in talks with other countries about setting up a maritime task force to secure this crucial waterway and reduce the growing threat to traffic there.

In terms of impacts on container rates, ZIM Lines was alone among the carriers in introducing a war risk insurance premium since the start of the war, with Hapag-Lloyd announcing this week new surcharges starting in January for shipments to and from Israel. Freightos Data shows that while the average cost per container for Asia – Mediterranean shipments had increased only 9% by the end of November compared to October, rates from some Chinese origins to Israel climbed between 16% – 36%, suggesting that the war is leading to higher costs for carriers and higher prices for their customers.

Asia – N. Europe rates ticked up last week and prices to the Mediterranean increased 12% with indications that rates are climbing on both lanes on early-month GRIs. The degree to which December’s rate increases will stick though, will depend on the carriers’ ability to reduce capacity to current demand levels.

And that challenge likely won’t be short lived: a recent projection expects Asia – Europe capacity growth to outpace volume growth through 2025, with volumes in 2025 still below 2019 levels. Though the container market in general is dealing with overcapacity, the situation appears particularly acute for Asia – Europe where the record orderbook has already added 400k TEU of capacity in the past year, compared to a 250k TEU reduction in capacity on the transpacific.

In air cargo, some observers think the ex-Asia e-commerce driven bump in air cargo demand could push through until Lunar New Year. Freightos Air Index data show that China – N. America rates were level but remained elevated at $6.30/kg last week, with China – N. Europe rates dipping 5% to $4.24/kg, and transatlantic rates increasing 2% to $2.14/kg.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.