Weekly highlights

Ocean rates – Freightos Baltic Index

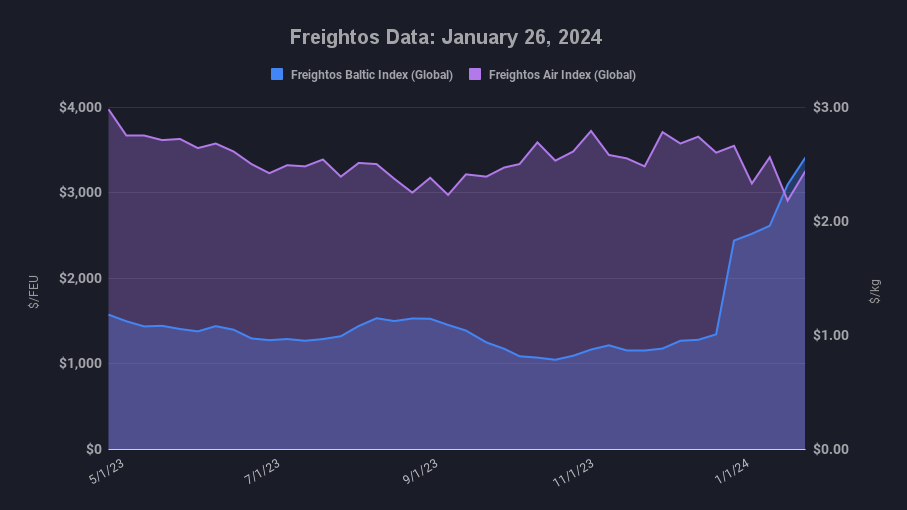

- Asia-US West Coast prices (FBX01 Weekly) increased 38% to $4,099/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 21% to $6,152/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 1% to $5,456/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 5% to $6,449/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices increased 11% to $5.33/kg

- China – N. Europe weekly prices fell 5% to $3.16/kg.

- N. Europe – N. America weekly prices increased 2% to $1.98/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

The Pentagon believes that US and UK strikes in Yemen are degrading Houthi abilities to carry out attacks on Red Sea traffic, but despite these steps and new attempts at diplomatic pressure the attacks continue and so do the widespread container traffic diversions away from the Suez Canal.

Ocean carriers are omitting some port calls in the Red Sea and Middle East, as well as at some Mediterranean ports as they adapt. In the meantime, there are reports of inventory shortages for some European importers as shipments are delayed or taking longer to arrive. And though there are still reports of tight space and equipment at Asian export hubs, congestion remains minimal, and there are signs space and equipment availability may already be improving.

With these operational challenges and Lunar New Year rapidly approaching ocean rates from Asia to N. America increased 38% to the West Coast last week, past $4K/FEU and 21% to the East Coast to the $6k/FEU level, while Asia to N. Europe and Mediterranean rates leveled off at $5,500/FEU and $6,500/FEU respectively.

Carriers are still working to add vessels and adjust ongoing schedules which should accommodate the longer voyages and help improve reliability in the coming weeks, and demand-side pressure is expected to ease in the period after LNY too. So as operations improve and with pre-LNY urgency likely a significant contributor to rate increases so far in January, freight rates – despite GRIs and surcharges announced for February – may be reaching their ceiling.

Ocean delays have pushed some shippers to alternatives like rail or land-bridge options. And though there were expectations of a significant move to air and sea-air logistics, so far the shift seems moderate and more pronounced for sea-air than for air cargo. Like in ocean freight, demand for alternatives should also ease after LNY.

Freightos Air Index data shows that China – N. America air cargo rates climbed 11% last week to $5.33/kg, but are below levels at the end of December, while China – N. Europe prices have declined for the past two weeks. Middle East – to N. Europe prices, meanwhile, climbed 24% in the last two weeks to $1.80/kg, possibly reflecting some ocean to sea-air shift.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.