Weekly highlights

Ocean rates – Freightos Baltic Index

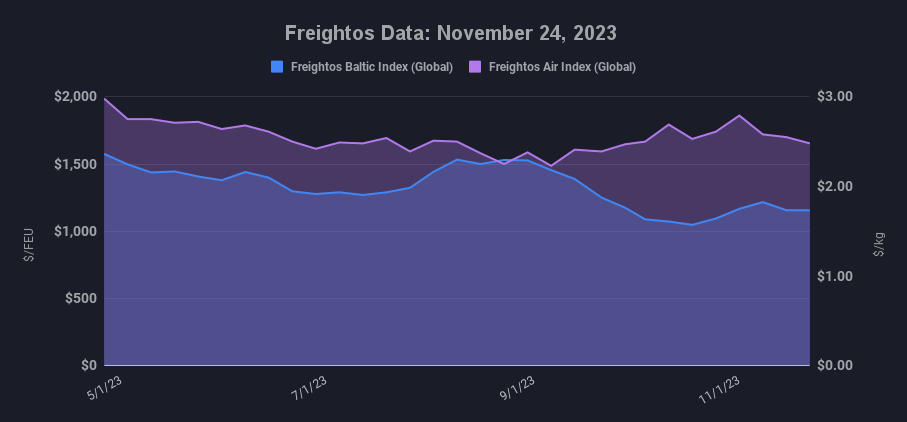

- Asia-US West Coast prices (FBX01 Weekly) increased 3% to $1,613/FEU.

- Asia-US East Coast prices (FBX03 Weekly) fell 1% to $2,362/FEU.

- Asia-N. Europe prices (FBX11 Weekly) fell 6% to $1,211/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) were level at $1,492/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices increased 20% to $6.28/kg

- China – N. Europe weekly prices increased 6% to $4.47/kg.

- N. Europe – N. America weekly prices increased 5% to $2.10/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Asia – N. Europe ocean rates dipped 6% last week to $1,211/FEU and are 17% lower than in 2019. Carriers are facing increasing pressure to push spot rates up on this lane as they serve as the basis for annual contract levels typically finalized by the end of the year.

Q3 Asia – Europe volumes were well above last year’s levels but declined relative to Q2 at a time of year imports normally increase on peak season demand. Carriers have been reducing capacity through blank sailings and other measures in response. But despite reducing scheduled Asia – N. Europe capacity by 21% in November (with a 24% reduction announced so far for December), capacity still remained 11% higher than in 2019, showing that growing fleets and easing demand are combining to challenge rate increase attempts.

Carriers have announced plans to keep trying nonetheless, with some announcing additional significant General Rate Increases for mid-December, aiming to push Asia – N. Europe rates above $2k/FEU. Some carriers are reportedly extending current annual contract terms through January to buy more time for spot rate gains and strengthen their position for contract negotiations crucial to their profitability in 2024.

Asia – US West Coast rates increased 3% to $1,613/FEU last week and are 20% above 2019 levels, while prices to the East Coast dipped 1% and are 8% lower than in 2019. Some carriers have announced upcoming $150 – $300 per container surcharges for shipments using the Panama Canal as further daily transit reductions go into effect, which could start putting some upward pressure on prices to the East Coast in the coming weeks.

After three attacks on Israel-linked vessels in the Red Sea, including one container ship, ZIM Lines decided to divert one ship around the Cape of Good Hope. One hijacking attempt was prevented by American and Japanese naval interventions, reflecting increased international efforts to keep crucial shipping lanes unobstructed.

While Asia – Mediterranean ocean rates have increased 9% since the end of October, Freightos Data shows that Asian import container prices to Israel have climbed from 16% – 36% to about $2,000/FEU for some port pairs, suggesting that, though ocean operations continue, security disruptions and some reported congestion may be contributing to upward pressure on rates to Israel due to the war.

Significant sustained passenger flight cancellations and some reduction in cargo operators may be driving sharp increases in air cargo import prices to Israel as well, with prices from some European and US origins to Tel Aviv up 60% or more in the last month.

Though global air cargo volumes increased through October, the seasonal bump is estimated at about a third its typical size. Nonetheless, Freightos Air Index data show that China – N. America rates climbed past $6/kg last week, a good sign for Black Friday and Cyber Monday demand, and for holiday shopping as we enter December. A recent analysis suggests that transpacific rate increases are being amplified by lingering capacity constraints on the lane. China – N. Europe prices increased 6% to $4.47/kg, their highest level since April, with reports that e-commerce imports are driving much of the recent rate rebound.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.