Weekly highlights

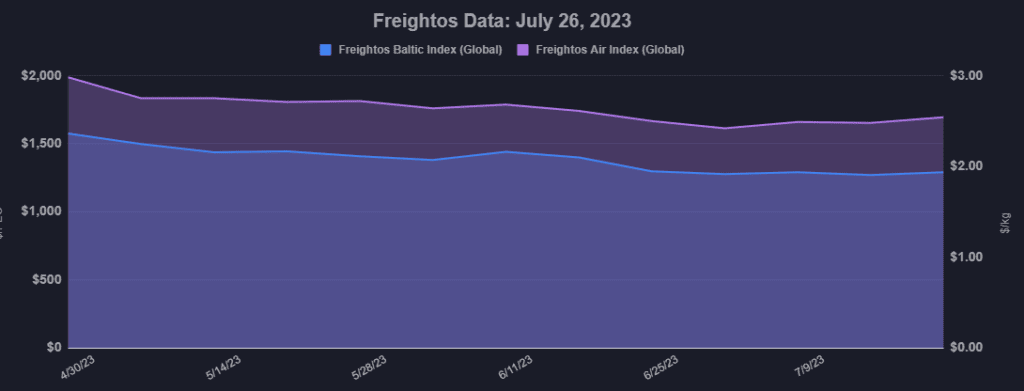

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) increased 12% to $1,527/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 3% to $2,598/FEU.

- Asia-N. Europe prices (FBX11 Weekly) dipped 2% to $1,264/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) increased 2% to $1,992/FEU.

Air rates – Freightos Air index

- China – N. America weekly prices decreased 8% to $3.94/kg

- China – N. Europe weekly prices fell 1% to $3.09/kg.

- N. Europe – N. America weekly prices fell 1% to $1.79/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Yellow’s last attempts to stay afloat in the face of mounting debt and an ongoing labor dispute fell short last week, as the LTL carrier ceased operations and will reportedly file for bankruptcy. Yellow was one of the US’s largest carriers, and LTL rates are expected to climb in the near term as their capacity is removed from the market.

The dispute causing the on again off again ILWU Canada port worker strike appears – once again – to have been resolved. Union members voted down a tentative agreement late last week raising the prospect of a renewed strike until leadership accepted a revised proposal Sunday night which will head back to members for ratification later this week. Though operations have returned to normal since mid-month, the rail backlog built up over the shutdown could take up to two months to clear.

More signs of US economic health in Q2, including consumer spending strength, are stoking optimism that inflation will be brought under control without pushing the economy into recession.

This consumer resiliency contributed to estimates that US ocean volumes grew moderately in July and will climb into August, though some major forwarders do not expect gains through October to qualify as a true peak season.

And though transpacific rates have climbed 13% to the West Coast and 9% to the East Coast since mid-July, these increases are likely more a function of stricter reductions in capacity than of surging volumes, as carriers work to reduce over-supplied fleets.

There is less economic optimism in Europe, and few signs of an imminent freight rebound. Even so, carriers will attempt a $600/FEU Asia – N. Europe rate increase to start the month, though consensus is that this push will not succeed.

In air cargo, forwarders are likewise not expecting much of a rebound during the November – December peak season, or a return to growth before 2024 at the earliest. Still-active long-term freighter charters leased while demand surged are – together with passenger travel growth – contributing to current overcapacity, pushing rates down as demand sags.

The Freightos Air Index Global benchmark closed July level with June but 29% lower than a year ago. China -N. Europe rates ticked up 2% to $3.09/kg in July and China – US prices were at $3.94/kg, for a 4% increase, but 31% and 47% lower than a year ago, respectively. Transatlantic rates fell 11% to $1.79/kg, about 40% lower than a year ago.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.