Weekly highlights

Ocean rates – Freightos Baltic Index

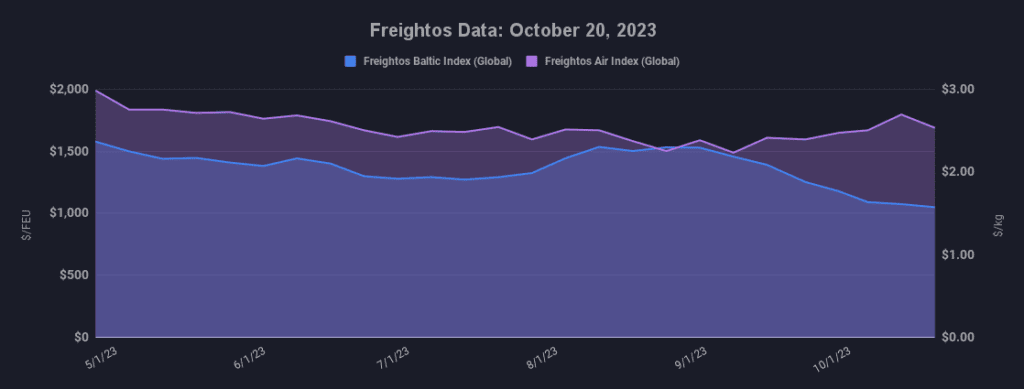

- Asia-US West Coast prices (FBX01 Weekly) decreased 3% to $1,499/FEU.

- Asia-US East Coast prices (FBX03 Weekly) fell 4% to $2,141/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 3% to $978/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 5% to $1,400/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices were level at $4.80/kg

- China – N. Europe weekly prices increased 4% to $3.86/kg.

- N. Europe – N. America weekly prices increased 1% to $1.71/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

The latest data from September showed continued strength among US consumers as retail spending increased .07% compared to August. At the same time, there are multiple signs that a slowdown could be coming including some spending pull-back among lower-income consumers, a falling personal saving rate, and an increase in debt delinquencies.

Reports by many major retailers that inventories are now under control is a positive sign for the possibility of a restocking cycle after the holidays if spending holds up. But the run down of those inventories in the last few months also meant less importing and a relatively short and subdued peak season this year.

Demand continues to ease into the typical post-peak season pre-Lunar New Year lull, but transpacific rates may be leveling off at a new floor as carriers work to reduce capacity. Prices to the West Coast fell 3% last week but are about even with the early-October level of $1,500/FEU. Rates to the East Coast decreased 4% and are 5% lower than at the start of the month. In addition to significant blanked sailings, THE Alliance also announced this week that they will suspend one East Coast service starting in mid-November until further notice.

Asia – N. Europe rates remained below $1,000/FEU last week. Major European ports reported lower Q3 volumes than last year, with overall Asia – N.Europe volumes falling in August after climbing the previous two months. Some analysts project year on year growth for the trade lane in Q4, but rates are likely to be much lower than last year pointing to ongoing struggles with overcapacity.

More carriers have announced Asia – N. Europe GRIs planned for November to try and push rates up to profitable levels. Like on the transpacific, carriers are suspending Asia – N. Europe services alongside slow-steaming and blanked sailings in the hopes of bringing capacity in line with demand.

But, industry-wide, ships with a total capacity of more than a million TEU are already idled, and some analysts are predicting that capacity growth will outstrip volume growth at least through 2024. These trends mean carriers will face the continued challenge of aligning supply with demand, downward pressure on rates and possible losses next year and beyond.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.