Weekly highlights

Ocean rates – Freightos Baltic Index:

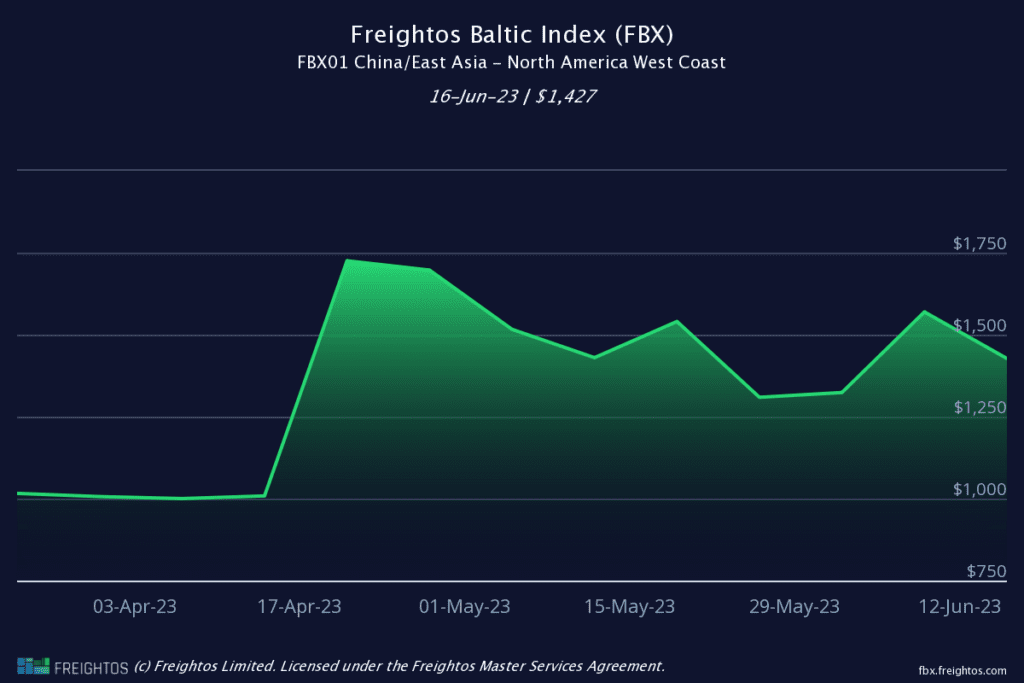

- Asia-US West Coast prices (FBX01 Weekly) fell 9% to $1,427/FEU. This rate is 85% lower than the same time last year.

- Asia-US East Coast prices (FBX03 Weekly) decreased 5% to $2,487/FEU, and are 79% lower than rates for this week last year.

- Asia-N. Europe prices (FBX11 Weekly) increased 10% to $1,325/FEU, and are 88% lower than rates for this week last year.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Labor disruptions that had slowed operations at major US West Coast ports since the beginning of the month ended last week as the ILWU and PMA agreed to terms for a new six-year contract, with little lingering impact on container flows.

The tentative agreement that will head through a ratification process over the next couple months reportedly includes a $70 million bonus and a gradual 32% wage increase for union members through 2028. Though other labor negotiations are ongoing – including ILWU Canada members and UPS Teamsters each authorizing their leaderships to call strikes if necessary – the resolution of this 13-month dispute represents a significant shift in the transpacific ocean landscape.

The threat of West Coast labor disruptions was one major driver of the volume shift from West Coast ports to the East Coast and Gulf – with West Coast ports now handling 56% of Asian import volumes down from more than 60% for much of the pandemic – and its removal could lead to some recovery of that traffic.

But improvements in East Coast and Gulf port capabilities as well as some diversification of sourcing to places like India and Vietnam whose containers typically head to the East Coast via the Suez Canal could also mean that not all shippers will be coming back.

In the near-term, the West Coast might enjoy an increase in volumes at the expense of alternative destinations as drought-driven low water levels in the Panama Canal are getting worse, with added restrictions announced for July that could significantly reduce the number of daily transits possible via the canal.

In terms of consumer demand, the Federal Reserve’s decision not to increase interest rates last week – after 10 consecutive increases – and improvements in consumer sentiment on easing though still elevated rates of inflation could be positive indications for consumer resiliency.

But those positive signs aren’t translating into a freight volume or rate rebound just yet, with only moderate increases in US import ocean volumes so far as we enter the typical peak season months and a lot of uncertainty surrounding when inventories will run down and consumer resiliency.

Carrier hopes for a June peak season bump were mostly dashed as transpacific rates have retreated from their early June GRI-driven increases. Prices to the West Coast fell 9% last week, with the latest daily rate dropping another 15% to about $1,200/FEU, a level even lower than at the end of May.

Rates to the East Coast fell 5% last week and slid another 6% so far this week to $2,342/FEU, about on par with rates for much of May and just below 2019 levels. Panama Canal low water surcharges are likely helping keep East Coast rates from decreasing further, and could put upward pressure on prices if conditions worsen.

Asia -N. Europe prices climbed last week, likely from an early-month rate push by carriers, but prices so far this week also appear to be falling to about the $1,260/FEU mark, below May levels and 5% below rates in 2019.

Though some in the air cargo space are still hopeful for some demand rebound air cargo peak season late in the year, others are less optimistic. As the drop in freighter conversions reflects, demand for air cargo continues to drop just as passenger travel and the cargo capacity it adds to the market continues to recover.

Freightos Air Index rate data show that China – N. Europe prices dipped 3% over the last month to $3.18/kg and are 53% lower than last year. China – N. America rates climbed more than 20% this month to $5.60/kg but are 25% lower than a year ago, while transatlantic prices dipped 10% to $2.23/kg and are 39% lower than last June.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.