Weekly highlights

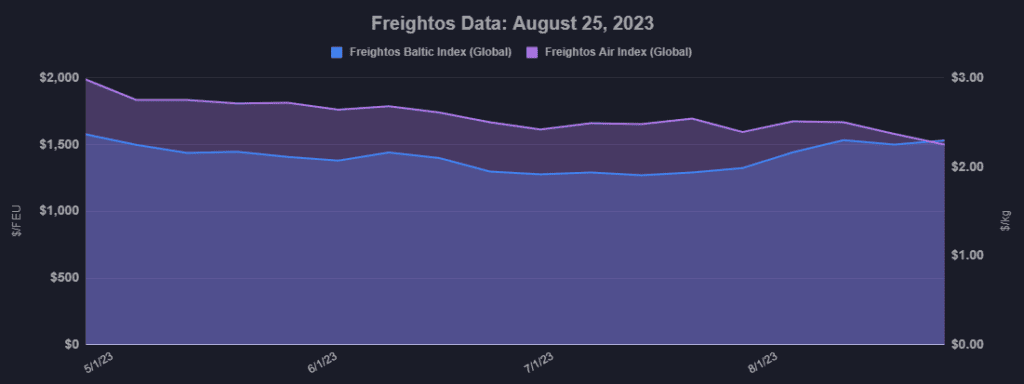

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) increased 5% to $2,029/FEU.

- Asia-US East Coast prices(FBX03 Weekly) climbed 3% to $3,075/FEU.

- Asia-N. Europe prices(FBX11 Weekly) increased 2% to $1,747/FEU.

- Asia-Mediterranean prices(FBX13 Weekly) fell 1% to $2,313/FEU.

Air rates – Freightos Air index

- China – N. America weekly prices increased 6% to $4.02/kg

- China – N. Europe weekly prices fell 3% to $2.91/kg.

- N. Europe – N. America weekly prices fell 4% to $1.67/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Though US retail spending has held up even as inflation cools, sales across major retailers have been uneven. While Amazon, Walmart and TJX reported strong Q2 numbers, others like Macy’s and Dick’s Sporting Goods did not fare as well and are seeing possible signs of a slowdown in consumer strength.

And while a recent analysis shows US retail inventory levels are decreasing, they remain elevated, and, together with slowing sales, will likely push off a significant restocking cycle and freight rebound until mid-2024.Taken together, these trends support projections that import volumes likely reached their peak for the year in August.

Transpacific ocean rates climbed slightly last week, with West Coast rates up 5% to $2,029/FEU, and East Coast prices up 3% to $3,075/FEU, both above 2019 levels. And though the success of August General Rate Increases were due not only to increased demand but also strict capacity management by carriers, if demand ebbs as fleet sizes continue to grow we may be seeing peak rates for this year as well, even as some carriers have announce transpacific GRIs for mid-September.

The Panama Canal Authority announced that low-water restrictions will likely stay in place for at least ten months, though there has not been any significant impact on container shipping via the canal yet. With alternatives and excess capacity in the market, it is looking unlikely that these restrictions will cause much disruption to container trade.

China – N. Europe total H1 import volumes were down year on year, though demand has improved since March, with June volumes 5% higher than last year and 6% higher than in 2019. August GRIs pushed Asia – N. Europe spot rates to about the $1,700/FEU mark and above contract levels through last week on this demand improvement and on capacity reductions, though there is skepticism that carriers will be able to sustain these prices.

Asia – Mediterranean demand was resilient through June, and August rates of $2,300/FEU have been about 20% higher than in July, suggesting volumes continue to improve.

Freightos Air Index data show that China – N. America air cargo rates increased for the third consecutive week last week, and at $4.02/kg are 15% higher than at the start of August, while China – N. Europe prices have fallen 7% to $2.91/kg over the same period.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.