Weekly highlights

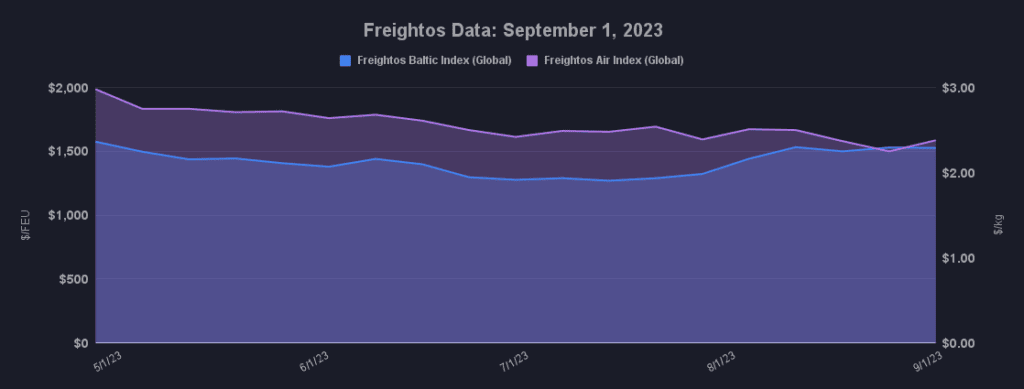

Ocean rates – Freightos Baltic Index:

- Asia-US West Coast prices (FBX01 Weekly) decreased 5% to $1,927/FEU.

- Asia-US East Coast prices (FBX03 Weekly) were level at $3,079/FEU.

- Asia-N. Europe prices (FBX11 Weekly) were level at $1,744/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) increased 1% to $2,338/FEU.

Air rates – Freightos Air index

- China – N. America weekly prices increased 14% to $4.59/kg

- China – N. Europe weekly prices increased 5% to $3.05/kg.

- N. Europe – N. America weekly prices increased 2% to $1.70/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Asia – US West Coast rates ticked down 5% last week despite ongoing capacity reductions suggesting a weakening of volumes at a time of year – the last few weeks before China’s Golden Week holiday – that typically sees some increase in demand from volumes pulled forward to avoid the manufacturing and logistics slowdown in China over the early-October break. Weakening demand would support the observation that this year’s short and relatively modest peak is behind us.

Analysis suggesting that carriers are also partially keeping rates up – and bove 2019 levels – through an increase of rejections despite reports that vessels are sailing at only 80% of capacity, and the no-show of proposed September GRIs or Peak Season Surcharges so far, are additional signs that volumes are declining, and that carriers may be looking toward Lunar New Year in February for the next rebound.

Carriers are increasing ex-China blanked sailings over the Golden Week lull, which is typical, but some carriers announced additional Asia – Europe blankings for early September as well, implying that no pre-holiday bump in demand has materialized on this lane either. Though Asia – N. Europe rates were stable last week, daily rates this week have declined about 7%.

On the labor front, the US West Coast’s ILWU members officially ratified their new six-year contract last week, ending the dispute that started last July, though some of the volumes that shifted to the East Coast and Gulf ports as a result of the conflict may not be coming back. At the same time, the East Coast and Gulf port worker union, the ILA, is a year away from the end of its contract with port operators and will begin negotiations soon.

In air cargo, the seasonal lull combined with overall low demand is pushing volumes below pre-pandemic levels at some of Europe’s major hubs, though some in the industry are hopeful that electronics product launches set to begin soon could drive some peak season rebound in the coming months nonetheless. Freightos Air Index data shows ex-Asia and transatlantic rates remain more than 40% lower than a year ago though China – N. America rates have increased more than 25% since a month ago.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.