Weekly highlights

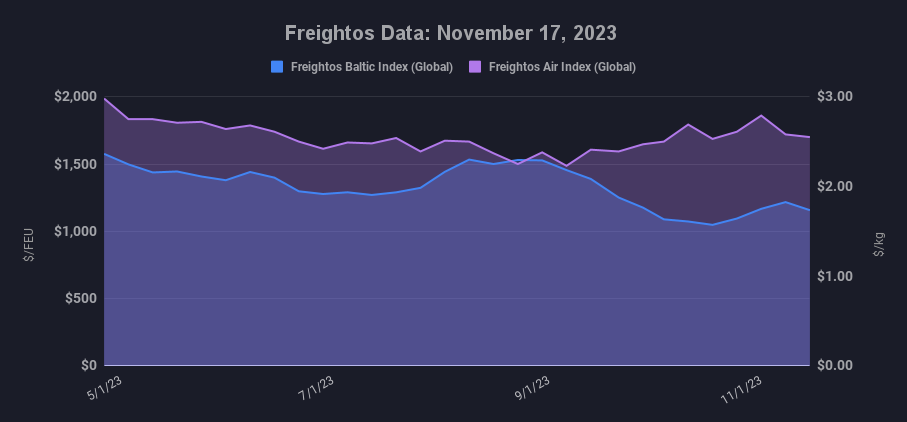

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) decreased 8% to $1,573/FEU.

- Asia-US East Coast prices (FBX03 Weekly) decreased 2% to $2,383/FEU.

- Asia-N. Europe prices (FBX11 Weekly) decreased 7% to $1,291/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 5% to $1,487/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 6% to $5.23/kg

- China – N. Europe weekly prices increased 25% to $4.23/kg.

- N. Europe – N. America weekly prices increased 9% to $2.00/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Ex-Asia ocean rates fell across the major tradelanes last week, showing that carriers’ attempts to increase rates in November with General Rate Increases had limited success.

Ocean carriers hoped to push rates up by reducing capacity even as seasonal volumes decrease, but Asia – US West Coast and Asia – Mediterranean prices are now about even with mid-October levels. Asia – US East Coast rates, however, are 7% higher than in October and Asia – N. Europe prices are 36% above their extreme lows last month showing some gains through the GRIs, though rates for both lanes remain below 2019 levels.

Despite falling back to October levels, Asia – US West Coast rates are still 11% above 2019 levels, possibly reflecting the continuing shift of volumes back to the West Coast since the labor dispute there ended this past summer.

Carriers have announced additional GRIs for December, but many are skeptical these will fare much better than November’s given the ongoing significant overcapacity on these lanes.

Easing volumes, growing fleet sizes and lagging rates have already led to negative financial impacts for some ocean carriers, with ZIM Lines being the latest and possibly strongest example so far as they recorded a $2B impairment for Q3.

Though Israel’s war with Hamas has so far not had much impact on ocean logistics, Houthis from Yemen, after threatening to target Israeli ships, hijacked a car carrier vessel in the Red Sea with ties to Israeli owners this week, raising concerns of broader supply chain impacts from the war.

In air cargo, Freightos Air Index data show China – N. America rates fell 6% last week, but remain 11% higher than in October, while China – N. Europe prices rebounded 25% to $4.23/kg and back to their early-month level, following more indications of demand improvements on these lanes, especially from B2C e-commerce shipments.

Transatlantic rates increased 9% to $2.00/kg last week to their highest level since June, marking a gradual 21% climb since early October, possibly on improved holiday season demand.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.