Weekly highlights

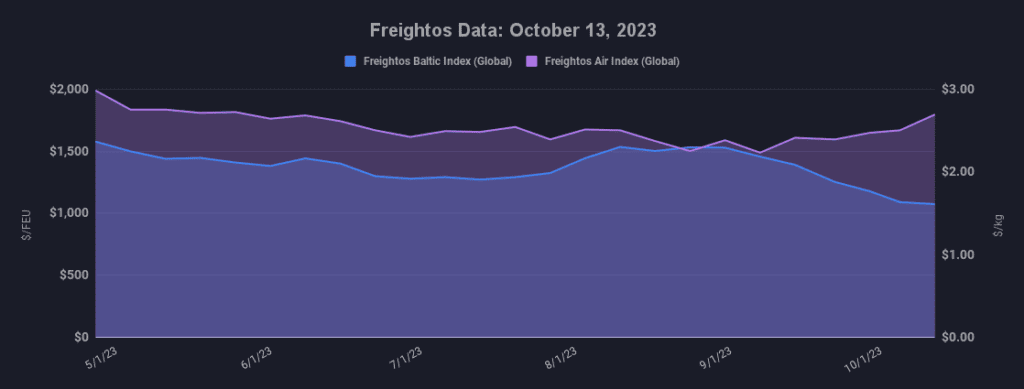

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) increased 3% to $1,548/FEU.

- Asia-US East Coast prices (FBX03 Weekly) dipped 1% to $2,219/FEU.

- Asia-N. Europe prices (FBX11 Weekly) increased 3% to $946/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) fell 1% to $1,480/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices increased 4% to $4.82/kg

- China – N. Europe weekly prices fell 1% to $3.71/kg.

- N. Europe – N. America weekly prices increased 3% to $1.69/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Ex-Asia ocean rates were stable overall last week, in the just-post-Golden Week period when rates are often under some upward pressure from the holiday backlog.

Rate levels that have fallen since the end of August reflect easing volumes as well as significant overcapacity in the market. Prices from Asia to the US East Coast and N. Europe are well below 2019 levels, while rates to the West Coast are still 17% higher than in 2019, possibly reflecting some shift of volumes back to the West Coast as the threat of labor disruptions has ended.

If rates have reached their floor, it is likely thanks to significant capacity management measures taken by carriers. The transpacific lane will have about 23% of deployed capacity blanked in October – the highest level since April. And though overcapacity is leading to lower rates, it is also leading to poorer reliability for shippers as last minute blanked sailings can cause delays in the form of rolled containers and late arrivals.

One way to mitigate this type of disruption is to schedule cancellations ahead of time, which is what the 2M alliance did this week through their reduced winter schedule for Asia – N. Europe announced through December. The scaled down service reflects both the lull in demand and excess capacity on this lane, where more new ultra large vessels are likely to be idled immediately upon delivery for the same reasons.

In Israel, ocean and inland logistics have continued to be fully operational despite the ongoing war. Freightos Data shows import container rates to Israel are in line with rates for the region overall. Yesterday, however, one vessel was diverted from the port of Ashdod to Haifa as carriers are reporting some congestion due to labor shortages and tighter security and Israeli carrier ZIM warned of the possibility of short-notice service interruptions and announced an $80 – $120 war risk premium on containers to and from Israeli ports.

Most passenger carriers and some cargo airlines have canceled flights to and from Israel, and Freightos Data shows Israeli air cargo export rates to destinations in Europe and the US have increased by 20% or more since last week.

Freightos Air Index rates from China to the US and Europe remain at their highest levels since the spring on reports of increased volumes in the last few weeks. Some observers think these rate increases are amplified by a more general shift to the spot market in air cargo, and many remain pessimistic about a prolonged air cargo rebound despite these recent trends.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.