Weekly highlights

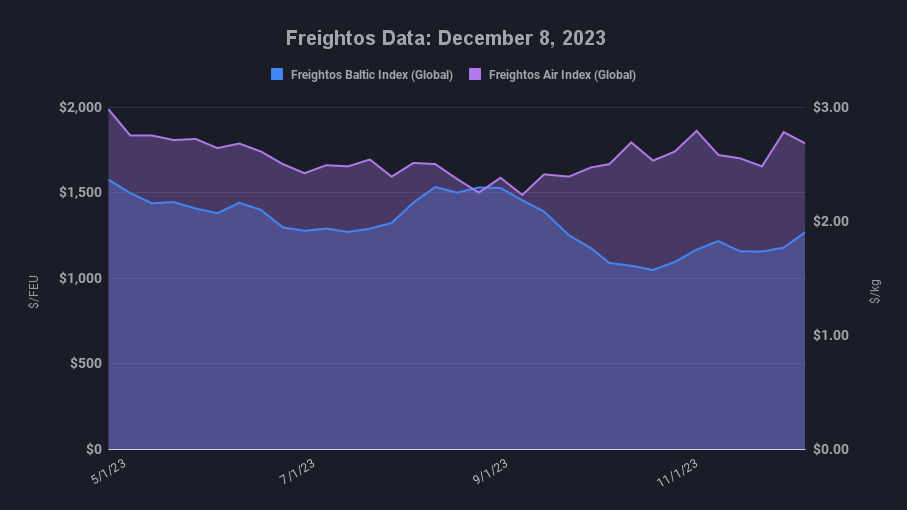

Ocean rates – Freightos Baltic Index

- Asia-US West Coast prices (FBX01 Weekly) fell 1% to $1,603/FEU.

- Asia-US East Coast prices (FBX03 Weekly) climbed 5% to $2,497/FEU.

- Asia-N. Europe prices (FBX11 Weekly) climbed 18% to $1,466/FEU.

- Asia-Mediterranean prices (FBX13 Weekly) increased 29% to $2,161/FEU.

Air rates – Freightos Air Index

- China – N. America weekly prices decreased 7% to $5.88/kg

- China – N. Europe weekly prices fell 13% to $3.69/kg.

- N. Europe – N. America weekly prices climbed 1% to $2.16/kg.

Dive deeper into freight data that matters

Stay in the know in the now with instant freight data reporting

Analysis

Asia – N. Europe and Mediterranean ocean rates increased significantly on early-month GRIs last week, with Mediterranean prices continuing to climb so far this week. With these increases, rates to N. Europe remain 8% below 2019 levels, but the sharper climb to the Mediterranean has prices 32% higher than pre-pandemic.

Additional GRIs are planned by some carriers mid-month, with some announcing January GRIs as well, aiming to push rates past the $3k/FEU mark. Rates maintaining or exceeding their recent gains would likely be a function of stricter capacity reductions aimed at getting prices up during long-term contract negotiations, though there are also signs that demand will start to improve ahead of Lunar New Year.

On the transpacific, rates to the West Coast have been about level since mid-November, while East Coast prices have ticked up 5% though some carriers will try for West Coast rates of $1,800/FEU and $3k/FEU to the East Coast in the second half of December. Reports of more carriers avoiding the Panama Canal in favor of the longer route around Africa’s southern tip will lead to more surcharges in the coming weeks.

In terms of demand, the National Retail Federation reported that peak season actually stretched through October with volumes 9% higher than in 2019, before dipping in November. Projections through February for volumes above 2019 levels may point to continued consumer strength and expectations for inventory restocking for after the holidays.

Houthis expanded their threat to Red Sea traffic to include all Israel-bound – not just Israeli-owned – vessels this week, and attacked a tanker it claimed was bound for Israel on Tuesday. A French Navy vessel assisted the tanker and shot down a drone headed the tanker’s way. Additional recent international steps to address the threat include more British Navy ships being deployed to the region, and US sanctions aimed at disrupting Houthi funds.

The increased risk to ships in the region has led Maersk to join carriers charging a war risk premium for containers to and from Israeli ports, and ZIM will increase rates for its Asia – Mediterranean service that will avoid the Red Sea in favor of the longer route around Africa.

And across lanes, as carriers struggle with volume declines and lower rates, some reports show they are seeking to increase or introduce other types of fees to increase revenue in other ways, even as service levels are likely to suffer due to growing overcapacity.

Freightos Air Index data show that ex-China air cargo rates continued to cool this week, possibly indicating that the e-commerce-driven increase in demand over the last couple months may be starting to subside as the holiday season nears. Some increase in transatlantic demand has pushed rates up to $2.16/kg as of last week – a 30% increase since early October – but volumes have been soft compared to normal peak season levels.

Freight news travels faster than cargo

Get industry-leading insights in your inbox.